Deciding to end a business partnership is a huge step, but it all boils down to two things at the start: having a frank, professional conversation with your partners and digging out that original partnership agreement. Getting these first moves right sets the entire tone for what comes next.

Think of your agreement as the rulebook you and your partners wrote for this exact situation. It鈥檚 time to dust it off.

Your First Steps to Ending a Partnership

The idea of dissolving a partnership can feel a lot like ending any other major relationship. It鈥檚 a messy mix of legal, financial, and often personal entanglements, usually sparked by disagreements, money problems, or just a change in direction. The reality is, many partnerships just don鈥檛 last.

There鈥檚 been a trend to make these splits cleaner. For example, in 2023, about 75% of legal partnership dissolutions in England and Wales were granted under new, simplified laws. This just goes to show how critical it is to have a clear process from the get-go.

That鈥檚 why your absolute first move should be to find and read your partnership agreement. It is your single most important tool right now.

Locating the Dissolution Clause

Somewhere in that agreement, there should be a section that spells out exactly how to break up. This isn鈥檛 just boilerplate legal text; it鈥檚 the custom plan you all agreed on back when things were good. Look for headings like "Dissolution," "Termination," or "Winding Up."

This clause is where you'll find the ground rules, answering questions like:

- Who gets to decide? Does dissolving the business require everyone to agree (unanimous vote), or just a majority?

- Is there a waiting period? How much notice do you have to give the other partners? 30 days? 90 days?

- What about buyouts? Can one partner buy out another's share? If so, how do you figure out the price?

Your agreement might say, for instance, that you need to give 60-day written notice, and the decision requires a unanimous vote. Trying to sidestep these pre-agreed terms is a recipe for legal battles and bad blood.

When you're looking through your agreement, certain clauses are more critical than others. They dictate how this whole process will unfold.

Key Clauses to Review in Your Partnership Agreement

| Clause Type | Why It's Important | What to Look For |

|---|---|---|

| Dissolution Triggers | Defines exactly what events can legally start the dissolution process. | Specific events like a partner's death, bankruptcy, a specific date, or a mutual agreement. |

| Voting Requirements | Tells you how the decision to dissolve must be made to be legally valid. | Whether a simple majority, supermajority (e.g., two-thirds), or unanimous consent is needed. |

| Notice Provisions | Sets the timeline and method for formally notifying other partners. | The required notice period (e.g., 30, 60, or 90 days) and if notice must be in writing. |

| Buyout/Buy-Sell | Outlines if and how a partner can be bought out, preventing a full dissolution. | The formula or process for valuing a partner's share and the terms of payment. |

| Asset Distribution | Explains the "waterfall" of how assets are divided after debts are paid. | The priority of payments鈥攃reditors first, then partner loans, then capital contributions, then profits. |

This table isn't exhaustive, but it hits the big ones. Finding these sections gives you a clear, factual basis for your next steps and helps take some of the emotion out of the equation.

Key Takeaway: Your partnership agreement isn't just a piece of paper鈥攊t's your roadmap. Following its directions is the best way to start the dissolution process on solid legal ground.

Starting the Conversation

Once you've done your homework and understand your contractual obligations, it's time to talk. This isn鈥檛 about pointing fingers or rehashing old arguments. You need to approach this with complete professionalism, framing it as a necessary business decision that鈥檚 guided by the agreement you all signed.

Kicking this process off the right way is crucial for protecting your own interests and walking away with your professional reputation intact. If you鈥檙e feeling unsure, this is the perfect time to get some professional business legal advice. An experienced attorney can help you make sense of the legal jargon in your agreement and map out a strategy, paving the way for a cooperative and far less painful dissolution.

Managing the Financial Wind-Down Process

Once you and your partners have made the tough call to dissolve the business, your focus has to pivot immediately to the financial wind-down. This is where things get real, and often, really complicated. It's the process of formally untangling all the money, assets, and debts tied up in the partnership. The main goal here is to get a perfectly clear snapshot of what the business owns and what it owes before a single dollar is paid out to any partner.

Let's be honest: dissolving a business partnership can feel a lot like a personal breakup, both emotionally and financially. It鈥檚 an interesting parallel. In the U.S., official records from 2022 showed over 673,000 divorces. A huge chunk of those鈥攁 staggering 60%鈥攚ere people in the 25-39 age group. This isn't just a random statistic; it鈥檚 the same demographic that's most likely to be starting businesses. It suggests the same life stressors that can pull personal relationships apart can just as easily fracture a business partnership. You can find more on these .

