Succession planning. It's one of those things every small business owner knows they should do, but it often gets pushed to the bottom of the to-do list. In simple terms, it's your game plan for transferring leadership and ownership of the company you've poured your life into.

Think of it as a roadmap. It鈥檚 what ensures your life's work continues smoothly long after you've retired, or in case something unexpected happens. It鈥檚 about protecting your legacy, your team, and your family.

Why Succession Planning Matters More Than You Think

Let鈥檚 be real. Thinking about the day you step away from your business is tough. For most of us, our company is more than just a balance sheet or a building; it鈥檚 a massive part of our identity. But putting off this conversation is one of the biggest gambles you can take.

This isn鈥檛 just an "exit strategy." It's a critical tool for ensuring the business can actually keep running, preserving the wealth you've built, and protecting the legacy you've created. Without a clear plan, you're leaving the future of your company鈥攁nd your family鈥檚 financial security鈥攃ompletely up to chance. A sudden health crisis or accident could trigger a chaotic fire sale, destroying the value you worked so hard to build and leaving your loved ones to clean up the mess.

The Stark Reality for Small Business Owners

The gap between what owners want to do and what they actually do is huge. A revealing U.S. Bank survey found that while a staggering 85% of small-business owners dreamed of passing their company on, only 54% have a formal plan in place to make it happen.

This disconnect is a ticking time bomb, especially since more than half of all business owners are over 55 and closing in on retirement. The data paints a clear, and frankly, scary picture: a huge number of businesses are just one unexpected event away from a total crisis.

A business without a succession plan is like a ship without a rudder. When the captain is no longer at the helm, it will drift aimlessly and likely run aground, taking its crew and cargo down with it.

So, what are your options? Every business is different, but most succession plans fall into one of a few main categories.

Here's a quick look at the most common pathways:

Your Primary Succession Planning Pathways

| Pathway | Best For | Key Consideration |

|---|---|---|

| Family Transfer | Owners who want to keep the business in the family and have capable, willing heirs. | Emotional family dynamics can complicate business decisions. Fairness to all children (involved or not) is critical. |

| Sale to Key Employees | Businesses with a strong, loyal management team that knows the operations inside and out. | Employees may need help securing financing (e.g., seller financing, bank loans). |

| Sale to an Outside Third Party | Owners looking to maximize their financial return and are ready for a clean break. | Finding the right buyer and preparing the business for sale can take years. Confidentiality is key. |

| Liquidation/Wind-Down | Businesses that are not easily sellable or have no clear successor. | This typically yields the lowest financial return, as assets are sold off piecemeal. |

Deciding on the right path is the first major step, but the process doesn't end there.

More Than Just a Financial Transaction

A good succession plan goes way beyond the numbers and legal papers. It has to address the human side of the transition, which is often where things get tricky. When done right, the benefits are immense:

- It secures your family鈥檚 future. A plan ensures your heirs get the full, fair value of the business you built鈥攏ot pennies on the dollar in a forced liquidation.

- It protects your team. It gives your dedicated employees stability and a clear path forward. This prevents your best people from jumping ship during a period of uncertainty.

- It preserves your legacy. You get to ensure the company鈥檚 culture, values, and community goodwill鈥攖he things you can't put a price on鈥攃ontinue under new leadership that you鈥檝e chosen and prepared.

- It maximizes your financial return. A planned transition almost always gets you a better price. It gives you time to beef up operations, polish the financials, and make the business as appealing as possible to a buyer.

Finding and Vetting Your Ideal Successor

Let's be honest, choosing your successor is probably the most personal鈥攁nd high-stakes鈥攄ecision you'll make in this whole process. This isn't just about finding someone whose resume looks good. It's about finding a leader who gets your vision and has the grit to steer the company into its next chapter.

The right person needs more than just operational smarts. They need the right temperament, a genuine respect for the culture you鈥檝e spent years building, and the drive to not just keep the lights on, but to make the business flourish. This decision is your legacy.

Gauging a Candidate's True Potential

When you start sizing up potential successors鈥攚hether it's a family member, a star employee, or an outsider鈥攜ou have to dig deeper than a standard interview. Your goal is to get inside their head and understand their character and what really motivates them.

Think of it less like a formal interrogation and more like a series of candid conversations. You want to see how they think on their feet.

