Why Legal Advice Isn't Just For Courtrooms

Many entrepreneurs see lawyers as a last resort鈥攕omeone to call when a lawsuit lands on their desk. This approach is like buying car insurance after you鈥檝e already crashed. The most successful business owners know better. They treat proactive small business legal advice as a powerful tool for growth, not just a shield against trouble. It鈥檚 their secret weapon for seizing opportunities, negotiating better deals, and building a stronger, more durable company.

When you start thinking of legal guidance as an investment instead of an expense, you change the entire direction of your business. It's about laying a solid foundation from the very beginning to prevent expensive problems from showing up later. This forward-thinking mindset is what separates businesses that truly prosper from those that just get by.

The Proactive vs. Reactive Mindset

Picture two new startups that are nearly identical. The first founder downloads a free, generic contract from the internet to cut costs. The second founder pays for a short consultation with a lawyer to create a custom agreement. For a while, everything seems fine for both.

Then, a major client fails to pay. The founder with the generic contract finds out it doesn't have the right legal language to enforce payment in their state. They end up in a stressful and expensive legal fight that drags on for months. Meanwhile, the other founder, whose contract was built for this exact situation, resolves the issue quickly and with little cost.

This is the key difference. Proactive legal help isn't about the upfront cost of a lawyer; it's about the tremendous value of avoiding future disasters. It鈥檚 about knowing which choices are critical before they become permanent headaches. One of the first and most important decisions is picking the right business structure.

The Small Business Administration (SBA) offers a helpful guide on the most common business structures available.

As the points out, your choice affects everything from your personal liability to your taxes. An LLC can shield your personal assets, while a corporation might be better if you plan to seek investment. Making this decision without advice is a risk your business can鈥檛 afford. This careful approach is why we have other business legal advice articles that dig deeper into these topics.

Legal Services as a Growth Engine

The legal services market is huge, which shows just how vital it is to the economy. By 2025, the worldwide legal services market is expected to reach $832.6 billion. The North American market alone is projected to hit $344.3 billion that same year, up from $295.3 billion in 2021. You can see a full market analysis to understand .

This growth isn't happening because more businesses are in trouble. It鈥檚 because smart owners understand that legal counsel fuels success. They use it to protect their ideas, create strong partnerships, and meet the rules needed to enter new markets. This strategic spending provides peace of mind and clears the way for growth.

Building Your Business Foundation the Right Way

Just like a house needs a solid foundation to stand against the elements, your business requires a strong legal structure to support growth and withstand challenges. Without this, you're building on quicksand, where small issues can quickly become catastrophic failures. Getting this part right from the start is one of the most crucial pieces of small business legal advice you can receive. It鈥檚 the difference between constantly fighting legal fires and confidently scaling your operations.

Choosing Your Business Structure

The first major decision is choosing a business structure. This isn't just a box to check on a form; it dictates your personal liability, tax obligations, and ability to raise capital. Think of it like choosing a vehicle for a cross-country trip. A sports car (sole proprietorship) is simple and fast for a solo journey but offers no protection in a crash. A minivan (LLC) offers more safety and room for passengers (partners/employees), while a bus (corporation) is built for serious, large-scale transport with complex rules.

Here is a look at the different business structures as outlined by the , a critical resource for any entrepreneur.

The IRS information highlights how each structure carries unique tax and liability implications, making it vital to choose based on your specific goals, not just convenience.

Here鈥檚 a quick comparison of the most common options:

- Sole Proprietorship: Simple to set up but offers no liability protection. Your personal assets (home, car) are at risk if the business is sued.

- Limited Liability Company (LLC): A popular choice that separates your personal and business assets. It provides the liability protection of a corporation with less formal requirements.

- Corporation (C Corp & S Corp): More complex and costly, but offers the strongest liability protection and is often necessary for attracting investors. S Corps have some tax advantages for eligible businesses.

To help you see the bigger picture, this table outlines the key legal areas, their importance, and the potential costs of getting things wrong.

Core Legal Areas and Their Business Impact

A comprehensive comparison of essential legal areas, their importance level, and typical costs for small businesses

| Legal Area | Importance Level | Average Cost | Consequences of Neglect |

|---|---|---|---|

| Business Structure | Critical | $100 – $800+ (initial setup) | Personal liability for business debts, higher tax rates, inability to secure funding. |

| Contracts | High | $300 – $1,500 per contract | Misunderstandings, unpaid invoices, legal disputes with clients or vendors. |

| Employment Law | Critical | Varies (ongoing compliance) | Significant fines for misclassification, lawsuits from employees, back taxes. |

| Intellectual Property | High | $250 – $2,000+ per trademark/copyright | Loss of brand ownership, competitors stealing your ideas, inability to defend your work. |

This table clearly shows that while there are upfront costs, the financial and operational damage from neglect is far greater. Investing in a solid legal foundation isn't an expense; it's insurance against future disaster.

