So, you're ready to get your New York business license. The whole process can feel like a maze, but it really boils down to figuring out your business structure, using the state's official tools to see what permits you need, and then registering with the right agencies. This is the groundwork for making your business legit in the state.

Your First Steps to New York Business Licensing

Navigating New York's business licensing requirements can seem complicated, but it's totally doable once you have a clear plan. Unlike some other states, New York doesn't have a one-size-fits-all "business license." Instead, your compliance checklist is a mix of registrations, permits, and specific licenses that depend on your industry, where you're located, and what you actually do.

Think of it like putting together a legal puzzle for your specific venture. It's less about filling out one single application and more about knowing which government bodies you need to talk to. For most people, this will involve both state agencies and your local city or county clerk's office.

Key Registrations to Understand

Your journey starts by getting familiar with the most common and crucial registrations. Don't stress about memorizing every single form. The goal is just to recognize the main categories so you can confidently use resources like the portal.

Here are the big ones:

- Business Structure Registration: Before you do anything else, you have to legally form your business. This means registering as an LLC, corporation, or partnership with the New York Department of State (DOS). If you're a sole proprietor using a business name, you'll file a DBA ("Doing Business As") with your county clerk.

- Certificate of Authority: This is non-negotiable if you plan on selling taxable goods or services. The Department of Taxation and Finance (DTF) issues this, giving you the green light to collect and remit New York sales tax.

- Industry-Specific Licenses: Some professions鈥攖hink cosmetology, engineering, or even security services鈥攁re regulated by the state. You'll need a professional license to operate legally in these fields.

- Local Permits: Your city or county has its own set of rules. This can be anything from a health department permit for your coffee shop to a signage permit for your storefront.

The official New York Business Express website is your best friend here. It's built to help you figure out exactly which of these apply to you.

This portal guides you through a series of questions and then spits out a personalized checklist of everything you need to file.

To give you a clearer picture, here鈥檚 a quick summary of the main registrations you'll likely encounter as a new business owner in New York.

Key New York Business Registrations at a Glance

| Registration/License Type | Who Needs It | Primary Issuing Agency |

|---|---|---|

| Business Entity Registration | All LLCs, Corporations, and Partnerships. | New York Department of State (DOS) |

| "Doing Business As" (DBA) | Sole Proprietors using a fictitious name. | County Clerk's Office |

| Certificate of Authority | Businesses selling taxable goods or services. | NYS Department of Taxation and Finance (DTF) |

| Professional/Occupational License | Individuals in state-regulated professions. | NYS Education Department or Department of State |

| Local Permits (e.g., Health, Signage) | Businesses operating within a specific city/county. | Local City or County Government/Clerk's Office |

This table should help you quickly identify which agencies you'll be working with as you get started.

Key Takeaway: The biggest mistake I see entrepreneurs make is thinking one state registration is enough. You absolutely have to check with your local city or county clerk for their requirements to be fully compliant and avoid nasty penalties down the road.

This layered system exists for a reason. New York has a massive and incredibly diverse business scene, with around 2.4 million small businesses making up 99.8% of all companies in the state. Proper licensing keeps the marketplace fair and regulated for everyone involved. For a deeper dive into these trends, check out the .

If you're at the very beginning of your journey, our guide on starting a business in NYC offers even more context for these initial steps. By breaking it all down into manageable pieces, you can tackle this process with confidence.

Decoding State vs. Local Licensing Requirements

One of the most confusing hurdles for any new business owner in New York is figuring out the maze of state versus local rules. It's a classic pitfall. You think registering with the state means you鈥檙e good to go, but that's only half the battle. In reality, your specific city, town, or county has its own list of requirements you absolutely cannot afford to miss.

This is where I see a lot of new entrepreneurs get tripped up. They鈥檒l go through the process of forming an LLC with the New York Department of State and, feeling accomplished, assume they can open their doors. But then they get hit with a notice because their local municipality requires a separate permit to operate from a home office, a special license for their industry, or even a permit just for their business sign.

State-Level vs. Local-Level Explained

Let's clear this up and break down who handles what between New York State and your local government.

State-level requirements are generally about your business's legal identity and your relationship with the state. Think of these as the foundational, big-picture permissions.

