Jumping into a business with a partner is a classic high-stakes move. It's a blend of shared risks and shared rewards, a dynamic that can either rocket your company to success or sink it with complications. At its core, you're getting access to more money and a broader skillset, but you're also taking on joint liability for every debt and decision. Your success really boils down to how well you manage these built-in trade-offs from day one.

Is a Business Partnership Right for You

Deciding to form a business partnership is a massive commitment. It’s not just about sharing an office and splitting the workload; it’s a legal and financial knot that ties your professional future to someone else. You have to be brutally honest with yourself: does this setup truly fit your goals, your work style, and how much risk you can stomach?

The appeal is obvious. Instead of going it alone, you’ve got a collaborator. Someone who brings in fresh capital, skills you don't have, and a different way of looking at problems. This can be a game-changer. Think of a visionary product developer teaming up with a sharp marketing mind—that’s a synergy a solo founder would kill for.

Balancing Opportunity with Risk

But let's not get carried away. This shared journey is loaded with serious risks. In a general partnership, every partner is on the hook for all business debts. That includes debts racked up by another partner, sometimes without you even knowing about it. Fights over the company's direction, money, or who’s pulling their weight can poison relationships and bring the whole operation to a halt.

A partnership is like a marriage; choosing the right partner and clearly defining the terms of the relationship upfront in a partnership agreement is the single most important factor for long-term success.

To make a smart call, you need to see the good and the bad side-by-side.

| Aspect | The Advantage (The Opportunity) | The Disadvantage (The Risk) |

|---|---|---|

| Capital & Resources | Easier access to funding by combining personal assets and investor networks. | Shared financial burden and the high potential for fights over money management. |

| Liability | The initial financial risk of starting up is spread across multiple people. | Unlimited personal liability for all business debts, even those your partner created. |

| Skills & Workload | You get complementary skills and a partner to help carry the enormous workload. | The possibility of unequal contributions of effort, which builds resentment fast. |

| Decision-Making | Collaborative brainstorming can spark better, more well-rounded ideas. | Slower decisions and the risk of deadlock or strategic disagreements killing progress. |

At the end of the day, the decision to partner up is both personal and strategic. It takes more than a great business idea; it requires a deep well of trust and open communication between everyone involved. For any entrepreneur thinking about these foundational steps, getting a handle on your legal standing is non-negotiable. You can learn more about getting the right business legal advice on corderolawgroup.com to make sure you start on solid ground.

The Strategic Gains of Joining Forces

Going into a partnership is about way more than just splitting the rent; it's a strategic play to build a stronger, more resilient business right from the get-go. One of the first and most obvious wins is having more cash to work with. Let's be real, launching a business is expensive, and trying to do it all with just one founder's savings can really hold you back.

When partners pool their financial resources, they instantly have a bigger budget. This doesn't just give you a better safety net to handle those early bumps in the road. It means you can be more ambitious with your launch, whether that means a serious marketing campaign or buying better equipment and inventory. Sharing the investment immediately opens up what's possible.

Merging Talents for a Competitive Edge

Beyond the money, one of the most powerful advantages of a business partnership is blending complementary skills. It’s incredibly rare for one person to be great at everything. A solo founder might be a genius engineer but totally clueless when it comes to landing that first big client.

A partnership lets you plug those critical holes. Think about this classic setup:

- The Visionary: This is your idea person, the product innovator who sees where the market is headed and what customers will need tomorrow.

- The Operator: This partner is a master of getting things done—logistics, finance, and operations. They build the systems that turn the vision into a real, profitable business.

This creates a balanced and seriously formidable leadership team. The visionary keeps pushing the company forward, while the operator makes sure the business stays stable and running smoothly. This kind of synergy helps you dodge common startup mistakes, like building an amazing product that nobody knows how to sell.

The right partner doesn't just double your output; they multiply your capabilities. A partnership built on complementary skills creates a whole that is far greater than the sum of its parts, allowing the business to tackle challenges from multiple angles at once.

The Power of a Shared Burden

The entrepreneurial journey can be incredibly lonely and stressful. The weight of every single decision, every failure, and every financial worry falls on one person's shoulders. A partnership offers critical emotional and psychological support that's often overlooked but is immensely valuable.

