Understanding What Makes Patent Valuation Critical

Many business owners find patent valuation to be a daunting process. However, seasoned IP experts know it's more than just assigning a number. It's about uncovering hidden business potential. Understanding a patent's true worth can significantly influence a company's strategic choices.

These choices include licensing agreements, mergers and acquisitions, and securing crucial investment. Businesses that grasp this process often gain a competitive edge.

For example, consider a startup developing a novel battery technology. Without a firm grasp of their patent's value, they could undervalue it during licensing negotiations, losing out on potential profits. Conversely, an accurate valuation might attract significant investment, driving further innovation and growth. This underscores how patent valuation transcends basic accounting, becoming a powerful strategic lever.

This importance is further highlighted by the growing recognition of intellectual property (IP) as a key business asset. The global patent valuation market is projected to grow from USD 2.8 billion in 2023 to USD 5.4 billion by 2032, a CAGR of 7.2%. This growth is driven by the rising number of innovations and patents filed annually, coupled with an increased awareness of IP's financial significance. For more detailed statistics, see this report: .

Why Accurate Patent Valuation Matters

Accurately valuing a patent provides several key benefits for businesses. It offers a clear picture of the patent’s financial worth. This is essential for making sound decisions regarding licensing or selling the patent.

This clarity enables businesses to negotiate favorable terms and maximize returns. A robust patent valuation can also attract investors. It showcases the potential for future revenue from the patented technology, making a company more appealing to investors.

This is particularly vital for startups seeking funding for further development and commercialization. Finally, accurate patent valuations are crucial in mergers and acquisitions. Knowing the true value of the patents involved ensures a fair transaction for both buyer and seller.

It provides a shared understanding of the potential value being gained or relinquished, protecting each party’s interests and facilitating smoother negotiations. Accurate patent valuation transforms intangible IP into tangible business assets, enabling data-driven strategic decisions.

Practical Applications of Patent Valuation

Understanding the value of your patents unlocks numerous strategic opportunities. Companies with valuable patent portfolios can use that value to secure loans or other financing, leveraging their IP as collateral. This provides access to capital for business growth without diluting ownership.

Moreover, precise patent valuations play a significant role in licensing negotiations. A well-supported valuation allows companies to confidently negotiate licensing fees, ensuring fair compensation for the use of their technology. This can generate substantial revenue without requiring the patent holder to manufacture or sell products.

Ultimately, valuing a patent empowers businesses to make informed decisions, maximizing the potential of their intellectual property.

