To get your LLC off the ground, you'll need to lock in a unique business name, pick a registered agent, and officially file your Articles of Organization with the state. Think of this as the moment your business is legally born. It becomes its own separate entity, which is the key to protecting your personal assets from any business liabilities.

Why an LLC Is the Go-to for Modern Founders

Before we jump into the paperwork, let's talk about why the Limited Liability Company (LLC) is the structure so many entrepreneurs lean on today. It hits a sweet spot, giving you the kind of liability protection you'd expect from a big corporation but with the simplicity and tax flexibility of a sole proprietorship. This isn’t just a legal hoop to jump through; it's a strategic move that dictates how you run things, how you get taxed, and how you shield your personal wealth.

The numbers don't lie. The boom in entrepreneurship is real. By 2023, the U.S. saw a record 5,481,437 new businesses get started—that’s a massive 56.7% jump from 2019. It's clear people are chasing their business dreams, and the LLC is often the vehicle they choose because of its straightforward management and that critical liability shield. You can dig deeper into these if you're curious.

At its core, the LLC builds a legal wall between your business life and your personal life. If the business ever gets sued or racks up debt, your personal stuff—your house, your car, your savings account—is generally off-limits. For a freelance creative, a small e-commerce shop, or a growing consulting firm, that peace of mind is everything.

Choosing a Business Name That Works

Your first real step is picking a name. This is more than just branding; it's a legal checkpoint. The name you choose has to be unique in your state and can't sound too much like another registered business.

Most states have an online business name search tool, usually on the Secretary of State's website. Use it. Seriously, before you get attached to a name, brainstorm a few options and check if they're available right away.

Here are a few ground rules to remember:

- You Need an LLC Designator: Your official name has to end with "Limited Liability Company," "LLC," or another approved abbreviation. It’s non-negotiable.

- Watch Out for Restricted Words: If you want to use words like "Bank," "Insurance," or "University," expect extra paperwork and licensing requirements. It's usually not worth the headache unless it's core to your business.

- Do a Trademark Search: A quick search on the database is a smart move. Just because a name is available in your state doesn't mean it won't infringe on a federal trademark, and that's a legal battle you don't want.

Pro Tip: What if your perfect name is taken? You might still be able to use it by filing for a "Doing Business As" (DBA) name. For example, if "Brooklyn Bagels LLC" is already registered, you could form "BKB Holdings LLC" and then file a DBA to operate publicly as "Brooklyn Bagels."

The Crucial Role of a Registered Agent

Every single LLC is required by law to have a registered agent. This is a person or a company that agrees to accept official mail and legal documents on your business's behalf. They are your business's official point of contact with the state.

Your registered agent needs a physical street address in the state where you're forming your LLC, and they have to be available during regular business hours. You can be your own registered agent, but I usually advise against it for a couple of big reasons.

Hiring a professional registered agent service gives you two huge advantages:

- Privacy: The agent's address goes on the public record, not your home address. If you're running your business from home, this is a massive win for keeping your private life private.

- Reliability: A professional service guarantees someone is always there to receive time-sensitive documents, like a court summons. Missing something that important can have devastating consequences.

Appointing a registered agent is way more than just filling out a line on a form. It's about maintaining your LLC's good standing with the state and protecting your privacy from day one. Nail these foundational pieces—understanding why the LLC is powerful, picking a compliant name, and appointing a solid agent—and you're setting yourself up for a much smoother journey.

Filing Your Articles of Organization in New York

This is the moment of truth. After all the brainstorming, name-checking, and appointing a registered agent, filing your Articles of Organization with the New York Department of State is what officially breathes life into your business. Think of it as the formal announcement to the state that your LLC now exists.

Getting this step right is absolutely crucial. I've seen countless entrepreneurs get delayed because of simple mistakes on this form. Even a small typo can lead to a rejection, sending you back to square one and pushing back your launch date. Let's break down exactly what you need to provide to make sure your filing is smooth and successful from the get-go.