- Business Formation: This is your initial registration as an LLC, corporation, or partnership with the Department of State. It鈥檚 what makes your business "real" in the eyes of the state.

- Certificate of Authority: If you plan on selling taxable goods or services, this registration from the Department of Taxation and Finance is non-negotiable. It鈥檚 your ticket to legally collect sales tax.

- Professional Licenses: Certain fields like engineering, cosmetology, and accounting are regulated at the state level. These require specific licenses from the NYS Education Department or Department of State to prove your credentials.

Local-level requirements, on the other hand, are all about how your business operates within a specific community. These are often more hands-on and depend entirely on your location.

- "Doing Business As" (DBA) Certificate: If you're a sole proprietor or partnership using a business name that isn't your own legal name, you file this with your county clerk鈥攏ot the state.

- Building and Zoning Permits: Your local town or city controls what types of businesses can set up shop where, and what kinds of renovations you can make to a property.

- Health Department Permits: This is a must-have for any business that serves food, whether you're a full-service restaurant or a small coffee cart.

- Industry-Specific Local Permits: A sidewalk cafe in New York City needs a permit from the NYC Department of Consumer and Worker Protection. A taxi service in Buffalo is governed by its own local rules. The list goes on.

The core takeaway is this: State registration makes your business a legal entity. Local permits allow that entity to operate legally in its specific location. Neglecting either side leaves you exposed and non-compliant.

Real-World Scenarios Unpacked

Let鈥檚 look at two different entrepreneurs to see how this plays out in the real world.

First, imagine a freelance graphic designer working from their apartment in Albany. Their main state-level task is probably getting a Certificate of Authority to collect sales tax on their services. If they operate as a sole proprietor under their own name, they might not even need a DBA. Locally, their only concern might be a quick check of Albany's zoning laws for home-based businesses. Simple enough.

Now, consider a retail shop owner opening a boutique in Manhattan. The checklist gets a lot longer, fast. They'll need to form an LLC or corporation with the state and get that same Certificate of Authority. But on top of that, they'll be dealing with a host of New York City agencies for local permits: a Certificate of Occupancy for the storefront, permits for any signage, and maybe even a Secondhand Dealer General license if they plan to sell vintage items.

These two businesses have vastly different compliance paths, and it鈥檚 almost entirely dictated by their business model and physical address.

It's also worth noting that New York's licensing process is shaped by broader economic trends. With a high number of people working part-time for economic reasons, proper licensing is crucial for businesses adapting their operations. The state and city are managing a massive volume of compliance, which is why the rules are so detailed. For a deeper dive, you can see how these trends are shaping business regulations in the state鈥檚 economic reports.

The complexity of forming your business entity itself can be a major hurdle before you even think about local permits. Our 10-step guide to forming a corporation in New York can help you nail that critical first step. Getting your business structure right from day one is an invaluable investment.

Using the NY Business Express Wizard Like a Pro

The website, and specifically its Business Wizard tool, is probably the most useful resource for any entrepreneur trying to figure out which licenses they need. But let's be honest鈥攇overnment websites can be a pain to navigate. This guide will walk you through using the wizard effectively so you can get a clear, actionable checklist without the headache.

Think of the Business Wizard as your own digital consultant. It runs you through a series of specific questions about your business鈥攚hat you do, where you're based, and your legal structure. Based on your answers, it builds a personalized roadmap of the exact registrations, permits, and licenses you'll need to operate legally.