Here are a few questions I've seen work wonders to get past the canned answers:

- "If I handed you the keys tomorrow, what's the very first thing you'd change? And what's the one thing you'd fight to protect?"

- "Tell me about a time you had to make a tough call that was unpopular but was the right move for the business. How did you handle the blowback?"

- "Paint me a picture: where is this company in five years? What are the specific moves you'd make to get us there?"

- "In your own words, how would you describe our company culture? What part of it clicks with you, and what do you think needs to evolve?"

These aren't gotcha questions. They're designed to reveal how a person thinks strategically, whether their values line up with yours, and how they lead when the pressure's on.

The Unique Challenge of Family Businesses

Nowhere are the stakes higher than in a family business. The dream of passing the company down is powerful, but good intentions aren't enough. It's a tough pill to swallow, but succession planning is a massive blind spot for most family-owned operations.

While 72% of owners want to keep the business in the family, a shockingly low 34% actually have a documented plan. This is a huge reason why only 30% of businesses make it to the second generation. The emotional ties make it incredibly difficult to be objective. It鈥檚 absolutely critical to separate family dynamics from business roles.

A classic mistake I see all the time is assuming the oldest child or the one who's been around the longest is the automatic choice. Leadership isn't a birthright. It has to be earned through real competence and commitment.

To sidestep the drama, you need to set up clear, objective goalposts for any family member who throws their hat in the ring. This might look like:

- Mandatory Outside Experience: Requiring them to work for another company for a few years. It gives them invaluable perspective they just can't get inside the family bubble.

- A Formal Evaluation Process: Using the exact same tough performance reviews and skill assessments you'd use for any other top-level hire.

- Educational Benchmarks: Insisting on specific degrees or certifications that are actually relevant to running the company.

This kind of structure helps take the emotion out of the decision. It ensures the person who takes over is the most qualified, not just the most convenient. Trust me, it protects both your business and your family relationships down the road.

Assessing Financial and Leadership Readiness

A successor's readiness isn't just about vision. It's also about their financial savvy and their ability to get funding if a buyout is on the table. An internal candidate, like a long-time manager, might know the business inside and out but have zero capital for a purchase. For a great look at this challenge, check out this guide on how to raise startup capital.

Your plan has to be grounded in reality. Ask yourself:

- Financial Literacy: Can they actually read a P&L and a balance sheet and understand the story the numbers are telling?

- Access to Capital: Do they have a realistic path to financing a buyout, or will you need to get creative with things like seller financing?

- Risk Tolerance: Are they truly prepared for the personal financial risks that come with being the owner?

Ultimately, vetting your successor is a deep-dive exercise. You're matching skills, vision, and character. Take your time, be brutally objective, and in the end, trust your gut. The future of what you've built depends on it.

Structuring the Legal and Financial Handover

This is where the rubber meets the road. All your planning and vision for the business's future now get hammered into concrete legal and financial terms. It can feel like a massive task, but if you break it down, it's far more manageable.

Think of this part of the process as building a sturdy bridge from your leadership to the next. The technical details are everything here. I've seen poorly structured deals create staggering tax bills, spark ugly disputes, and even tank the entire sale. Getting this right isn't just important鈥攊t's essential for a clean, successful transition.

Assembling Your Transition Dream Team

You wouldn't perform surgery on yourself, so don't try to navigate this legal and financial maze alone. Your first move should be to put together a professional "dream team" to guide you. Each person has a critical role to play.

- Business Attorney: This is your legal quarterback. They鈥檙e the one drafting the iron-clad agreements, making sure everything is compliant, and defending your interests at the negotiating table.

- Accountant (CPA): Your CPA is your tax guru. Their job is to structure the sale to be as tax-efficient as possible, which means more of your hard-earned money stays in your pocket. They'll also help whip your financials into shape so they look appealing to buyers and their lenders.

- Financial Advisor: This pro helps you see past the sale itself. They鈥檒l work with you to map out your financial life after you exit the business, ensuring the proceeds support your retirement, investments, and legacy goals.

Getting the right experts in your corner is the single best investment you'll make in this entire process. Don鈥檛 be afraid to seek out professional business legal advice to ensure you鈥檙e protected from day one.