The Power of Well-Crafted Contracts

Once your structure is set, your daily operations will be governed by contracts. A handshake deal might feel friendly, but a written contract is your business's rulebook. It clarifies expectations, defines responsibilities, and provides a clear path to resolve disputes before they escalate. A weak contract is like a leaky pipe鈥攁 small drip that can eventually cause massive damage. For instance, a vague payment term can lead to cash flow crises, while a missing confidentiality clause could expose your best ideas to competitors.

Employment and Intellectual Property Basics

Even if you鈥檙e a solo founder, understanding employment law is critical. The moment you hire your first employee鈥攐r even an independent contractor鈥攜ou step into a heavily regulated area. Misclassifying an employee as a contractor, for example, can result in significant fines and back taxes.

Finally, your intellectual property (IP)鈥攜our brand name, logo, inventions, and creative works鈥攊s often your most valuable asset. Failing to protect it with trademarks, copyrights, or patents is like leaving the front door of your store wide open overnight. Securing your IP ensures that your unique ideas remain yours, giving you a competitive edge that can define your long-term success.

Mastering Contracts Without a Law Degree

Contracts are the lifeblood of your business, setting the ground rules for your most important relationships with clients, vendors, and partners. Many entrepreneurs see them as dense pages of confusing legal jargon, but that's the wrong way to look at it. Think of a contract not as a trap, but as a detailed blueprint for a successful project. A good blueprint prevents miscommunication, clarifies who is responsible for what, and ensures everyone agrees on the outcome before any real work begins.