What Goes into the Articles of Organization

You can think of this document as your LLC’s birth certificate. It contains the fundamental details the state needs to keep on public record, and while the form itself is fairly straightforward, each piece of information serves a specific legal purpose.

Here's what you'll need to have ready:

- Your LLC's Name: The full legal name you selected, which must include a proper designator like "Limited Liability Company" or the abbreviation "LLC."

- The County Location: You have to specify the county in New York where your LLC’s main office will be located.

- Registered Agent Details: This includes the full name and physical New York street address of the registered agent you designated.

- Organizer’s Information: The name and address of the person or company filing the document. This can be you, a business partner, or a third-party service you've hired.

Accuracy is your best friend here. I can't stress this enough—double-check, and then triple-check, every single entry for spelling and correctness before you hit submit.

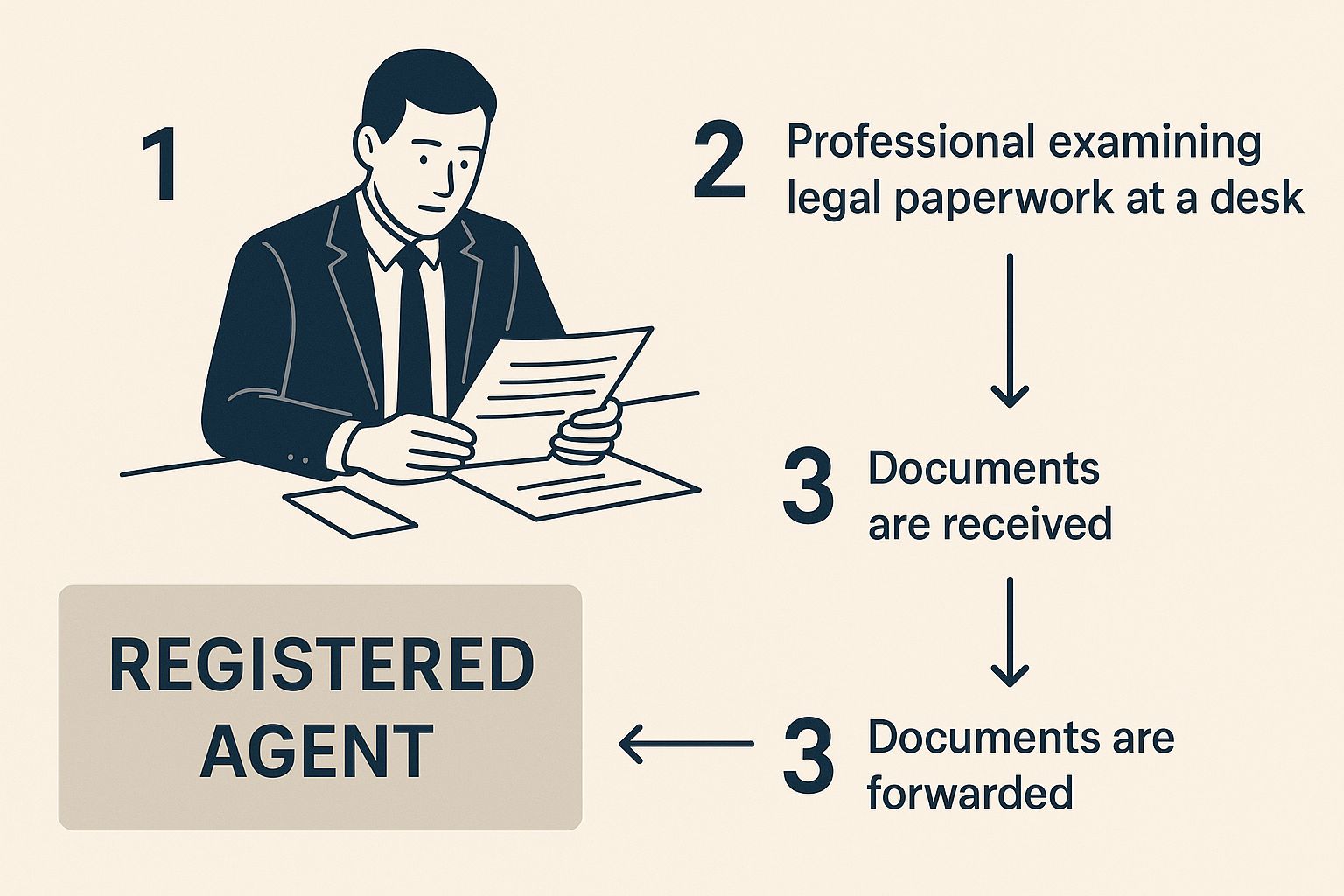

The image below shows just how important the registered agent is in this whole process. They are your official point of contact for any legal or state communications.

As you can see, the agent acts as that critical go-between, making sure your business stays compliant by reliably receiving any important notices.

Filing Fees and Processing Times

Let's talk numbers. Forming an LLC comes with a few mandatory costs, and in New York, the state filing fee for the Articles of Organization is a flat $200. This fee is non-refundable, which is another great reason to get your submission right the first time.

While formation fees vary across the country—ranging from $50 to $500 depending on the state—New York sits right in the middle. For context, California's fee is $70, but Massachusetts charges a hefty $500.

To get your business officially registered, you have a few options for filing, each with different timelines.

New York LLC Formation Key Costs and Timelines

Here’s a quick look at what you can expect in terms of cost and turnaround for getting your New York LLC off the ground.

| Item | Associated Cost | Standard Processing Time |

|---|---|---|

| Online Filing | $200 (State Fee) | 1-2 business days |

| Mail-In Filing | $200 (State Fee) | Several weeks |

| In-Person Filing | $200 (State Fee) | Same-day processing (often possible) |

For most founders I work with, filing online strikes the perfect balance of speed and convenience. It's usually the fastest and most efficient route.

Avoiding Common Filing Mistakes