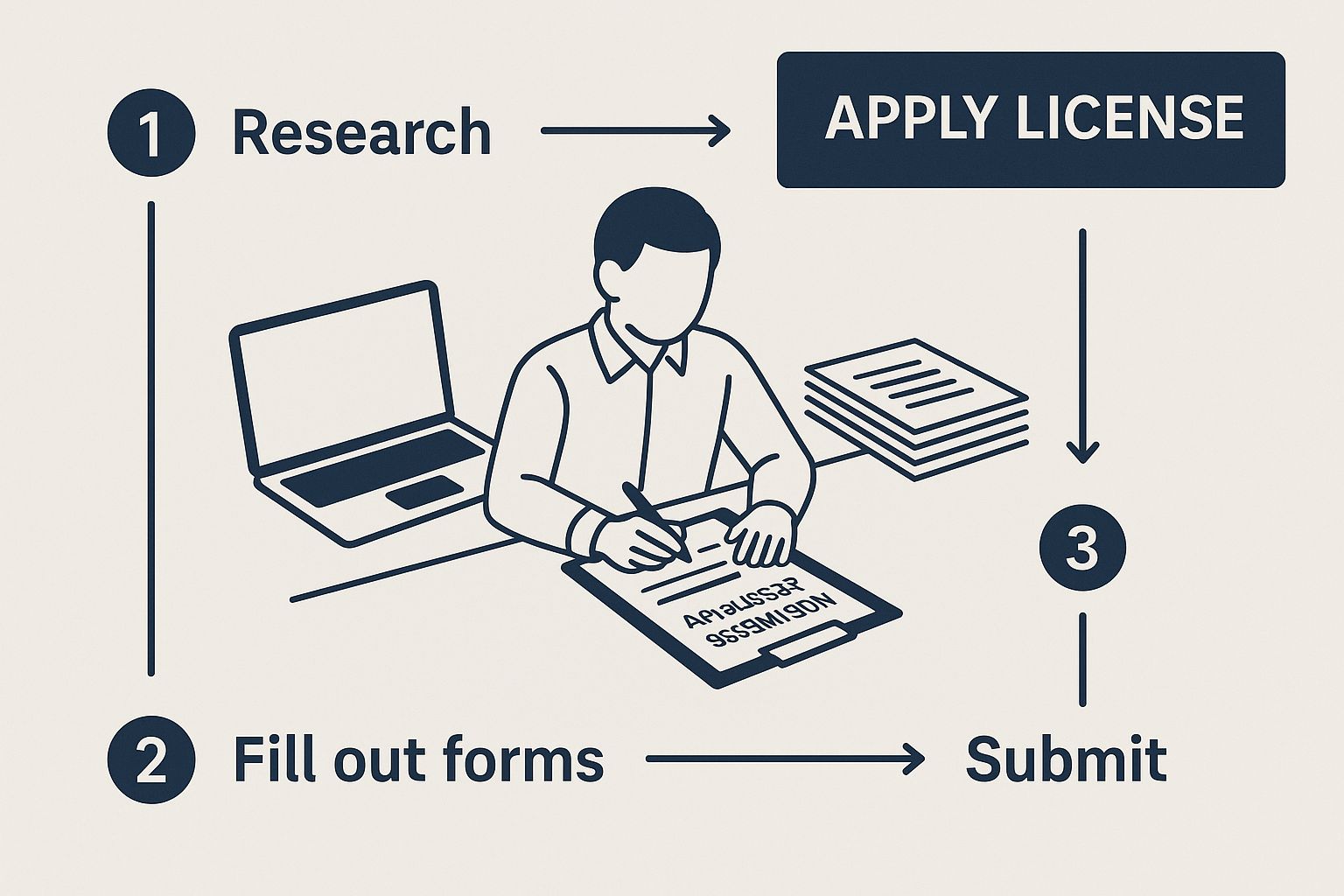

This infographic breaks down the core steps you'll take, from gathering your info to finally submitting everything.

It鈥檚 a good reminder that with the right tools and a bit of prep, this process becomes a manageable series of steps, not some overwhelming monster of a task.

Answering the Wizard's Questions Accurately

The quality of the checklist you get is only as good as the information you put in. It's crucial to have your details straight before you even start clicking through the questions.

Here鈥檚 a snapshot of what the wizard will ask for:

- Your Business Type: Are you selling goods, providing a service, or maybe both? This is the first fork in the road and directs much of what comes next.

- Your Location: The wizard needs to know the county and sometimes the specific city or town where you'll be operating. This is essential for flagging any local permits you might need.

- Your Industry: You'll have to select an industry and, in many cases, a more specific business activity.

One common spot where people get tripped up is selecting the right NAICS (North American Industry Classification System) code. This is just a government code used to classify businesses for statistical purposes. The wizard will likely ask you to pick the one that best describes what you do.