The Power of a Buy-Sell Agreement

If you have partners or co-owners, a buy-sell agreement is the most important document you can have to prevent future chaos. Seriously. It鈥檚 like a prenuptial agreement for your business. It spells out exactly what happens if an owner retires, gets sick, passes away, or just decides they want out.

Without one, you're opening the door to messy disputes that could end in expensive lawsuits or even a forced sale on terrible terms.

A buy-sell agreement is a roadmap for ownership changes. It sets the rules of the road before a crisis hits, taking the emotion and guesswork out of what would otherwise be a very tense situation.

A solid agreement needs to clearly define three key things:

- Triggering Events: What specific events鈥攍ike death, disability, or retirement鈥攌ickstart the buyout process?

- Valuation Method: How will the business be valued when a triggering event occurs? Nailing this down prevents arguments over the price tag later.

- Funding Mechanism: How will the buyout actually be paid for? This could be through cash, an installment plan, or, quite commonly, life insurance policies held by the business.

Financing the Handover

So, how is your successor actually going to pay you? This is a huge piece of the puzzle. The financing structure impacts your payout schedule, your tax situation, and the overall viability of the deal. Let's look at a few common ways this gets done.

Common Financing Options

| Option | How It Works | Best For… |

|---|---|---|

| Seller Financing | You act as the bank, accepting payments over time from your successor. | Internal successors (like family or a key employee) who might not qualify for a traditional bank loan. It also gives you a steady income stream. |

| Traditional Bank Loan | Your successor gets a loan from a bank, often an SBA-backed loan, to pay you. | Financially solid businesses and successors who can meet a bank's tough lending criteria. You get your money in a lump sum. |

| Employee Stock Ownership Plan (ESOP) | You sell your shares to a trust, which then holds them for the benefit of your employees. It's a powerful tool, but it's complex. | Companies with a strong team culture where the owner wants to reward employees and keep the company's legacy intact. |

Each of these paths has its pros and cons. Seller financing is flexible but carries the risk that the buyer could default. A bank loan gives you a clean break, but it can be hard to get approved. An ESOP is great for morale but comes with a lot of administrative hurdles.

This is exactly why you need that dream team. Talking through these options with your financial advisor and accountant is the only way to figure out what makes the most sense for your specific succession planning for small business goals.

Mentoring Your Successor for a Seamless Transition

A successful handover is a process, not a single event. I've seen it happen: an owner picks a successor, tosses them the keys, and walks away. That's a recipe for disaster. The real work鈥攁nd the true art of succession planning for small business鈥攊s in the slow, deliberate mentorship that turns a promising candidate into a confident leader.

This journey is about so much more than just teaching someone to read a balance sheet or manage inventory. It's about gradually passing down the institutional knowledge, the key relationships, and the strategic gut feelings you've spent a lifetime building. A well-run mentorship ensures the business doesn't just survive your exit but actually thrives long after you're gone.

The goal of mentorship isn't to create a clone of yourself. It's to empower your successor with the skills, knowledge, and confidence to lead the company in their own way, while still honoring the legacy you built.

This whole process should ideally kick off years, not months, before you plan to leave. A rushed transition just creates anxiety for your team, confusion for your customers, and puts an insane amount of pressure on your successor.

Crafting a Multi-Year Mentorship Plan

Think of this as a slow, intentional transfer of power. A phased approach is always the best bet, as it lets your successor grow into the role without getting completely overwhelmed. I鈥檝e seen timelines like this work wonders:

- Years 1-2: The Shadowing Phase. Your successor is basically your shadow. They learn by observing, attending key meetings, getting the hang of the day-to-day operational rhythms, and starting to grasp the business's nuances. Their main job is to listen and ask a ton of questions.

- Years 2-3: The Delegation Phase. Now you start handing off specific, lower-stakes responsibilities. This could be managing a small department, overseeing a particular project, or taking the lead on a client account. This is where they begin making decisions, and you provide constructive feedback.

- Years 3-4: The Leadership Phase. The successor starts taking on serious strategic responsibilities. Maybe they're leading budget meetings, developing new business strategies, or managing critical client and supplier relationships. You shift from being the director to more of a supportive advisor.

- Final Year: The Transition Phase. By now, your successor is operating as the de facto leader, with you acting as a safety net. This is the final test run, proving to you, the team, and themselves that they are truly ready.