Conducting a Final Accounting

The absolute first step on the financial side is to conduct a final, comprehensive accounting. I'm not just talking about checking the company bank account. This is a deep dive into every single financial corner of your business. You need to create a definitive list of every asset and liability as of the official date of dissolution.

- Assets: This is everything of value. Think cash, accounts receivable (money owed to you), and physical property like office furniture, computers, and any inventory you're holding.

- Liabilities: This is everything you owe. It includes bank loans, lines of credit, unpaid bills from suppliers, and any outstanding taxes.

This final balance sheet is the bedrock for every financial move you make from this point forward. Don't rush it. Getting this right from the start will save you from massive headaches and potential legal battles down the road.

The Challenge of Asset Valuation

Just listing your assets isn't enough. You have to figure out what they're actually worth鈥攖heir fair market value. From my experience, this is one of the biggest friction points when partners go their separate ways. Cash is easy, of course. But what about everything else?

That server you bought three years ago for the office? It's not worth its original price. What about your intellectual property, like a valuable client list or the brand name you worked so hard to build? That has value, but pinning a number on it can be tricky and subjective. This is where disagreements can flare up and turn an otherwise friendly split into a contentious one.

Pro Tip: To sidestep these disputes, I strongly recommend hiring a neutral, third-party business appraiser. They provide an unbiased, professional valuation that gives you a credible, defensible number all partners can agree on. It takes the emotion and personal opinion out of the equation.

Settling Debts and Notifying Creditors

Before any partner gets a dime, you have to pay off all the business's debts. It鈥檚 the law. In New York, you're required to formally notify all your known creditors that the partnership is dissolving. This is their official window to submit any final claims for payment.

There's a specific pecking order for who gets paid, and you have to follow it:

- Outside Creditors: Banks, landlords, suppliers鈥攖hese are the first to be paid.

- Partner Loans: If a partner personally loaned money to the business, they're next in line to be repaid.

- Capital Contributions: After all other debts are settled, partners get their initial capital investments back.

Only when all of these obligations have been met can any leftover profits or assets be distributed among the partners.

If part of your dissolution involves selling off significant business assets, it's really helpful to know the ins and outs of how that works. You can check out our guide on the different ways to buy or sell a business to get more context.

Finally, you need to close all company bank accounts and credit cards. This is a crucial final step to formally sever the financial ties and protect every partner from any future liability.

How to Distribute Assets and Settle Accounts

After you've paid off every last vendor and settled every outside debt, you've arrived at what is almost always the toughest, most emotionally-charged part of the breakup: splitting up what鈥檚 left. This is where a cool head and absolute loyalty to your partnership agreement are non-negotiable.

Your agreement should be your roadmap here. It acts as a "waterfall" schedule, spelling out the exact order for paying back partners and dividing any remaining assets. It's not just about splitting the cash in the bank; it鈥檚 a detailed process that respects each partner's unique financial journey with the business. Getting this right is crucial for preventing a messy legal battle down the road.

Calculating Each Partner's Final Share

First things first, you need to figure out each partner's final capital account balance. This number isn't just what they initially put in. Think of it as a running tab of their total financial stake in the company.

It starts with their original contribution, but then you have to adjust it for their share of the profits and losses over the partnership's life, plus any draws they took.

Let's say Partner A invested $50,000 and Partner B put in $25,000. They don't just get that money back. If the partnership has $40,000 in retained earnings and a 50/50 profit-sharing agreement, each partner's capital account gets a $20,000 boost before any money is paid out.

Key Takeaway: The final check a partner receives rarely matches their initial investment. It鈥檚 a dynamic figure that tells the story of the business's performance and the specific terms you both agreed to.

Handling Non-Cash Assets and Buyouts

Now for the tricky part: physical assets. You can't exactly saw the company server in half. Your dissolution agreement should give you guidance here, but you generally have a few solid options.

- Sell and Split: This is the cleanest path. You liquidate all the non-cash assets鈥攕ell the furniture, the computers, the inventory鈥攁nd turn it all into cash. That cash then gets added to the pot for distribution based on those final capital account balances.

- In-Kind Distribution: Sometimes a partner wants to keep a specific asset. That's perfectly fine, as long as everyone agrees on its fair market value. That value is then "charged" against their final payout. So, if a partner takes a $5,000 computer, their cash distribution is cut by $5,000. It keeps things equitable.

- Partner Buyout: This is common when one partner plans to continue in the industry and wants something specific, like the client list or a key piece of machinery. In that case, they can "buy" the asset from the dissolving partnership. The money from that sale goes right back into the partnership's funds to be distributed among all partners.