Pro Tip: Don't overthink the NAICS code. If you aren't sure, just do a quick search for "NAICS code for [your industry]" before you begin. Picking the closest match is all you need to do here. The wizard's goal is just to understand your business activities, not to lock you into some permanent, unchangeable category.

Interpreting Your Custom Checklist

Once you've answered all the questions, the NY Business Express portal spits out your personalized checklist. This is your compliance blueprint. It will list every form you need to file and every agency you need to deal with, often with direct links to the applications themselves.

Instead of seeing a confusing jumble of government agencies, you'll see specific, actionable tasks. For example, it won鈥檛 just say "register for taxes." It will tell you to apply for a Certificate of Authority with the Department of Taxation and Finance and give you the link to get it done.

Saving Your Progress and Moving Forward

The single best feature of the Business Wizard is the ability to create an account and save your checklist. Seriously, don't try to knock this all out in one sitting. You'll burn out.

- First, create an account. Before you even start with the wizard, sign up for a free NY.gov ID. This is what lets you save everything.

- Run through the wizard. Answer the questions as accurately as you can.

- Save your checklist. Once the results pop up, save them to your profile.

- Tackle one thing at a time. Use that saved checklist to work through your registrations methodically. Do one or two a day, or a few a week.

This approach transforms the daunting task of getting licensed in New York into a simple project management exercise. By using the Business Wizard as your guide and checking things off one by one, you can get fully compliant without all the stress.

Gathering Your Documents and Budgeting for Fees

Okay, so you've figured out which licenses you need. That's a huge step. But now comes the real work: pulling together everything you need for the actual applications.

To make this process as painless as possible, you have to be organized. Think of it like a chef preparing their ingredients before cooking鈥攊t prevents that last-minute, panicked search for something crucial. This means gathering all your essential business info and, just as important, figuring out the costs. Surprises are great for birthdays, not for your startup budget.

Let鈥檚 walk through what you need to have on hand and what you should expect to pay.

Your Essential Document Checklist

Before you even think about filling out a single form, take some time to get your core business details in order. Having this stuff ready in one place will save you a ton of time and headaches down the road.

Here鈥檚 a practical list of what you鈥檒l almost certainly be asked for:

- Federal Employer Identification Number (EIN): Think of this as a Social Security number for your business. It's a must-have for most businesses, especially if you plan on hiring employees. If you don't have one yet, make it your top priority.

- Business Name and Address: This needs to be your official, registered business name and the physical address where your business actually operates. No P.O. boxes for this one.

- Business Structure Details: Are you an LLC, corporation, sole proprietorship, or partnership? You'll need to know and have the formation documents to prove it.

- Owner and Officer Information: Get the full legal names, home addresses, and contact info for all business owners, key partners, or corporate officers.

- Description of Business Activities: Be ready to clearly and concisely explain what your business does. You鈥檒l need this for the NY Business Express Wizard and pretty much every other application.

Out of all of these, your EIN is foundational. Many state and local agencies won't even talk to you without it. If you're not sure where to start with that, this guide on how to get an EIN number for your business is a great resource.

Demystifying the Costs of Licensing

Budgeting for fees is a critical part of your launch plan, and it's an area where a lot of new entrepreneurs get tripped up. The costs for getting a business license in New York are all over the map; they vary widely based on your industry, location, and the specific permits you need.

A simple online registration might be relatively cheap, but a specialized permit that requires physical inspections will be a much bigger investment.

A common mistake I see is entrepreneurs only budgeting for the main business formation fee (like the LLC filing). You have to remember to account for every single permit your business needs, from the state level right down to your specific city or town.

These costs can add up fast. And in a high-stakes market like New York, you want to get this right. The city anticipates a significant 8.21% year-over-year increase in tax collections for fiscal year 2025, with business income taxes projected to grow by 10% to $10.6 billion. This just underscores how seriously the government takes compliance鈥攁nd why avoiding penalties through proper licensing is so important.

To give you a clearer picture, I've put together a table of some common licenses and what you can generally expect in terms of costs and waiting times.