Navigating state bureaucracy can feel like a maze, but most rejections boil down to a few common, totally avoidable errors. Knowing what these are ahead of time can save you a massive headache.

One of the most frequent issues is a name conflict. You might have checked the state database a month ago, but someone else could have snagged that name in the meantime. My advice? Always perform one final name search right before you're about to file.

Another classic mistake involves the registered agent information. You must provide a physical street address in New York—P.O. boxes are not allowed and will get your application automatically rejected. Make sure the agent's name is spelled correctly and matches public records, especially if you're using a commercial service.

Finally, don't forget that forming your LLC is just the first major step. Depending on your industry and where you operate, you'll likely need other permits or licenses to do business legally. For more on that, check out our guide on how to get a business license in New York.

Crafting Your LLC Operating Agreement

If the Articles of Organization are your LLC's birth certificate for the outside world, the Operating Agreement is its internal constitution. This is the rulebook that governs how your business actually runs day-to-day. In New York, this document is a legal requirement, but honestly, its real value goes way beyond just checking a box on a state form.

Too many founders, especially solo entrepreneurs, either skip this step or grab a generic template off the internet. That's a huge mistake. For LLCs with multiple members, it's completely non-negotiable. This agreement is your roadmap for handling everything from profits and losses to navigating disagreements and planning for the unexpected.

Why Even a Single-Member LLC Needs One

I get it. If you're the only owner, writing up an agreement with yourself sounds a little strange. But here's why it's so important: it reinforces your LLC's separate legal identity.

Think about it this way: if your business ever faces a lawsuit, a well-drafted Operating Agreement is a key piece of evidence showing that your LLC is a legitimate, separate entity—and not just an extension of your personal finances. It proves you're treating the business like a business. Without it, a court could potentially "pierce the corporate veil," putting your personal assets like your house and car on the line.

Essential Clauses for Every Operating Agreement

A solid Operating Agreement doesn't just outline the basics; it anticipates future challenges and sets up clear solutions before they turn into real problems. While it should absolutely be tailored to your specific business, there are a few core areas every agreement must cover.