This gradual release of control is absolutely critical for building their confidence and ensuring authority is transferred smoothly.

Communicating the Change with Confidence

How you talk about the transition is just as important as the plan itself. Your employees, customers, and suppliers need to feel stable and confident about the company's future. Dropping a surprise announcement can spark panic and rumors.

Instead, be transparent and strategic. For your employees, this means introducing the successor early on and explaining their evolving role. Frame it as a positive step for the company's growth, not just your retirement plan.

For customers and suppliers, a joint introduction is magic. A simple email or a personal call from both you and your successor can go a very long way.

Here鈥檚 an example of what you could send to a key client:

"Hi [Client Name], I'm writing with some exciting news. As we plan for the future of [Your Company], I've been personally mentoring [Successor's Name] to take on a leadership role. [Successor's Name] will be joining our next call to get acquainted, and I'm incredibly confident in their ability to continue providing the excellent service you expect from us."

A simple message like this does three things at once: it signals a planned, thoughtful transition, introduces the new leader with your personal endorsement, and reassures the client that their needs are still the top priority.

The Personal Journey of Letting Go

Finally, let's talk about you. This is a massive personal milestone. Letting go of the business you poured your life into can be incredibly tough, emotionally. It鈥檚 vital to prepare yourself for this next chapter.

Be crystal clear about what your future role will be. Will you be a silent owner, a paid consultant for a fixed period, or completely hands-off? Any ambiguity here can lead to you unintentionally undermining your successor. Set a firm departure date and, when the time comes, stick to it. This gives everyone clarity and forces you to fully embrace whatever new adventures await.

Exploring Alternative Paths to Secure Your Legacy

What happens if a family member or an internal manager taking over just isn鈥檛 in the cards? It鈥檚 not just okay; it鈥檚 an incredibly common scenario for small business owners. I see it all the time. Many of the most successful transitions I've witnessed happened outside the traditional family or management buyout route.

This opens up some powerful alternatives that can lead to fantastic outcomes, both for your financial future and for the legacy of the company you poured your life into. Thinking through these options is a critical part of any real succession planning for small business.

Selling to an Outside Party

The most obvious alternative is selling your business on the open market. This path can certainly maximize your financial return, but it demands a serious amount of prep work to make your company attractive to a stranger.

A third-party buyer will scrutinize everything. They have zero emotional attachment; their decision will be based purely on the numbers and future potential. To pull this off, you need to start thinking like a buyer yourself.

This means getting your house in order years in advance by:

- Documenting Everything: Create crystal-clear standard operating procedures (SOPs) for every key function. The goal is to prove the business can run smoothly without you walking through the door every morning.

- Building a Strong Management Team: Show that there's a capable team in place that isn't completely reliant on your daily presence. This de-risks the entire purchase for a new owner.

- Cleaning Up Your Financials: Work with your accountant to present at least three years of clean, professional financial statements. This builds immediate trust and makes it far easier for a buyer to secure financing.