Estimated Costs and Timelines for Common NY Business Licenses

This table breaks down some of the typical fees and processing times for various New York business registrations and permits. Keep in mind these are estimates鈥攜our actual costs and waits could be different.

| License/Registration Type | Typical Fee Range | Average Processing Time |

|---|---|---|

| LLC Articles of Organization | $200 | 1-2 weeks (expedited options available) |

| DBA Certificate (County Filing) | $25 – $100 | 1-5 business days |

| Certificate of Authority | No Fee | 2-5 business days (online) |

| Professional License (e.g., Cosmetology) | $40 – $500+ | 4-8 weeks |

| NYC Food Service Establishment Permit | $280 | Several weeks (requires inspections) |

As you can see, the differences are dramatic. An online application for a Certificate of Authority is fast and free, while a specialized permit like one for a restaurant involves a hefty fee and a much longer, more involved process with inspections.

The key takeaway? Start early. Budget for both the application fees and the time it will take to get approved so you aren't left waiting to open your doors.

Maintaining Compliance and Renewing Your Licenses

Getting your initial business licenses feels like a huge win. And it is! But here's something I see trip up new entrepreneurs all the time: they think the race is over. In reality, your focus just needs to shift from getting licensed to staying licensed.

This is all about ongoing compliance. It鈥檚 a core responsibility for every New York business owner, and it means keeping your permits current, staying on top of regulatory changes, and just generally operating within the legal lines day in and day out. Trust me, ignoring this can lead to some serious headaches, from hefty fines to getting your operations shut down.

Create Your Compliance Calendar

One of the most common鈥攁nd most damaging鈥攎istakes I see is simply forgetting to renew a permit. A local license you got a year ago can easily fall off your radar until a penalty notice lands in your mailbox. The best way to dodge this is to be proactive from day one.

While all the dates are still fresh in your mind, build a dedicated compliance calendar. This doesn't need to be anything complicated; a basic spreadsheet or a shared digital calendar works perfectly.

For every single license and permit you now hold, log these details:

- The name of the license (e.g., "NYC Food Service Establishment Permit")

- The agency that issued it (e.g., "NYC Department of Health")

- The exact expiration date

- The renewal fee amount

- A direct link to the renewal website or application form

Now for the critical part: set at least two reminders for each renewal. I recommend one for 90 days out and another for 30 days out. This buffer is your best friend鈥攊t gives you plenty of time to get the paperwork together, budget for the fees, and handle any unexpected hiccups without panicking.

Keeping Up with Regulatory Changes

New York's business rules aren't static. They evolve. A new state law could impact your entire industry, or a local ordinance might suddenly change the rules for your storefront signage. Pleading ignorance won't get you out of a violation, so staying informed is just part of the job.

A great, low-effort strategy is to subscribe to newsletters from the key agencies that regulate you. The New York Department of State, the Department of Taxation and Finance, and your local county clerk's office often send out updates on new legislation. Following your industry's trade associations is another smart move, as they live and breathe this stuff.

Key Insight: Don't just file your licenses away in a drawer and forget about them. Think of compliance as an active, ongoing process. A little time each month reviewing your obligations can save you from massive problems down the road.

The Importance of Displaying Your Licenses

Some of your most important documents, like your Certificate of Authority for collecting sales tax, have to be displayed publicly at your business. This isn't a friendly suggestion; it's a legal requirement.

Think about it from a customer鈥檚 point of view. Seeing official licenses hanging on the wall builds instant trust and signals that you're a legit, professional operation. From a regulator's perspective, it's a quick, easy way for them to see you're compliant during an inspection.

Make sure you know the specific display rules for each permit you hold. Usually, they need to be in a "conspicuous" spot near your entrance or cash register. Failing to post a required license is low-hanging fruit for an inspector to write you a fine.

Handling Address and Business Changes

Did you move your shop to a new location? Change your official business name? Any time a core detail about your business changes, you have to loop in all the agencies you're registered with.

This is another common compliance trap. You might remember to tell the Department of State about your LLC's new address but completely forget to notify the Department of Taxation and Finance for your sales tax certificate. That one little disconnect can cause you to miss crucial tax notices or renewal reminders, leading to penalties for problems you didn't even know you had.