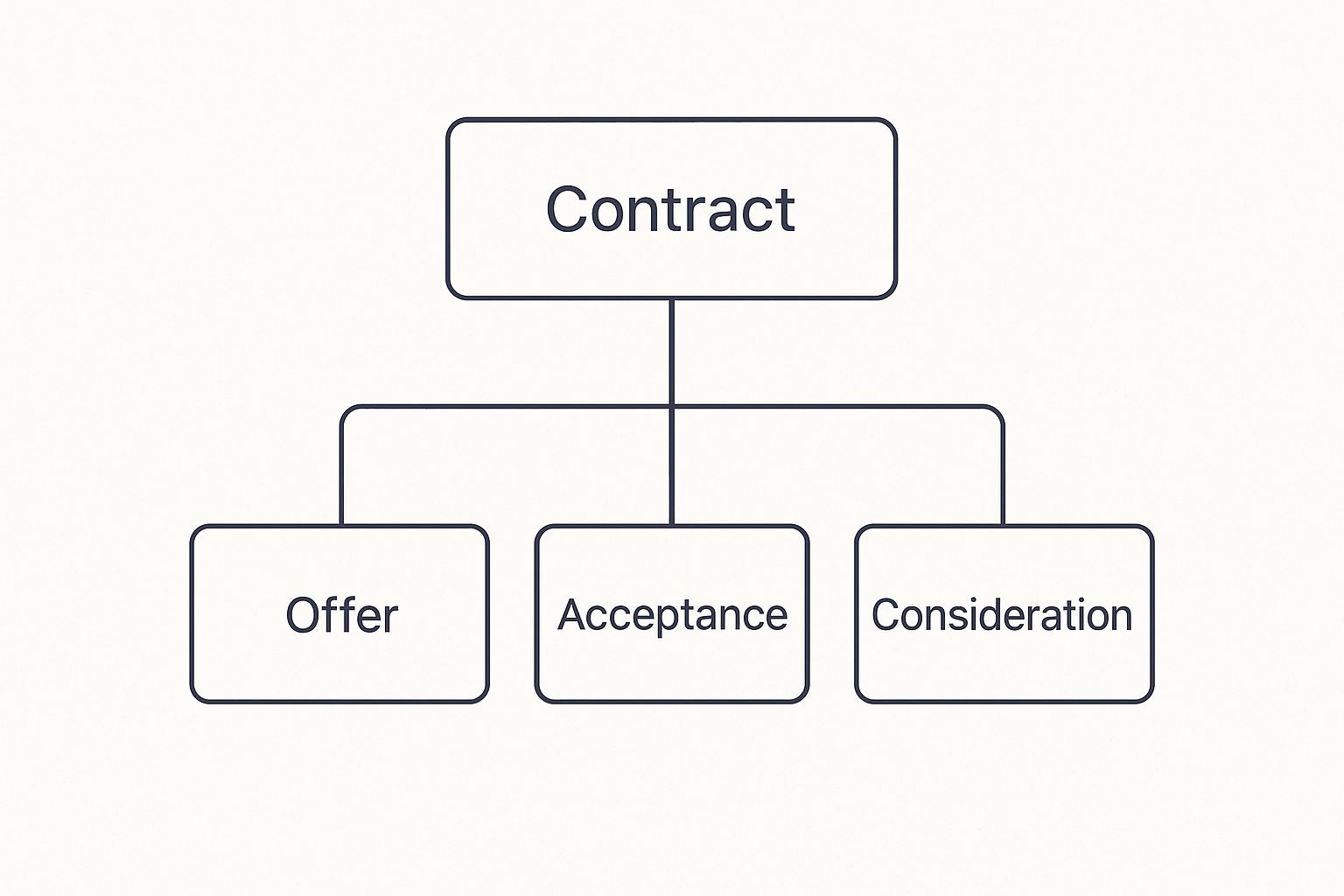

As the image above from legal resource Nolo shows, questions about contracts are incredibly common. This proves that getting a handle on the basics鈥攍ike what makes an agreement valid, what happens if it's broken, and what key terms mean鈥攊s essential knowledge for any business owner. Without this foundation, your business relationships are built on assumptions, which is a shaky way to grow.

Key Clauses That Protect Your Business

While every contract is different, certain clauses are non-negotiable for protecting your interests. Overlooking them is like leaving your front door unlocked. Always make sure your agreements include these critical components:

- Scope of Work: This section must be crystal clear. Vague descriptions like "provide marketing services" are invitations for future arguments. Instead, specify exact deliverables, timelines, and milestones. For example: "Deliver five 1,000-word blog posts on topics X, Y, and Z by the 15th of each month."

- Payment Terms: Clearly state the total cost, the payment schedule (e.g., 50% upfront, 50% on completion), accepted payment methods, and what happens if a payment is late. A late fee clause is a powerful tool for protecting your cash flow.

- Term and Termination: How long does the agreement last? Just as important, how can it be ended? A termination clause allows either party to exit the agreement under specific conditions, like failure to perform or by giving a 30-day written notice. This is your escape hatch if the relationship sours.

- Confidentiality: This clause, often called a Non-Disclosure Agreement (NDA), prevents the other party from sharing your sensitive business information. It's vital when working with contractors or anyone with access to your trade secrets.

- Dispute Resolution: This part outlines how you'll handle disagreements. Will you use mediation, arbitration, or go to court? Defining this process upfront can save you a mountain of time and money by avoiding a drawn-out court battle over a minor issue.

To help you visualize how these elements come together, the table below breaks down common contract types and the clauses that offer the most protection.

| Contract Type | Key Clauses | Protection Level | When to Use |

|---|---|---|---|

| Client Service Agreement | Scope of Work, Payment Terms, Termination, Intellectual Property Ownership | High | When providing ongoing professional services (e.g., consulting, marketing, design). |

| Vendor/Supplier Agreement | Delivery Schedules, Quality Standards, Payment Terms, Liability Limits | Medium-High | When purchasing goods or services from a third party for your business operations. |

| Independent Contractor Agreement | Scope of Work, Confidentiality, Worker Classification (not an employee), IP Rights | High | When hiring freelancers or contractors to ensure clarity on roles and ownership of work. |

| Non-Disclosure Agreement (NDA) | Definition of Confidential Info, Obligations of Receiving Party, Duration of Secrecy | Varies | Before sharing any proprietary information with potential partners, investors, or contractors. |

This table shows that the right clauses are your first line of defense. By matching the contract type to the business situation, you create a solid legal shield tailored to each specific relationship.

From Handshakes to Written Agreements

A classic mistake is relying on verbal agreements for important deals. While some handshake deals can be legally binding, they are notoriously difficult to prove in court. The rule of thumb is simple: if the deal involves a significant amount of money, a long-term commitment, or your intellectual property, put it in writing.

This doesn't mean every transaction requires a 50-page document. A simple, clearly written agreement covering the key points can offer powerful protection. For more complex situations, knowing how to approach the conversation is key. If you want to build your confidence, our guide on powerful contract negotiation strategies provides practical tips. Mastering these basics turns contracts from a source of anxiety into a tool for building a secure and successful business.

Staying Compliant Without Losing Your Mind

Trying to keep up with regulatory compliance can feel like you're playing a game where the rules are constantly changing. The sheer complexity can make you want to put your head in the sand and hope for the best. But treating compliance as an "I'll get to it later" task is a recipe for disaster. A much better way to think about it is like regular car maintenance鈥攁 set of small, routine checks that prevent a massive, expensive breakdown later. This forward-thinking approach is a key piece of small business legal advice.