Creating a Final Distribution Plan

To keep everything above board and avoid any "he said, she said" arguments later, you need to document this entire process in a final distribution plan. This is your official record. It should clearly list every single asset, its agreed-upon value, and exactly how it was distributed.

Here鈥檚 a simplified look at what that might entail for a basic two-partner business:

| Item | Value | Partner A's Share | Partner B's Share | Notes |

|---|---|---|---|---|

| Remaining Cash | $80,000 | $40,000 | $40,000 | Distributed according to 50/50 agreement. |

| Office Server | $5,000 | $0 | $5,000 | Partner B takes asset in-kind. |

| Final Payout | $40,000 | $35,000 | Partner B's cash share is reduced by the asset's value. |

This final, clear-as-day schedule is your proof that the financial wind-down was handled fairly and by the book. It鈥檚 the last step in making sure everyone can walk away knowing the partnership was concluded with integrity.

Filing Your Final Dissolution Paperwork

You鈥檝e divided the assets and settled the debts, and now you鈥檙e on the final straightaway. This last phase is all about the paperwork鈥攎aking the end of your partnership legally official with the state of New York and other government agencies.

Think of it as formally closing the book on your business. Done right, you can walk away cleanly, with no lingering liabilities or surprises down the road. This is the step that transforms your internal agreements into a public record, officially signaling to everyone that your partnership no longer exists.

While business and personal partnerships are different, we're seeing a similar trend in how they end. For instance, Europe saw around 0.7 million divorces in 2023, and many laws now encourage amicable splits to reduce legal friction. You can see similar thinking in business law, where a clean, documented dissolution is always the best path forward. If you're interested in these broader social trends, you can find more details in the .