Just having someone else in the trenches with you makes the wins feel better and the losses more manageable. When you're facing a tough call or a major setback, a partner is there as a sounding board, offering a different perspective and moral support. This shared responsibility can drastically reduce the risk of founder burnout, which is a huge reason why so many solo ventures don't make it. It's not just about splitting the workload; it's about splitting the mental load.

This collaborative model is a proven recipe for success. There's a reason partnerships make up a huge chunk of the business world. In fact, companies with two founders have shown a 30% greater likelihood of a successful exit, like an IPO or acquisition. Of course, it's no guarantee—conflict is always a major risk. You can learn more about the .

Ultimately, these strategic gains—more capital, diverse skills, and shared resilience—aren't just nice ideas. They translate directly into better problem-solving, faster growth, and a more sustainable business, which makes a strong case when you're weighing the advantages and disadvantages of a business partnership.

Navigating the Inherent Risks of Partnerships

The idea of sharing success is great, but you have to go in with a clear-eyed view of the potential pitfalls. A partnership isn't just two people working together; it's a legal and financial web where the downsides can hit you hard, both personally and professionally. Knowing what can go wrong is your first line of defense.

The biggest and most startling risk for many is unlimited personal liability. In a general partnership, you and the business are legally seen as one and the same. This means if the business racks up a debt it can't cover, creditors can come after your personal assets—your house, your car, your savings—to get what they're owed.

Even more alarming, this liability is usually "joint and several." That’s a legal term that means you're not just on the hook for your slice of the debt; you're responsible for 100% of it. If your partner makes a terrible financial move and disappears, you could be left holding the entire bag.

The Inevitability of Founder Conflict

Even when you start with the best of intentions, disagreements are almost a guarantee. Founders are passionate, and that same passion can easily fuel conflict over the very soul of the business. These disputes are a huge reason why businesses fail, and they usually circle back to three core areas:

- Strategic Vision: One partner might want slow, steady, organic growth. The other might want to take on a mountain of debt to scale up fast.

- Financial Management: Arguments over spending, how profits are split, and reinvestment strategies are incredibly common and can poison the well quickly.

- Work Ethic and Roles: It’s a classic story. One partner feels like they're doing all the heavy lifting, which leads to resentment and a total breakdown in collaboration.

These aren't just minor tiffs. They're fundamental disagreements about how to run the show, and they can paralyze your ability to make decisions, turning a creative space into a toxic one.

The most dangerous myth in partnerships is that friendship can overcome business friction. In reality, business stress is a powerful force that can fracture even the strongest personal bonds if a formal structure for resolving conflict isn't established from day one.

The Drag of Slower Decisions

While two heads can be better than one for brainstorming, they can really slow down execution. When you're a solo act, you can make a decision and act on it in minutes. In a partnership, every big choice might need a full-on discussion, debate, and eventual consensus.

This built-in delay can mean missing out on time-sensitive opportunities. If a competitor makes a move, you might spend precious days just talking about your response while they're out there grabbing market share. This operational slowdown is one of the most practical disadvantages of a partnership, turning your agility into bureaucracy.

The struggle to keep collaborations effective is a global problem. Reports show a staggering 60-65% of strategic alliances don't meet their goals. A key reason cited by 45% of executives is simply the difficulty of keeping partnerships active and beneficial for everyone over the long haul. You can find more revealing data about .

You can't overstate the emotional toll of a partnership gone sour. A failing business is tough enough, but when it’s tied to a failing professional relationship, the stress just multiplies. It can feel like a messy divorce, hitting your mental health, your finances, and even your personal life. Pointing out these business partnership disadvantages isn't about scaring you off. It's about making sure you enter the arena prepared to build something that lasts.

Okay, you’ve decided to go into business with someone. That's a huge step. But the very next question is just as important: what kind of partnership are you actually forming?

Not all partnerships are built the same. The legal structure you pick will have a massive impact on your personal liability, how you get taxed, and who has the final say in big decisions. Frankly, getting this wrong can turn the advantages of a partnership into major disadvantages, fast.

You need to get familiar with the main options: the General Partnership (GP), the Limited Partnership (LP), and the Limited Liability Partnership (LLP). Each one offers a different trade-off between protection and control. This means sitting down with your partners—and I'd strongly suggest your lawyer and accountant, too—to make sure the structure fits your goals and how much risk you're willing to take.