Identifying Your Core Compliance Obligations

You don鈥檛 have to become a legal scholar overnight. The trick is to identify and focus on the regulations that directly affect your specific industry and daily operations. It鈥檚 like tackling a home repair list; you鈥檇 fix a leaky pipe before you start thinking about redecorating the living room. For most small businesses, the main areas to watch are:

- Business Licenses and Permits: At a bare minimum, every business needs a license to operate. Depending on what you do鈥攚hether it鈥檚 running a food truck, a construction company, or a daycare鈥攜ou will likely need extra local, state, or federal permits.

- Tax Compliance: This is more than just filing your taxes once a year. It involves handling payroll taxes correctly, collecting sales tax if your products or services require it, and paying estimated taxes throughout the year to stay out of trouble with the IRS.

- Data Privacy and Security: If you collect any kind of customer data, from email addresses for a newsletter to credit card details for a sale, you have a legal duty to protect it. Laws are getting stricter about how businesses must store, manage, and secure personal information.

- Advertising and Marketing Rules: What you say in your marketing matters. Your claims must be truthful and not deceptive. The Federal Trade Commission (FTC) has clear guidelines on everything from using customer testimonials to making endorsements.

A Practical Approach to Staying Current

Keeping on top of changing rules doesn't need to take over your life. Having a system makes it far less daunting. A great first step is to identify the government agencies that oversee your industry. Their official websites are often the best source of truth.

For instance, the U.S. Department of Labor provides a central spot for compliance information that helps businesses of all sizes.

The portal shown here lets you search by topic, making it easier to find the exact rules that apply to you. You can even set up a simple compliance calendar with quarterly reminders to check these key sites, which helps ensure nothing important slips through the cracks.

Unfortunately, finding good help can be tough. In fact, around 58% of law firms say that a shortage of qualified staff is a barrier to growing their services, which directly affects how much advice is available for small businesses. You can to see why this gap exists. This reality makes it even more critical for entrepreneurs to take the lead. While you can manage many of these tasks on your own, it's just as important to know when to call in a professional, especially for thorny issues like employment law or complex tax situations.

When To Call A Lawyer And When To Handle It Yourself

Deciding when to spend money on professional legal help versus tackling a task yourself is one of the most critical financial choices you'll make as an entrepreneur. Striking the right balance can save you thousands of dollars and help you avoid devastating mistakes.

Think of it like a home renovation. You might feel confident painting a room or installing a new faucet鈥攖his is your DIY legal work. However, you would absolutely hire a licensed professional to rewire the entire house or fix a structural issue. That's when you call a lawyer. The risk of getting the big jobs wrong is simply too high.

The DIY vs. Professional Framework

So, where do you draw the line? The decision usually boils down to two key factors: the complexity of the task and the potential fallout if you get it wrong. Simple, low-risk tasks are often perfect for a DIY approach, especially with so many templates and resources available today.

However, some situations are clear "red flags" that should always have you reaching for the phone to call a legal professional. In these scenarios, the cost of a mistake far outweighs the expense of an expert's advice.

When to Handle It Yourself:

- Basic Business Formation: Filing for a simple, single-member LLC in your state.

- Simple Contracts: Using a professionally vetted template for a straightforward client service agreement where the stakes are low.

- Initial Research: Getting a handle on the basics of industry regulations or licensing requirements before you consult an expert.

When to Call a Lawyer Immediately:

- Partnership Agreements: Any time you are going into business with someone else, a lawyer is essential to draft an agreement that covers ownership, responsibilities, and what happens if someone wants out.

- Complex Contracts: Deals involving large sums of money, intellectual property rights, or commitments that span multiple years.

- Receiving Legal Threats: If you get a cease-and-desist letter, a notice of a lawsuit, or any other threat of legal action.

- Hiring Employees: Employment law is tricky, especially when it comes to correctly classifying workers. Mistakes here can be very expensive.

- Selling Your Business or Seeking Investment: These are high-stakes transactions that demand expert legal guidance to protect your interests.

Finding Affordable Small Business Legal Advice

Securing quality small business legal advice doesn't always have to break the bank. Many bar associations and legal aid groups offer free or low-cost resources designed for entrepreneurs.

For instance, the American Bar Association has directories to help people find these kinds of services.

This shows that established legal institutions are actively trying to connect people with accessible help, which is a great place to start. The legal industry itself is also changing. In the U.S., a notable 72% of solo lawyers and 67% of small law firm professionals are adopting AI tools to make their services more efficient and affordable. You can learn more about how technology is changing legal services and what it means for your business.