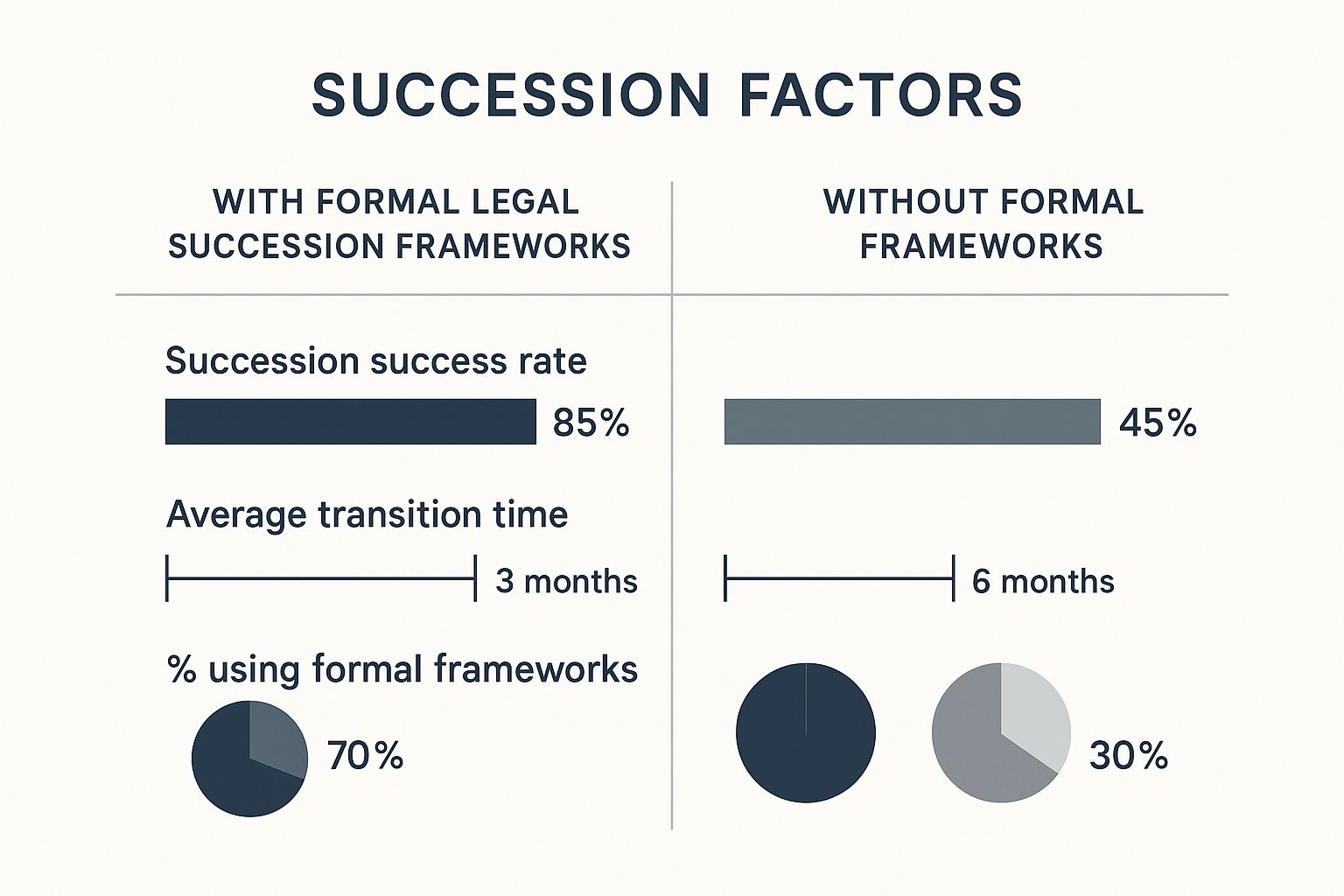

This kind of structured preparation is vital because it directly impacts your chances of success. The difference between businesses with formal plans and those without is stark.

As you can see, having a formal plan in place does more than just help鈥攊t significantly boosts the likelihood of a successful transition and can cut down the time it takes to get the deal done.

Employee Ownership: The Overlooked Powerhouse

Another path that鈥檚 gaining serious traction is selling the business to your employees鈥攏ot through a direct management buyout, but through an Employee Stock Ownership Plan (ESOP) or a similar model. This is an incredible tool for preserving your company culture and rewarding the very people who helped you build it from the ground up.

An ESOP is essentially a trust that buys your company shares and holds them for the benefit of your employees. You get a fair market value for your business, and your team gets a powerful, tangible stake in its future success.

An employee ownership model turns a succession plan into a collective mission. It aligns everyone鈥檚 interests, protects the company鈥檚 identity, and gives your team a real reward for their loyalty and hard work.

While selling on the open market can be a tough, uncertain road, these alternative models are proving remarkably effective. Statistics show that only about 30% of small businesses listed for sale actually end up selling. In contrast, some employee-focused transition platforms see close rates as high as 90% on signed letters of intent. The difference is night and day. You can review the full findings on .

Choosing between a third-party sale and an employee-centric model really comes down to weighing your personal and financial goals. For owners who prioritize legacy and culture above all else, an ESOP can be a perfect fit.

Comparing Your Succession Options

To make an informed choice, it helps to see these paths laid out side-by-side. Each has distinct benefits and challenges that will resonate differently depending on what you value most. Navigating the legal and financial complexities of these structures isn't something to do alone. Getting expert legal help for your small business is a crucial step in figuring out which path is truly right for you.