Mastering The Three Core Valuation Approaches That Work

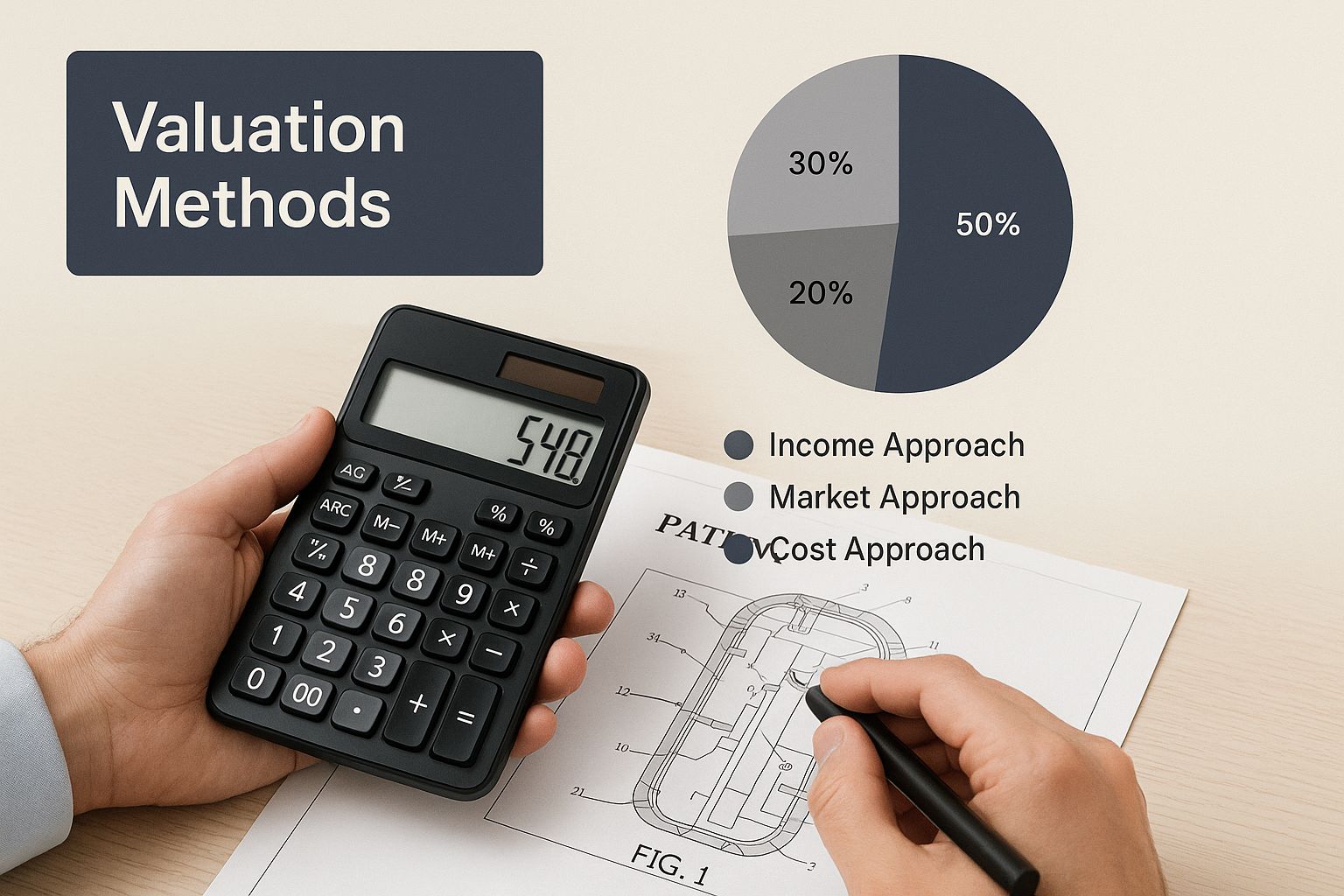

The infographic above illustrates the connection between calculations and patent blueprints, visually representing the three core valuation methods. This highlights the importance of selecting the right approach for valuing a patent. While these methods may seem technical at first, practical application makes them much clearer.

The Cost Approach

This method determines a patent's value based on the cost to reproduce or replace the patented technology. This involves calculating all expenses associated with developing the patent, including research, development, and legal fees. This approach, however, has limitations.

It doesn't consider the patent's potential future earnings. For instance, a groundbreaking drug patent might have cost millions to develop, but its market potential could be billions.

Therefore, the cost approach is generally best suited for patents nearing expiration or those with limited market potential.

The Market Approach

The market approach compares the patent to similar patents that have been recently sold or licensed. This means identifying comparable patents and analyzing their transaction values. This method is particularly useful when a robust market for similar patents exists.

However, finding truly comparable patents can be difficult, especially for niche or emerging technologies. Market conditions can also fluctuate, affecting the reliability of past transactions.

Think of it like real estate: similar properties provide a benchmark, but unique features and market trends influence the final price. Therefore, careful analysis and adjustments are essential when using the market approach.

The Income Approach

This approach projects the future revenue the patent is expected to generate. This might involve estimating future licensing fees, sales revenue from products using the patented technology, or cost savings from the patent. The income approach is often seen as the most accurate and defensible method, particularly for patents with high earning potential.