Ultimately, the smartest move is to build a relationship with a lawyer before you desperately need one. This can be as simple as a one-time consultation to review your business setup. For more guidance on finding the right support, check out our guide on how to get legal help for your small business. Taking this proactive step ensures you have a trusted advisor ready to call when the stakes are high.

Creating Your Legal Strategy For Growth

The best business owners don't wait for legal problems to find them; they see them coming. Think of it like a skilled chess player who plans several moves ahead, rather than just reacting to their opponent's last turn. This forward-thinking approach shifts legal planning from a dreaded chore into a powerful tool for your business. When you weave small business legal advice into your core strategy, you create a foundation that supports growth instead of slowing it down.

This proactive mindset is all about spotting potential issues before they escalate into costly emergencies. It means setting up simple, repeatable ways to manage risk that don't require a law degree to understand. With legal considerations baked into your big decisions, you can move forward with certainty instead of fear.

Aligning Your Legal Needs with Your Business Stage

Your company's legal needs aren't set in stone; they change and grow right alongside your business. The legal setup that works for a solo founder is completely insufficient for a business with ten employees and customers across the country. A smart growth strategy involves anticipating these shifts and preparing for them without breaking the bank.

For instance, a new startup might only need help with business formation and a solid client contract. But as it scales, the picture changes.

- Growth Stage: The moment you hire your first employees, a host of new legal duties appear, including employment contracts, payroll compliance, and workplace policies.

- Expansion Stage: Moving into new markets or launching new products demands a close look at protecting your intellectual property, navigating state-specific rules, and handling more intricate vendor agreements.

- Maturity Stage: An established company might require guidance on corporate governance, major partnerships, or even planning for a potential acquisition.

Thinking about these stages ahead of time lets you budget for legal support and put scalable systems in place before you're scrambling to put out a fire.

Building Your Proactive Legal Framework

A fantastic way to stay on top of things is to perform regular, simple legal check-ups. This doesn鈥檛 need to be a complex, formal audit. It鈥檚 about consistently looking at your business through a legal lens. Using a checklist can be a huge help in spotting potential cracks in your legal foundation.

For example, this business legal requirements checklist from SCORE provides a solid starting point for any business owner.

This checklist covers the essential building blocks鈥攆rom federal and state registration to ongoing compliance鈥攖hat every business must address. By using a resource like this, you can systematically see where you stand and create a clear action plan for any weak spots. This kind of methodical risk assessment allows you to focus on what you do best: serving customers and growing your company, all with the confidence that your legal house is in order.

Your Legal Action Plan That Actually Works

Knowing the law is one thing, but actually putting that knowledge into practice is what keeps your business safe. This section is your practical roadmap, designed to turn legal theory into concrete steps you can take today. Forget feeling overwhelmed; this is a straightforward guide to building your legal foundation without a massive budget. The goal is to weave legal checks into your daily operations, creating systems that protect you without slowing you down.

Prioritize and Execute

First things first: you can't tackle everything at once, so you need to prioritize. Not all legal tasks are created equal. A brand-new business should focus intensely on its legal structure and having a solid client contract. On the other hand, a business hiring its first team member needs to get employment law right immediately.

Here is a simple checklist based on your business stage to help you get started:

- Launch Stage (Months 0-6):

- Task 1: Solidify Business Structure. This is your top priority. Filing your LLC or corporation paperwork is what separates your business assets from your personal ones.

- Task 2: Draft a Master Service Agreement. Create a reliable, reusable contract template for your main service or product. This will save you time and headaches down the road.

- Growth Stage (Months 6-18):

- Task 1: Review Employment Practices. Before you even think about hiring, talk to an expert about how to classify workers correctly (employee vs. contractor). Getting this wrong can lead to serious penalties.

- Task 2: Secure Intellectual Property. It's time to protect your brand. File for trademarks for your business name and logo to stop others from profiting off your hard work.

- Scaling Stage (Year 2+):

- Task 1: Conduct a Compliance Audit. Take a hard look at your data privacy policies and any regulations specific to your industry.

- Task 2: Establish a Relationship with a Lawyer. Find a legal professional you trust. Having someone you can call for ongoing small business legal advice is an invaluable asset as you grow.

This staged approach keeps you focused on the most immediate needs and opportunities for your business right now. By systematically checking these items off your list, you build a stronger, more resilient company ready for whatever comes next.

If you鈥檙e ready to move from planning to action with confidence, the team at Cordero Law can help. We specialize in providing clear, strategic counsel tailored to entrepreneurs and creators. Contact Cordero Law today to build a legal foundation that supports your vision.