Here鈥檚 a practical comparison of the different paths, their success rates, and what they mean for you.

| Succession Path | Typical Success Rate | Primary Benefit | Main Challenge |

|---|---|---|---|

| Third-Party Sale | Low to Moderate (around 30%) | Potentially highest financial payout. | Finding a qualified buyer and navigating a lengthy, complex due diligence process. |

| Employee Ownership (ESOP) | High (can exceed 80-90%) | Preserves company culture and rewards loyal employees. | The legal and administrative setup is more complex and can be costly upfront. |

Ultimately, there is no single "best" answer here. The right choice depends entirely on what you want your legacy to be. Is it about maximizing your final payout with a clean break? Or is it about ensuring the company you built continues to thrive in the hands of the people who know it best?

Your Questions About Succession Planning Answered

Even with a solid plan in hand, you're going to have questions. This is a huge step for any business owner, and it's completely normal to feel a little uncertain. Let's cut through the noise and tackle some of the most common questions that keep people up at night.

Think of this as a straight-to-the-point FAQ, giving you the direct advice you need to move forward.

How Long Does Succession Planning Really Take?

The honest answer? A lot longer than you probably think. Ideally, you should be starting this process five to ten years before you actually want to exit. No, that's not a typo. A long runway is your single biggest advantage.

This kind of timeframe gives you the space to properly groom a successor, get your business in peak shape to maximize its value, and carefully sort out all the legal and financial details without being rushed. It lets you be proactive instead of reactive. While you can pull off a plan in two or three years, it almost always means making compromises that could cost you a fortune down the road.

Starting early gives you the most options and the best possible chance for a seamless, profitable transition. Procrastination is the enemy of a good succession plan.

A longer timeline means you can methodically grow your company's value, which translates directly to a higher selling price. Every dollar you grow your Seller's Discretionary Earnings (SDE) can net you two to three times that amount in the final sale.

What Is the Biggest Mistake Owners Make?

Without a doubt, the single biggest mistake is simply waiting too long. So many owners see succession planning for small business as something to think about later, like a retirement task, not as a critical, ongoing business strategy. This delay nearly always ends in a rushed, crisis-driven plan.

A sudden health problem or an unexpected offer can force your hand, leaving you scrambling. The result is almost always a lower valuation for your business, fewer choices for a successor, and a chaotic handover that can damage your legacy and leave your team feeling lost.

A close second is failing to properly mentor the successor. Too many owners just hand over the keys and hope for the best. That鈥檚 a recipe for disaster. A gradual, deliberate transfer of knowledge, relationships, and responsibilities is essential for success.

What if I Have No Obvious Successor?

This is an incredibly common situation, so don't panic. If you don鈥檛 have a family member or a key manager ready to take the reins, your goal just shifts. You're now focused on making your business as attractive and turnkey as possible for an outside buyer.

This means it's time to get your house in order.

- Document everything. Create detailed Standard Operating Procedures (SOPs) for every important function in your business.

- Build a strong management team. You need to prove the business can thrive without you calling all the shots.

- Clean up your financials. Work with a good CPA to get your books absolutely pristine.

Once your business is "sale-ready," you can explore selling to a third party. Another powerful option is an Employee Stock Ownership Plan (ESOP). An ESOP lets you sell the business to the very people who helped you build it, rewarding their loyalty and keeping the company culture intact.

How Much Should I Budget for This Process?

The cost of creating a succession plan can vary a lot depending on how complex your business is. The key is to view this as an investment, not an expense.

You'll need to pay for legal experts to draft agreements, accountants to map out the tax strategy, and maybe a business appraiser for a formal valuation. This could run anywhere from a few thousand dollars for a simple internal transfer to tens of thousands for a more complicated external sale.

But here鈥檚 the thing: a well-executed plan can easily add six or even seven figures to your final payout and save you a massive amount in taxes. The return on this initial investment is almost always huge. Don't let the upfront cost scare you away from a process that will secure your financial future.

Navigating the legal and financial complexities of succession planning is a high-stakes process where expert guidance is non-negotiable. At Cordero Law, we don't just draft documents; we partner with you to protect your legacy, empower your transition, and ensure the future you've envisioned becomes a reality. To build a succession plan with a legal team that puts you first, visit us at corderolawgroup.com.