However, accurately projecting future revenue can be complex. It requires market analysis, competitor assessment, and forecasting. For example, a new software feature patent might generate revenue through sales or licensing. Estimating this revenue necessitates understanding market demand, pricing, and competition. Learn more in our article about How to master trademark licensing. Despite the difficulties, the income approach often provides the most realistic valuation for commercially valuable patents.

The following table summarizes the key differences between these three approaches:

Patent Valuation Methods Comparison

A detailed comparison of the three primary patent valuation approaches, their applications, advantages, and limitations

| Valuation Method | Best Used For | Key Advantages | Main Limitations | Typical Accuracy Range |

|---|---|---|---|---|

| Cost Approach | Patents nearing end of life or with limited market potential | Simple to calculate if development costs are well documented | Doesn't consider future earnings or market value | Low to Moderate |

| Market Approach | Patents where similar patents have been sold or licensed | Leverages real-world market data | Difficulty finding truly comparable patents, market volatility | Moderate |

| Income Approach | Patents with high earning potential | Considered most accurate and defensible, reflects potential future revenue | Complex to calculate, requires accurate revenue projections | High, but dependent on accuracy of projections |

By understanding these three approaches, along with their strengths and weaknesses, businesses can choose the best method, or combination of methods, for their specific needs. This careful selection ensures a more robust and credible valuation, maximizing the patent's strategic and financial potential.

Riding The Wave: Market Forces Driving Patent Values

The patent valuation landscape is constantly shifting, making it essential for patent owners to understand the market forces at play. Savvy IP owners are recognizing this dynamic environment and strategically positioning their patents for optimal returns. This section delves into the current market dynamics that are shaping patent values and creating lucrative opportunities.

Increased R&D Spending and Its Impact

A primary driver of patent value is the significant increase in research and development (R&D) investment across various sectors. Industries such as technology, pharmaceuticals, and biotechnology are heavily investing in innovation, leading to a surge in the development of valuable intellectual property. This influx of new IP demands sophisticated valuation methods to accurately assess its true worth.

For example, developing a new pharmaceutical drug often requires years of research and substantial financial investment. Accurately valuing the resulting patent necessitates considering the R&D costs, the potential market size, and the competitive landscape.

Moreover, the global patent valuation market itself is experiencing rapid growth. Projections indicate it will reach $1051.6 million by 2025, with a CAGR of 11.2% from 2025 to 2033. This impressive growth is fueled by increased R&D spending and the rising demand for professional valuation services due to increased patent litigation and licensing agreements. For more detailed analysis, see .

Patent Litigation and Licensing Trends

The rise in patent litigation is another significant factor influencing the demand for professional patent valuations. When patents become involved in legal disputes, accurate valuations are crucial for determining damages or potential settlement amounts.

Likewise, the evolving licensing market plays a substantial role in affecting valuation multiples. As certain technologies gain commercial traction, the demand for licenses increases, potentially driving up their value. Staying informed about licensing trends is therefore essential for accurately assessing a patent's worth.

Emerging Technologies and Premium Valuations

Certain emerging technology sectors are commanding premium valuations due to their high growth potential and disruptive nature. Fields like artificial intelligence, blockchain, and renewable energy are attracting substantial investment and generating significant interest, resulting in higher valuations for related patents. Identifying these high-value sectors can be a strategic advantage for IP portfolio management.

For instance, a patent related to a groundbreaking AI algorithm could hold significantly more value than a patent for a more established technology. This underscores the importance of recognizing market trends and their impact on specific technology areas.

Analyzing High-Value Patent Transactions

Analyzing recent high-value patent transactions offers valuable insights into broader market trends. By examining the factors driving these deals, IP owners can gain a better understanding of how to position their own patents for maximum value. This includes understanding the characteristics of high-value patents, such as their breadth of coverage, commercial potential, and defensibility.