Here are the key components you have to include:

- Membership and Contributions: Who are the owners (members), and what did each person put in to get the business started? This could be cash, property, or even services (often called "sweat equity"). Be specific and clearly state each member's ownership percentage.

- Management Structure: How will the LLC be run? Will it be member-managed, where all owners have a say in daily operations? Or will it be manager-managed, where you appoint a specific person or group to run the show? This is a critical decision that defines your company's leadership.

- Voting Rights and Decision-Making: How will you make big decisions? You need to define what counts as a majority vote—is it based on ownership percentage or just one-member-one-vote? You should also specify which major decisions, like taking on significant debt or selling the company, require a unanimous vote.

- Profit and Loss Distribution: This part is crucial. Outline exactly how profits (and, just as importantly, losses) will be distributed among the members. It doesn't have to perfectly match ownership percentages, but whatever you decide must be clearly defined in the agreement to head off future arguments.

- Changes in Membership: Life happens. What if a member wants to leave, passes away, or becomes disabled? This section, often called a buy-sell provision, lays out the process for transferring ownership and figuring out how much a member's share is worth.

A well-crafted Operating Agreement is like business insurance. You hope you never need its dispute-resolution clauses, but if you do, it will be the most valuable document you own. It’s what prevents a minor disagreement from blowing up into a costly legal battle.

Putting It into Practice

Let's look at a real-world scenario. Two friends, Alex and Ben, start a graphic design LLC. Alex puts in $10,000 in cash, while Ben contributes a high-end computer and software he already owned, also valued at $10,000. Their Operating Agreement clearly states they are 50/50 owners.

A year in, they land a massive client, and business is booming. The problem? Alex wants to reinvest all the profits back into the company to fuel growth, but Ben wants to take a distribution to pay off some personal debt. Without an Operating Agreement, this kind of disagreement could easily fracture their partnership and even sink the business.

Fortunately, they had the foresight to include a clause covering this exact situation. It states that any profit distributions require a majority vote, but reinvesting up to 50% of net profits is at the discretion of the managing member (a role they decided to rotate annually). This pre-agreed rule gives them a clear path forward, turning what could have been a crisis into a simple business decision. Learning how to form an LLC the right way means planning for these scenarios from day one.

Alright, you've filed your Articles of Organization and your LLC is officially created. Pop the champagne, right? Well, not so fast. If you're in New York, a unique—and often expensive—hoop is waiting for you just around the corner.

New York is one of only three states that has a mandatory publication rule. I see a lot of new business owners overlook this, but trust me, ignoring it can have serious consequences for your LLC's legal standing.

This isn't just a minor piece of red tape; it's a critical legal requirement. If you miss the 120-day deadline, the state can suspend your authority to do business. That means you could lose the ability to sign contracts or even defend your business in court. It effectively kneecaps the liability protection you formed the LLC for in the first place.

So, What Is This Publication Mandate Anyway?

In short, you're required to publicly announce your LLC's formation by publishing a notice in two different newspapers for six consecutive weeks. The notice itself has to include specific details about your new business.

Here's the catch: you can't just pick any two papers. The newspapers must be designated by the county clerk in the county where your LLC's office is located. One has to be a daily paper, and the other has to be a weekly. The whole point is to make your business formation a matter of public record.

For example, if your LLC is based in Brooklyn (Kings County), you need to get in touch with the Kings County Clerk's office to get their official list of approved publications. The costs for these ads can swing wildly, from a few hundred bucks to well over $1,000, depending on which county you're in.

The Step-by-Step Publication Process

Navigating this can feel like a headache, but breaking it down makes it much more manageable. Here’s the path I walk my clients through to make sure they stay compliant:

- Find the Right Newspapers: Your first move is to call the county clerk's office where your LLC is registered. Ask for their official list of designated newspapers for LLC publication. Don't guess—using the wrong papers means you haven't met the requirement.

- Draft Your Public Notice: The notice needs to be precise. It must include your LLC's name, the filing date, the county of its principal office, and a statement about its business purpose. Double-check every single detail.