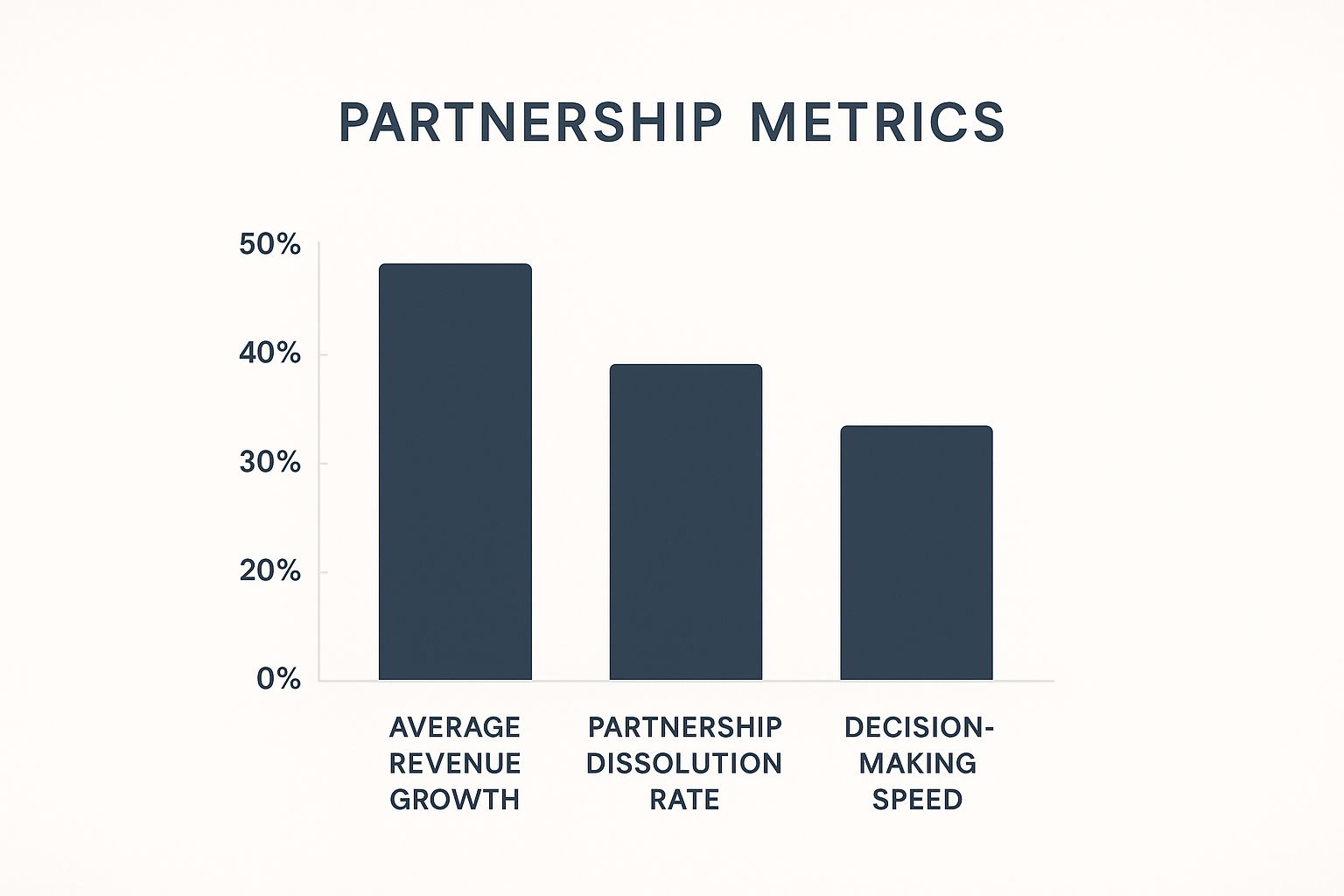

This image breaks down some of the numbers behind partnerships—the potential revenue jumps, how often they dissolve, and how they can speed up decisions.

The data shows what many of us in the business world already know: partnerships are high-reward but also high-risk. There's real growth potential, but also a significant chance of things ending early.

The General Partnership (GP)

The General Partnership is the most basic, default structure. If you and a partner just start doing business together without filing any special paperwork, you've probably formed a GP without even realizing it. It’s incredibly easy to start, but that simplicity comes with a serious string attached.