By staying informed about these market forces, IP owners can make more strategic decisions about their patent portfolios. This knowledge empowers them to perform effective patent valuations and develop strategies to maximize the potential of their intellectual property.

Leveraging AI and Tech Tools for Smarter Valuations

Patent valuation is a dynamic field, constantly evolving. The introduction of Artificial Intelligence (AI) is significantly impacting how professionals approach this crucial process. This section explores how advanced AI-powered tools are enhancing the accuracy and speed of valuations, making professional-grade assessments more readily available.

AI-Driven Patent Landscape Analysis

AI algorithms can analyze extensive patent landscapes considerably faster than traditional methods. These algorithms identify comparable technologies that human analysts might overlook, revealing valuable insights for valuation. This ability to uncover hidden connections within the patent landscape provides a more comprehensive understanding of a patent's competitive position and potential value.

Imagine valuing a patent for a new type of solar cell. AI can analyze millions of patents to identify similar technologies, competitor activity, and market trends, providing a more comprehensive valuation than manual analysis alone.

Additionally, AI-powered tools are automating prior art searches. They can quickly and thoroughly identify existing patents and publications relevant to a particular invention. This automated prior art search is often far more comprehensive than manual searches, helping to uncover critical references that might otherwise be missed, leading to more accurate and reliable patent valuations.

Predictive Analytics and Patent Strength

AI is also being applied to predictive analytics for patent valuation. These analytic tools assess a patent's strength and potential litigation risk, providing valuable input for valuation. This helps determine a more realistic and defensible valuation, considering the patent's enforceability and potential for legal challenges.

For example, AI algorithms can analyze litigation data, including past court decisions and settlement amounts, to estimate the likelihood of success in a potential patent infringement lawsuit. This information is critical for determining a patent's true value.

Patent professionals using AI-enhanced valuation tools report impressive improvements in efficiency and accuracy. They experience 67% faster assessment completion times and a 34% improvement in valuation accuracy compared to traditional methods. Automated landscape analysis uncovers an average of 23% more relevant prior art references. Learn more about AI-patent valuation studies here. You might be interested in: How to master Intellectual Property for Software.

Machine Learning and Market Data Processing

Machine learning models are transforming how market data is processed for patent valuation. These models can handle vast amounts of data, identifying relevant market trends and pricing information that impacts patent value. They can consider various factors, including market size, competitor pricing, and consumer demand, to provide more accurate and nuanced valuations.

For instance, in the pharmaceutical industry, AI can analyze clinical trial data, regulatory approvals, and market sales projections to estimate the potential revenue of a drug patent, providing a more robust valuation than traditional methods.

Choosing the Right AI Tools

While the potential of AI in patent valuation is significant, not all tools are created equal. Some deliver substantial return on investment (ROI), while others offer limited value. It's crucial to carefully evaluate the features, capabilities, and track record of different AI valuation tools before investing. This due diligence ensures selecting the right tool for your specific needs and avoids costly mistakes.

Turning Valuations Into Strategic Business Wins

A precise patent valuation is more than just a number; it’s a powerful tool that can drive strategic business decisions. Smart companies use these valuations to gain a competitive edge in licensing negotiations, mergers and acquisitions, and portfolio optimization. This section explores how accurate valuations translate into tangible business advantages.

Dominating Licensing Negotiations With Data

A robust patent valuation provides a strong foundation for licensing negotiations. It allows you to confidently present the value of your intellectual property to potential licensees, justifying your desired licensing fees. Without this data-driven approach, you risk undervaluing your patent and losing potential revenue. For example, imagine licensing a patented manufacturing process. A well-supported valuation empowers you to demonstrate the cost savings and increased efficiency the licensee can expect, justifying a higher licensing fee.

This data-driven approach ensures fair compensation for the use of your technology. It also provides a clear basis for negotiations, leading to mutually beneficial agreements.