- Run the Ads: Once you have your approved list, contact one daily and one weekly paper and arrange to have the notice published for six straight weeks. They'll give you a quote for the cost.

- Get Your Proof: After the six weeks are up, each newspaper will send you something called an Affidavit of Publication. This is your legal proof that you've done what the law requires. Guard these documents carefully.

- File with the State: The final step is to fill out a Certificate of Publication form and file it with the New York Department of State. You have to attach the affidavits from both newspapers and include a $50 filing fee.

Crucial Takeaway: The 120-day clock starts ticking the moment your Articles of Organization become effective. You absolutely have to start this publication process right away to avoid missing the deadline and putting your LLC's legal protections at risk.

How to Manage Costs and Avoid Common Pitfalls

The cost of this publication requirement is a huge pain point for founders. One of the biggest mistakes I see is people registering their LLC in a super expensive county like New York County (Manhattan) when their business could be based anywhere.

If your business doesn't need a physical presence in a high-cost area, think about forming your LLC in a more affordable county like Albany. Publication costs there can be dramatically lower. You can still operate your business all over the state. This one choice on how to form an LLC can save you hundreds, if not thousands, of dollars right out of the gate.

So, you've successfully navigated the paperwork, and your New York LLC is officially a legal entity. This is a huge milestone, but don't pop the champagne just yet—the work isn't quite over.

Think of this next phase as setting up your business's financial and operational headquarters. Getting these post-formation steps right is just as crucial as the initial filing. It's what truly solidifies that legal shield between you and your business, which is the whole reason you wanted to form an LLC in the first place.

First Things First: Get Your EIN

Before you do anything else, you need to get an Employer Identification Number (EIN) from the IRS. An EIN is basically a Social Security number for your business. It's a unique nine-digit number that you'll need for almost every financial move your company makes.

You'll need an EIN to:

- Open a business bank account (a non-negotiable step).

- Hire employees, whether it's your first or your fiftieth.

- File your federal and state business taxes.

- Apply for many business licenses and permits.

Getting an EIN is completely free and can be done online, directly on the . The process is fast, and you’ll get your number as soon as you complete the application. Whatever you do, don't pay for a service to do this for you—it's a straightforward task you can easily handle yourself.

Open a Separate Business Bank Account

This might be the single most important thing you do to protect that corporate veil. Mixing your personal and business funds is a surefire way to invite legal trouble. If your business ever gets sued, a court could see your jumbled finances as proof that your LLC isn't really a separate entity, potentially putting your personal assets on the line.

A dedicated business bank account creates a clean, clear financial boundary. All business income goes in, and all business expenses come out. Simple. This not only protects your personal liability but also makes bookkeeping and tax season infinitely less painful.

To open an account, the bank will typically ask for your Articles of Organization, your shiny new EIN, and your LLC Operating Agreement.

A separate business bank account isn't just a best practice; it's the bedrock of your LLC's liability protection. It serves as tangible proof that you and your business are distinct legal entities, which is the whole point of this structure.

Interestingly, the retail trade sector is a leader in new LLC formations, making up 18.98% of all non-corporate business applications. This is followed by professional services at 12.77% and construction at 9.72%. No matter what industry you're in, financial separation is non-negotiable. You can see more on the .

Understand Your Ongoing Compliance Duties

Forming your LLC is a one-time event, but keeping it in good standing is an ongoing responsibility. In New York, this means staying on top of a few key obligations to avoid penalties or, even worse, having the state dissolve your company.

The Biennial Statement

One of the most important requirements is filing your biennial statement. Every two years, your LLC must file a statement with the Department of State during its anniversary month. It's a simple filing that just confirms your LLC's basic info—like your registered agent and address—is still current.

The fee is minimal, only $9, but failing to file can get your LLC marked as delinquent. It's an easy deadline to miss, so put a recurring reminder in your calendar now.

New York State Taxes

You'll also need to get a handle on your state tax obligations. Depending on what your business does, this could include sales tax, withholding tax (if you hire employees), and New York's annual LLC filing fee.