In a GP, every partner is usually involved in the day-to-day grind and has a say in decisions. But here’s the kicker: every partner also has unlimited personal liability. If the business racks up debt it can't pay, creditors can come after your personal bank account, your car, even your house. It also means you’re on the hook for debts your partner creates, a concept called "joint and several liability."

- Best For: Simple, low-risk ventures where the partners trust each other completely and are both hands-on. Think of a small local shop or a two-person consulting gig.

- The Big Risk: The total lack of a shield for your personal assets. One bad move by your partner could put your entire financial life at risk.

The Limited Partnership (LP)

A Limited Partnership (LP) is a more sophisticated setup. It’s designed for situations where some partners want to be investors and others want to run the show. An LP has two completely different types of partners, which changes everything.

You have at least one general partner. Just like in a GP, this person manages the business day-to-day and has unlimited personal liability. Then, you have one or more limited partners. These are your passive investors. They put up the capital but have zero involvement in running the company. In exchange for staying hands-off, their liability is limited to whatever amount they invested.

A Limited Partnership is a strategic tool for separating investment from operations. It allows a business to raise capital from investors who want a financial stake without taking on the risks or responsibilities of running the company.

You see this structure all the time in real estate deals or film productions. Money is raised from a group of investors (the limited partners) who trust a single developer or producer (the general partner) to see the project through.

The Limited Liability Partnership (LLP)

The Limited Liability Partnership (LLP) is a powerful hybrid. It blends the collaborative nature of a partnership with the kind of liability protection you'd get from a corporation. In an LLP, all partners can manage the business, but they also get a critical shield protecting their personal assets.

The main advantage here is that partners are not personally responsible for the business's debts or—and this is huge—for the professional mistakes or negligence of other partners. That’s a game-changer. For example, if one partner in an accounting firm makes a massive, costly error, the other partners’ personal finances are safe. Each partner is, however, still responsible for their own misconduct.

It's no surprise this is the go-to structure for professional service firms where the risk of individual malpractice is a real concern.

- Common Use Cases:

- Law firms

- Accounting firms

- Architecture groups

- Medical practices

Choosing between these structures is a foundational decision that requires you to weigh control, liability, and complexity. To make it a bit clearer, let's break it down side-by-side.

Comparing Key Business Partnership Structures

This table offers a straightforward look at how these three common structures stack up against each other on the most critical points.

| Feature | General Partnership (GP) | Limited Partnership (LP) | Limited Liability Partnership (LLP) |

|---|---|---|---|

| Personal Liability | Unlimited for all partners. | Unlimited for general partners; limited for limited partners. | Limited liability for all partners. |

| Management Control | All partners typically have equal management rights. | General partners manage; limited partners are passive. | All partners can actively manage the business. |

| Best Suited For | Small businesses with low risk and high trust. | Ventures needing passive investors, like real estate. | Professional service firms (lawyers, accountants, etc.). |

| Key Consideration | Simplicity vs. massive personal risk. | Attracting capital vs. concentrated GP liability. | Comprehensive protection vs. more complex setup. |

Making this call isn't just about checking a box on a form; it's a strategic move that defines the rules of the game for your entire business journey. Taking the time to really understand the pros and cons of each legal structure will pay you back for years to come.

Building a Bulletproof Partnership Agreement

Going into a partnership without a detailed agreement is like setting sail in a storm without a rudder. Seriously. A well-crafted partnership agreement is your single most important tool for heading off future conflict. It acts as the foundational rulebook for your business and is the best way to guard against the downsides of a partnership.

This legally binding document does way more than just list who the partners are. It forces you to have those tough, sometimes awkward, conversations right at the beginning, when everyone is still excited and on the same page. Getting these things hammered out early builds a strong foundation and stops minor disagreements from blowing up into business-ending disasters. Think of it as the blueprint that will see you through both the good days and the inevitable rough patches.

Defining Roles and Responsibilities

One of the fastest ways for a partnership to turn sour is ambiguity over who does what. Resentment builds up in a hurry when one partner feels like they’re pulling all the weight or making every critical decision alone. Your agreement has to clearly spell out the specific roles, duties, and authority of each partner.

This isn't about micromanaging; it's about creating clarity and accountability. For instance:

- Partner A: Handles all marketing, sales, and client acquisition.