Making Smarter M&A Decisions

Patent valuations play a critical role in mergers and acquisitions. They provide both buyers and sellers with a clear understanding of the value of the intellectual property involved. This transparency is crucial for fair and efficient transactions. Overpaying for a company with overvalued patents can be a disastrous financial decision. Conversely, undervaluing a target company’s patents can lead to missed opportunities.

Accurate valuations help to avoid these pitfalls. They allow for a more objective assessment of a company’s true worth, considering the value of its IP assets. This leads to informed decision-making and ultimately, more successful transactions.

Optimizing IP Portfolios for Maximum Return

Patent valuations are essential for effective IP portfolio management. By understanding the value of individual patents, companies can make strategic decisions about which patents to maintain, license, or sell. This helps to focus resources on the most valuable assets and maximize the overall return on investment for the IP portfolio.

This strategic approach ensures that the portfolio aligns with the company’s overall business goals. For example, a company might choose to sell patents that are not core to its business but hold significant value for another company. This generates revenue that can be reinvested in developing and protecting core technologies.

Presenting Valuation Results Effectively

Effectively communicating the results of a patent valuation is just as important as the valuation itself. You need to present the findings in a clear and concise manner that resonates with executives, investors, and board members. This involves translating complex valuation methods and data into actionable insights.

Highlighting the key drivers of the valuation and the potential business implications helps stakeholders understand the value proposition. Using visuals and real-world examples can further enhance the presentation and make the information more accessible. You might be interested in: How to master business legal advice.

Integrating Patent Values With Business Valuation

Patent valuations should not be viewed in isolation. They need to be integrated into the overall business valuation model. A company’s IP assets contribute significantly to its overall value. Therefore, accurately reflecting this contribution in the business valuation is critical. Accurately representing patent values enhances the company’s perceived worth.

This is particularly important for attracting investors and securing funding. It demonstrates the long-term value and growth potential of the company. Further, studies show the impact of professional patent valuations. Companies achieving 156% higher licensing revenue per patent complete M&A due diligence 43% faster. Strategic patent sales generate an average of 2.8x more value than ad-hoc disposals. Find more detailed statistics here: Strategic Patent Valuation Impact. This integration is fundamental for a comprehensive understanding of the company’s financial position and future prospects.

Solving The Toughest Valuation Challenges Like A Pro

Valuing a patent can be tricky. Even seasoned professionals find that real-world scenarios often present unique obstacles. This section tackles these challenges, providing practical strategies for accurate and effective patent valuation.

Emerging Technologies: Navigating Uncharted Territory

One of the biggest challenges in valuing a patent lies with emerging technologies. These innovations often lack established markets, making traditional valuation methods, like the market approach, difficult. How do you assign value to something without market history?

One solution is to look beyond traditional markets. Analyzing early adoption rates, industry buzz, and expert predictions can offer valuable insights into potential future value. For example, a new type of 3D printing material might not have a wide market yet. However, its rapid adoption by early adopters and positive industry forecasts could indicate significant future value.

Defensive Portfolios: Measuring Deterrence Value

Many companies hold patents not for licensing or selling, but for defense. These patents deter competitors from entering their market or copying their technology. Quantifying the value of this deterrence can be a challenge.

One approach involves assessing the potential cost of litigation. How much would a competitor spend to challenge the patent, and what are the potential damages if they lose? This provides a framework for estimating the patent's defensive value, similar to assessing the value of insurance – mitigating risk.

Crowded Fields and FRAND Obligations: Finding Clarity in Complexity

Valuing patents in crowded fields, where multiple companies hold overlapping intellectual property (IP) rights, presents unique challenges. Determining the value of a specific patent among similar technologies requires careful analysis of its unique features and advantages.

Another layer of complexity involves standard-essential patents (SEPs) subject to fair, reasonable, and non-discriminatory (FRAND) licensing obligations. These obligations restrict licensing fees, impacting overall value. Valuing SEPs often requires specialized expertise and deep understanding of FRAND case law.