It's a really smart move to chat with a tax professional who understands New York's specific rules. Getting expert advice from the start will save you a world of headaches down the road.

Putting all these pieces together can feel like a lot, but it’s completely manageable with a clear plan. Our comprehensive small business setup checklist provides a step-by-step guide to help you organize these crucial post-formation tasks.

And to make it even easier, here is a quick-glance table of your post-formation duties.

Your Post-Formation Compliance Checklist

This table breaks down the essential tasks you need to tackle after your LLC is formed. Think of it as your roadmap to staying compliant and keeping your business running smoothly from day one.

| Task | Why It's Important | Typical Deadline |

|---|---|---|

| Obtain an EIN | Required for banking, hiring, and filing taxes. Establishes your business as a separate entity with the IRS. | Immediately after formation |

| Open Business Bank Account | Protects your personal liability by keeping funds separate. Essential for clean bookkeeping. | As soon as you have your EIN |

| File Biennial Statement | A mandatory filing in New York to keep your LLC in good standing with the state. | Every two years in your LLC's anniversary month |

| Set Up Tax Compliance | Ensures you meet all federal, state, and local tax obligations, avoiding penalties and interest. | Varies (consult a tax professional) |

| Obtain Licenses/Permits | Many industries require specific licenses to operate legally. | Before you begin business operations |

Staying on top of these tasks is what separates a well-run business from one that’s constantly playing catch-up. Make them a priority, and you’ll be setting yourself up for long-term success.

Common Questions About Forming an LLC

Even with a detailed guide in front of you, it's totally normal to have some questions rattling around. The process of forming an LLC dips into legal and financial territory that can feel pretty complex. Let's walk through some of the most common questions entrepreneurs have so you can move forward with confidence.

Probably the biggest question I get is: "Do I really need a lawyer to form my LLC?" The short answer is no, you can absolutely file the paperwork yourself. But the better question is whether you should.

Going the DIY route or using a cheap online service can save you some cash upfront, but it puts all the responsibility for getting it right squarely on your shoulders. A single mistake on your Articles of Organization or a poorly written Operating Agreement can snowball into expensive headaches later. For a lot of new business owners, the peace of mind that comes with professional guidance is worth every penny.

Can I Form an LLC in a Different State?

You've probably heard the buzz about forming an LLC in states like Delaware or Wyoming. They're famous for their business-friendly laws and privacy perks. While it's technically possible, it's usually not the right play if your business is actually operating in New York.

Here’s the catch: If you form an LLC in Wyoming but you're doing business in New York, you'll still have to register your Wyoming LLC as a "foreign entity" in New York.

That means you’re suddenly on the hook for:

- Filing fees in both states.

- Annual report fees in both states.

- And you might even need a registered agent in both states.

This move just complicates your life and doubles your administrative costs. For the vast majority of small businesses, the simplest and most cost-effective path is to form your LLC right where you actually do business.

Do I Need an LLC for My Side Hustle?

Another big one: is a formal structure like an LLC really necessary for a small side business or a freelance gig? When you're just starting out and the income is small, sticking with a sole proprietorship can feel easier.

But the moment your side hustle starts bringing in consistent money or involves any real risk, forming an LLC becomes a very smart move. It doesn't matter if you're making $1,000 a month or $100,000 a month—the risk to your personal assets is the same.

Think of an LLC as insurance for your personal life. It builds a legal wall between your business and your personal assets, protecting your home, car, and savings from business debts or lawsuits. That protection is crucial, no matter how big or small your operation is.

Ultimately, setting up an LLC shows you're serious about your venture and you're taking the right steps to protect yourself. It adds a layer of credibility and gives you a solid legal foundation to build on as your side hustle grows into something more. Figuring out these details is a perfect example of why getting professional legal help for your small business from the start can be so valuable.

At Cordero Law, we specialize in guiding entrepreneurs through every stage of their business journey. If you're ready to form your LLC with confidence and ensure your business is built on a solid legal foundation, we're here to help. Visit us at to learn more.