- Partner B: Manages product development, operations, and all things finance.

By defining these domains, you create clear lanes of ownership. This not only streamlines how you operate but also dramatically cuts down on friction, making sure every essential function is covered and everyone knows what’s expected of them.

Structuring Contributions and Compensation

Money is a classic source of conflict, so your agreement must be crystal clear on all financial matters. It needs to detail what each partner is putting in at the start—whether that's cash, property, or intellectual property—and assign a clear value to any non-cash assets.

On top of that, the agreement has to specify how profits and losses will be split. Is it a straight 50/50? Or will it be tied to how much capital someone put in, the hours they work, or specific performance goals? There's no single right answer, but there absolutely has to be an answer written down and agreed upon by everyone. This section should also lay out the procedures for salaries or draws for the partners.

A partnership agreement isn’t a sign of mistrust; it’s a framework for trust. It codifies your mutual understanding and respect, ensuring that when pressure mounts, you have a shared document to fall back on, not just fading memories of a verbal promise.

Planning for the End at the Beginning

I get it, no one wants to think about a partnership ending. But failing to plan for it is a catastrophic mistake. A comprehensive dissolution clause, or exit strategy, is completely non-negotiable. This clause details the precise steps to take if a partner wants out, becomes incapacitated, passes away, or if the business simply needs to be wound down.

This section should cover things like:

- Buyout Provisions: A clear formula or process for valuing a departing partner’s share and the terms for the remaining partners to buy it.

- Triggering Events: Specific definitions of what events (like a voluntary resignation or breach of contract) can trigger a buyout or dissolution.

- Winding-Down Process: The step-by-step plan for liquidating assets, paying off debts, and distributing whatever is left to the partners.

Creating such a detailed document involves some serious negotiation. If you need to sharpen your skills, exploring effective contract negotiation strategies is an invaluable step on corderolawgroup.com. This preparation ensures that an exit, while maybe sad, is orderly and fair—not a chaotic and expensive legal nightmare.

Answering Your Top Partnership Questions

As you think through the pros and cons of starting a business partnership, you'll naturally run into some big questions. Getting solid answers is the only way to move forward with confidence and build a plan that actually works. Let's dig into some of the most common issues that come up for entrepreneurs.

One of the first things people worry about is the money. How are profits and losses split? The default answer is pretty simple: unless your partnership agreement says something else, everything is divided equally among the partners.

But you don't have to stick to that. You can get creative and structure this split any way that makes sense for your business. Maybe you tie it to how much cash each person put in, who works the most hours, or even specific performance goals. The key is to spell it all out in your agreement so there's no room for arguments later on.

Another huge point of concern is what happens when someone wants out. This is where a rock-solid buy-sell provision in your partnership agreement becomes absolutely essential. This clause details the exact steps for a partner's exit. It covers how their share of the business will be valued and the terms for the remaining partners (or the business itself) to buy them out. Without this, a departing partner can throw the entire business into a messy, expensive, and legally tangled dissolution.

Navigating Legal Structures and Agreements

Many entrepreneurs get tripped up on the difference between a partnership and a Limited Liability Company (LLC). The main distinction boils down to one critical thing: liability protection. In a general partnership, your personal assets are on the line. If the business gets sued or racks up debt, your house, car, and savings could be at risk.

An LLC, on the other hand, creates a separate legal entity. This shield protects your personal assets from the business's problems, offering a layer of security a standard partnership just can't match.

So, do you even need a written agreement? Technically, no. You can form a partnership with just a verbal agreement or even by your actions alone. In fact, many "accidental" partnerships happen this way. But this is playing with fire. Without a written agreement, you're leaving every major decision and potential conflict up to vague interpretations and state default laws, which almost certainly won't reflect what you and your partners actually intended.

A partnership agreement is your business's prenuptial agreement. It forces you to address uncomfortable "what-if" scenarios upfront, ensuring that your collaborative venture is built on a foundation of clarity, not just hope.

Getting everything in writing isn't about a lack of trust; it's just smart business. For a deeper look at protecting your new venture, check out the resources on getting legal help for small business on corderolawgroup.com.

At Cordero Law, we specialize in transforming legal complexities into clear, empowering solutions for entrepreneurs like you. If you're ready to build your business on a solid legal foundation, let's talk. Contact Cordero Law today to see how we can help.