Here鈥檚 a simple action plan for any business change:

- Make a list of every single state and local agency where your business is registered.

- Go down that list one-by-one and update your information with each of them.

- Get confirmation that the changes went through and keep a copy for your records.

At the end of the day, staying compliant is less about high-stakes legal drama and more about consistent, organized habits. If you set up a solid system with a calendar, stay informed, and are meticulous with your updates, the business you worked so hard to build will keep running smoothly and legally for years to come.

Common Questions About New York Business Licenses

Diving into the world of New York business licensing always seems to bring up a few tricky questions. I've seen it time and time again鈥攅ven the most prepared entrepreneurs get tripped up by the specific details.

So, let's tackle some of the most common points of confusion I hear. These are the real-world questions that pop up right when you鈥檙e trying to get things done. My goal is to give you clear, direct answers so you can get unstuck and keep your momentum going.

Do I Need a Business License as a Freelancer in NY?

This one comes up constantly. The short answer is: probably, but it's not a single "freelancer license." New York doesn't have a one-size-fits-all general operating license. It really all depends on how you're working.

If you run your freelance business under a creative name鈥攕ay, "Brooklyn Web Design" instead of your legal name, Jane Doe鈥攜ou must file a "Doing Business As" (DBA) certificate. This isn't a state-level thing; you handle it right at your local county clerk's office.

More importantly, if your services are taxable in New York (and many creative and consulting services are), you absolutely need a Certificate of Authority. This registration comes from the NYS Department of Taxation and Finance and gives you the legal power to collect and hand over sales tax. On top of that, some freelance fields, like massage therapy or architecture, require specific state-issued professional licenses to even practice legally.

What Is a Certificate of Authority vs a Business License?

It鈥檚 incredibly easy to get these two mixed up, but they do very different jobs. The best way to think about it is that "business license" is a huge umbrella term for any permit you might need to operate legally. A Certificate of Authority is just one specific, and very important, type of registration that falls under that umbrella.

- A Certificate of Authority comes from the state tax department. Its only purpose is to give you the legal right to collect sales tax. That's it.

- A Business License could be anything else: a professional license from the State Education Department, a food service permit from your county, or a local permit for a sidewalk cafe in NYC.

To put it simply: Nearly every business needs some form of "license" or permit. Only businesses that sell taxable goods or services need a Certificate of Authority. It's a critical piece of the puzzle, for sure, but it's not the whole puzzle.

What Happens if I Operate Without a License in New York?

Look, operating without the right licenses in New York is a high-stakes gamble you just don't want to take. The consequences can be severe and escalate fast, potentially crippling your business before it even gets off the ground.

The penalties aren't just a slap on the wrist. They can include:

- Steep Fines: We're talking hundreds, sometimes thousands, of dollars for each violation.

- Back Taxes and Penalties: If you were supposed to be collecting sales tax but weren't, you could be held personally liable for the entire amount you should have collected, plus hefty interest and penalties.

- "Cease and Desist" Orders: State or city agencies have the power to shut you down on the spot until you get compliant.

- Legal Action: In the most serious cases, you could be looking at civil or even criminal charges.

Trust me, it is always far cheaper and less stressful to invest the time and money to get properly licensed from day one.

How Long Does It Take to Get a Business License in NY?

There's no single answer here, because the timeline can vary wildly. It all depends on which specific permits and licenses your business needs. A simple online registration for a Certificate of Authority, for example, might get approved in just a few business days.

However, forming an LLC with the Department of State can take one to two weeks, and that鈥檚 just step one. Anything that requires a real person to review it or an inspector to visit your location is going to take much longer. Getting a liquor license or a food service permit can easily become a multi-month process involving stacks of paperwork and on-site visits.

My best advice is to start early鈥攊deally, three to six months before you plan to open your doors. Use the tool to map out everything you need upfront. Whenever you can, apply for multiple things at the same time to get those processes running in parallel.

Navigating the legal side of your business can feel complex, but you don't have to do it alone. At Cordero Law, we specialize in helping entrepreneurs and creatives in New York build their businesses on a solid legal foundation. We break down the complexities and work with you to ensure you're protected and compliant from day one. If you're ready for a legal partner who empowers you, learn more at .