Rapidly Evolving Industries: Adapting to Constant Change

In fast-paced industries with rapidly changing technology and markets, patent valuations quickly become outdated. Maintaining accuracy requires constant monitoring and adjustments based on the latest market data and technological advancements.

Regularly reviewing and updating valuations ensures they remain relevant and reflect the current market. This dynamic approach is crucial for making informed decisions.

Quantifying Litigation Risk: Assessing Enforceability and Validity

A patent's value is tied to its enforceability. A patent likely to be invalidated in court has less value than a strong, defensible one. Assessing litigation risk involves evaluating prior art, claim scope, and potential vulnerabilities.

This analysis requires examining similar patents and publications to determine the novelty and non-obviousness of the invention. Understanding potential legal challenges helps in establishing a more realistic valuation.

Uncertain Market Adoption Timelines: Factoring in Time and Uncertainty

Predicting market adoption of new technology is inherently uncertain. This uncertainty impacts valuation, especially when using the income approach, which relies on projecting future revenue.

One strategy uses different market adoption scenarios, from rapid adoption to slow uptake. Calculating the patent's value under each scenario provides a range of potential values, reflecting the inherent uncertainty and enabling a more informed assessment.

International Patent Families: Navigating Global Landscapes

Many patents are part of international families, with corresponding patents filed in multiple countries. Valuing these families requires considering the various legal landscapes and enforcement strengths in different jurisdictions.

A patent may be highly valuable in one country with strong IP protection, but have limited value in another with weaker enforcement. Assessing each patent's value within the family, considering the specific legal and market conditions of each country, is crucial.

Overcoming Valuation Challenges with Cordero Law

Navigating these complex valuation challenges is difficult. Cordero Law, with its expertise in intellectual property law, offers comprehensive guidance and support in valuing patents effectively. Our team helps clients navigate the intricacies of patent valuation, ensuring they receive accurate and defensible assessments. Contact us today to learn how we can help you maximize the value of your IP. Learn more about how Cordero Law can assist you.

To further illustrate the challenges and solutions in patent valuation, let's look at the following table:

Patent Valuation Challenges and Solutions

| Valuation Challenge | Impact on Assessment | Expert Solution | Success Rate | Best Practice Tips |

|---|---|---|---|---|

| Emerging Technologies | Difficulty in applying traditional valuation methods due to lack of market history | Analyzing early adoption rates, industry buzz, and expert predictions | Varies greatly depending on the technology | Conduct thorough market research and engage industry experts |

| Defensive Portfolios | Difficulty in quantifying the value of deterrence | Assessing potential litigation costs and damages | Moderate to High | Consider the competitor's financial strength and motivation |

| Crowded Fields and FRAND Obligations | Difficulty in determining the value of a specific patent amidst similar technologies and FRAND restrictions | Analyzing unique features and advantages, and understanding FRAND case law | Moderate | Conduct a detailed patent landscape analysis and consult with FRAND experts |

| Rapidly Evolving Industries | Valuations can quickly become outdated | Regularly reviewing and updating valuations based on market data and technological advancements | High, if consistently updated | Implement a system for continuous monitoring and updating |

| Quantifying Litigation Risk | Uncertainty regarding enforceability impacts value | Evaluating prior art, claim scope, and potential vulnerabilities | High | Conduct a thorough legal analysis and consider expert opinions |

| Uncertain Market Adoption Timelines | Difficulty in projecting future revenue | Using different market adoption scenarios and calculating value ranges | Moderate | Conduct sensitivity analysis and consider market forecasts |

| International Patent Families | Varying legal landscapes and enforcement strengths across different jurisdictions | Assessing the value of each patent within the family based on specific country conditions | Moderate to High | Engage local experts and conduct country-specific legal analysis |

This table summarizes some of the key challenges and solutions in patent valuation. Each challenge requires a tailored approach for a successful outcome. Remember, engaging experienced professionals can significantly improve the accuracy and effectiveness of your patent valuation efforts.