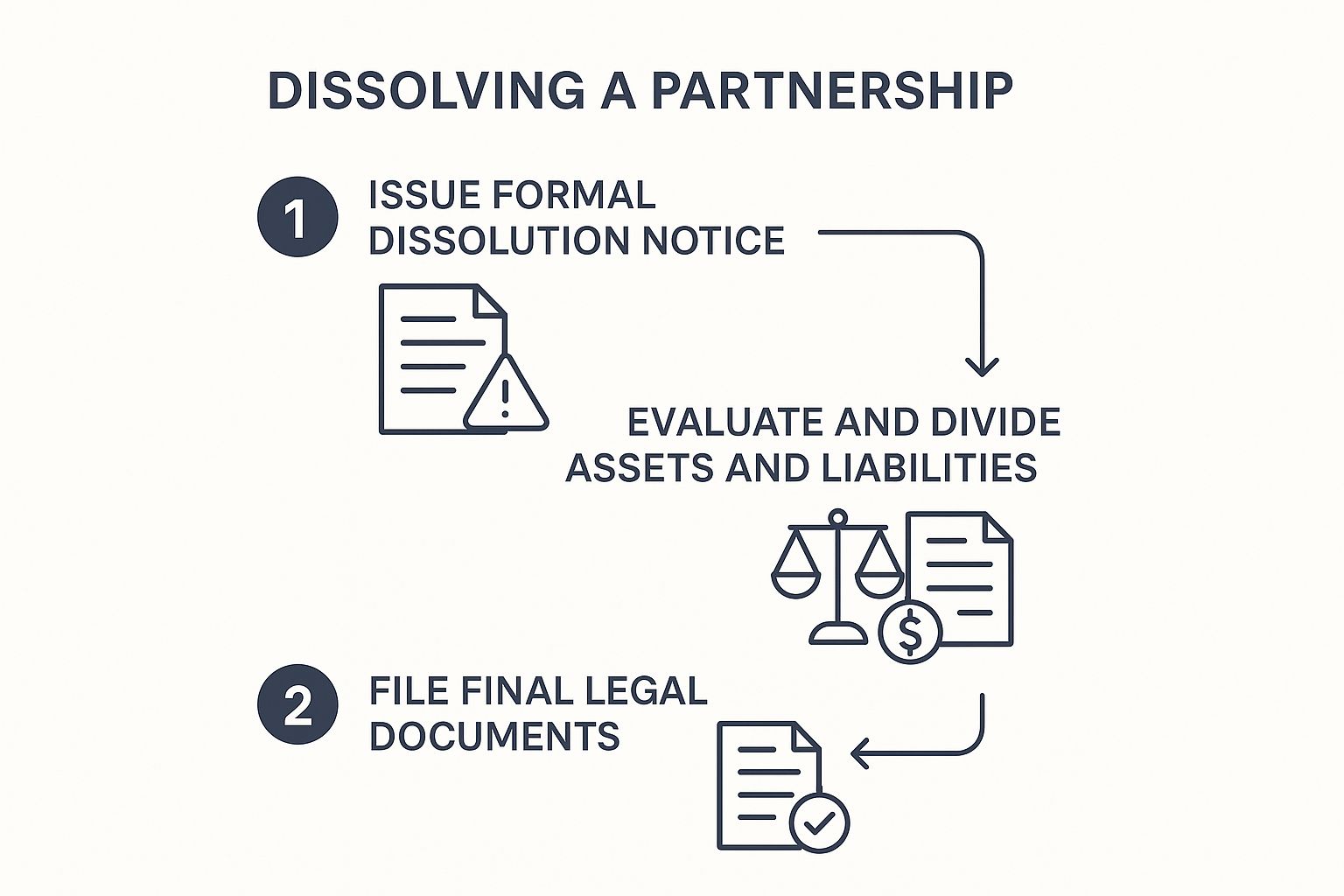

This flowchart breaks down the basic workflow for winding things down, from that initial notice to filing the last form.

As you can see, each step builds on the last. It鈥檚 a logical process designed to ensure an orderly conclusion to your business's life.

Filing with the New York Department of State

If your partnership is a registered entity like a Limited Liability Partnership (LLP), your most important filing is the Certificate of Dissolution. This is the document that officially tells the New York Department of State that your business is shutting down.

You'll have to provide basic information, like the partnership's official name and the date you decided to dissolve. There鈥檚 a filing fee, so make sure you check the Department of State's website for the current amount. Trust me, this isn't an optional step. It's a legal requirement that formally dissolves your entity in the eyes of the state.

Notifying Tax Agencies

Next up, and just as crucial, is formally closing your business tax accounts. I鈥檝e seen this trip people up before. If you fail to do this, the government assumes your business is still active and, you guessed it, still owes taxes. This can lead to some nasty penalties.

You need to notify:

- The IRS: You must file a final federal tax return for the year your partnership closes. It鈥檚 critical that you check the box indicating it鈥檚 a "final return."

- New York State Department of Taxation and Finance: You'll do the same at the state level鈥攆ile a final state tax return and follow their procedures for closing your New York business tax accounts for good.

Key Insight: Simply ceasing operations and locking the doors isn't enough for the tax authorities. You have to be proactive and file those final returns to officially close out your tax obligations and prevent a major headache later on.

The Final Dissolution Agreement

Lastly, it鈥檚 always a smart move to create a formal Dissolution Agreement. This is an internal document, signed by all partners, that serves as the definitive record of every decision made during the wind-down.

It should detail how assets were valued and divided, how every last debt was paid, and the final distribution amounts each partner received. Think of this agreement as your final, binding proof. It shows that everyone agreed to the terms of the split, which can be invaluable if any questions鈥攐r worse, disputes鈥攑op up months or even years later.

To help keep it all straight, here鈥檚 a quick checklist of the official filings you鈥檒l be handling.

New York Partnership Dissolution Filing Checklist

| Task | Agency/Party to Notify | Key Document/Form | Purpose |

|---|---|---|---|

| State Dissolution | New York Department of State | Certificate of Dissolution | To legally terminate the partnership's existence with the state. |

| Federal Taxes | Internal Revenue Service (IRS) | Form 1065 (marked "Final") | To file the final income tax return and close the federal tax account. |

| State Taxes | NYS Dept. of Taxation and Finance | Final state partnership return | To close out all state tax obligations (income, sales tax, etc.). |

| Creditor Notification | All known creditors | Written notice of dissolution | To inform creditors the business is closing and settle final claims. |

| Internal Record | All partners | Final Dissolution Agreement | To create a binding internal record of asset/debt settlement. |

Following this checklist ensures you鈥檝e covered all your bases and can officially close this chapter of your professional life without leaving any loose ends.

Tips for a Smooth and Amicable Dissolution

The legal paperwork and financial accounting are only half the story when it comes to dissolving a partnership. The other half鈥攖he human side鈥攊s what truly determines if this process is a clean break or a painful, drawn-out conflict. How you handle the conversations, disagreements, and tough decisions will make all the difference.

Your single greatest tool through all of this is open communication.

Even when you鈥檙e at odds about the business's future, it鈥檚 possible to keep things respectful and professional. This isn't about scoring points or winning arguments. The real goal is to find a constructive way forward for everyone. It's tough, I know, but you have to separate the business decision from the personal feelings.

Embrace Open and Honest Communication

From the moment the word "dissolution" is first mentioned, commit to being transparent. Nothing fuels animosity faster than ambiguity and surprises. I recommend setting up regular meetings just to check in on progress, even if there isn't much to report. It keeps everyone in the loop and cuts down on the anxiety of the unknown.

For instance, instead of dropping a major decision in an email, pick up the phone. Propose a call to walk through your reasoning. This gives your partner a chance to ask questions and feel heard, which can stop a potential blow-up before it even starts. Treat every single interaction like a business negotiation, not a personal fight.

Key Insight: Clear, consistent communication is the bedrock of an amicable split. It builds trust when things are tense and reminds everyone you're both working toward the same goal: a fair and final end to the partnership.

This mindset shifts the whole dynamic. Instead of a battle, it becomes a collaborative project. You鈥檙e both working to carefully dismantle what you built together, and doing it with respect protects both your professional reputations and your sanity.

Consider Using a Neutral Mediator

Sometimes, no matter how hard you try, communication just hits a wall. When you're completely stuck on a major issue鈥攍ike how to value company assets or who鈥檚 responsible for certain debts鈥攂ringing in a neutral third party can be a game-changer. A professional mediator鈥檚 job isn't to take sides; it's to get you both talking productively again.

A good mediator can help you find creative solutions you might have missed. Let's say you're deadlocked over the client list. A mediator might suggest a joint announcement plan or a temporary non-compete agreement that feels fair to both of you. Trust me, this is far cheaper and faster than letting a judge decide.

Document Everything in Writing

Even if you鈥檙e on friendly terms, do not rely on verbal agreements. Ever.

After every single meeting or important phone call, send a quick follow-up email. Just summarize what you talked about and what you agreed to. This simple habit creates a running record of your decisions and prevents a classic case of "that's not what I remember" down the line.

This paper trail becomes the foundation for your official Dissolution Agreement. When it's time for the lawyers to draft that final document, you'll have a clear log of decisions to pull from. It makes the last legal steps so much quicker and less contentious. This isn't about mistrust; it's just smart business.

Common Questions About Partnership Dissolution

Even with the best roadmap, ending a partnership brings up a ton of "what if" questions. I see it all the time. Getting clear, no-nonsense answers is key to feeling confident as you work through this major business shift. Let's tackle some of the most common worries that pop up during a business breakup.

This isn't just about legal paperwork; it's about setting yourself up for what's next. For many, that means launching a new venture, which usually requires finding new funding. If that's you, check out our introductory guide on how to raise startup capital for the basics on securing investment for your next big idea.

What Happens If We Don't Have a Written Partnership Agreement?

This is, hands down, one of the riskiest positions a business can be in. If you don't have a formal agreement spelling out the rules for a split, you're at the mercy of New York's default Partnership Law.

The law is blunt: all partnership assets get sold, all debts get paid, and whatever is left over gets divided equally among the partners.

This equal split happens whether you put in $100,000 or $10,000. It doesn't care who worked more hours or brought in more clients. The default rules are a one-size-fits-all solution, which is exactly why having a custom, detailed agreement from the start is so vital.

Can One Partner Force the Dissolution of the Partnership?

Whether a single partner can pull the plug on the whole operation really boils down to how the partnership was set up in the first place.

- Partnership for a Definite Term: Was your agreement created for a specific time frame or to finish a particular project? If so, one partner can't just decide to leave without potentially facing a breach of contract lawsuit.

- Partnership-at-Will: If your agreement has no end date, it's what we call a "partnership-at-will." In this case, any partner can usually trigger the dissolution just by giving notice to the others. It鈥檚 that simple.

Of course, a partner can always go to court and ask a judge to dissolve the partnership. This typically happens in messy situations, like when another partner engages in serious misconduct, becomes incapacitated, or does something that makes it impossible to keep the business going.

A Critical Distinction: Knowing if your partnership is "at-will" or for a "definite term" is everything. This one small detail, usually buried in your founding documents, determines if a partner wanting out is a simple notification or the start of a serious legal fight.

Are All Partners Personally Liable for Business Debts?

Yes. In a general partnership, every single partner has unlimited personal liability for the business's debts. This is a massive point that catches too many people by surprise. The whole "winding down" phase is designed to use business assets to pay off creditors first.

But what if the business assets aren't enough? If there's still debt left over, creditors can legally come after the personal assets鈥攚e're talking homes, cars, savings accounts鈥攐f any of the partners to get what they're owed. This is why a meticulous and thorough debt settlement process is non-negotiable. It鈥檚 about protecting everyone鈥檚 personal financial future.

At Cordero Law, we know that dissolving a partnership is more than a legal task鈥攊t鈥檚 a major turning point in your career. We offer the strategic counsel you need to get through it with clarity and confidence. If you need guidance, contact us today.