So, you have some intellectual property鈥攁 patent, a trademark, or a copyright. That's great. But just owning it is like having a car parked in the garage. It has potential, but it isn't making you any money. Monetizing your IP is about taking those intangible assets and turning them into real, tangible revenue.

This means figuring out a smart way to let others use your IP in exchange for cash. It could be licensing, an outright sale, or something else entirely. The goal is to shift your IP from a line item on your legal bill to a profit-generating part of your business.

Your First Moves in Monetizing Intellectual Property

Before you can turn your ideas into income, you need a solid game plan. This isn't just about having a patent; it's about being strategic. Think of this early stage as building the blueprint before you start construction鈥攊t prevents costly mistakes down the line, like selling your best asset for pennies or getting locked into a bad deal.

Getting this right from the start is your best defense against common pitfalls. Let鈥檚 walk through where to begin.

Conduct a Thorough IP Audit

First things first: you need to know exactly what you've got. An intellectual property audit isn't some boring legal formality; it's more like a treasure hunt inside your own company. Your job is to identify and list every single piece of IP you own.

You鈥檇 be surprised what you might find. Most businesses have more IP than they realize. Go beyond the obvious and look for:

- Patents: These protect your inventions, unique processes, or product designs.

- Trademarks: This includes your brand name, logos, taglines, and even specific colors.

- Copyrights: Think software code, marketing copy, website content, photos, music鈥攁nything creative you've produced.

- Trade Secrets: This is the secret sauce. It could be a customer list, a unique manufacturing technique, or a confidential recipe.

Once you have your list, get it organized. For each asset, note down any registration numbers, key dates, and its current legal status. This inventory is the foundation for everything that comes next.

Define Your Core Monetization Goals

With a clear list of what you own, the next question is simple: what are you trying to accomplish? There鈥檚 no one-size-fits-all answer here. Your goals will shape your entire strategy.

Are you looking for:

- Steady, long-term income? Licensing is probably your best bet. It can provide a consistent stream of royalties over many years.

- A quick, clean cash infusion? An outright sale (also called an assignment) gives you a lump-sum payment. It's fast, but you give up future control.

- Market expansion and growth? You might consider a joint venture or a strategic partnership where your IP is your main contribution to the deal.

Be honest with yourself about what your business needs and how much risk you're willing to take. Deciding on your main objective now will keep you from getting sidetracked by a shiny offer that doesn鈥檛 actually align with where you want to go.

An IP asset without a clear monetization goal is like a car without a destination. It has potential, but it isn't actually going anywhere. Aligning your assets with specific business objectives is the first step toward unlocking their financial value.

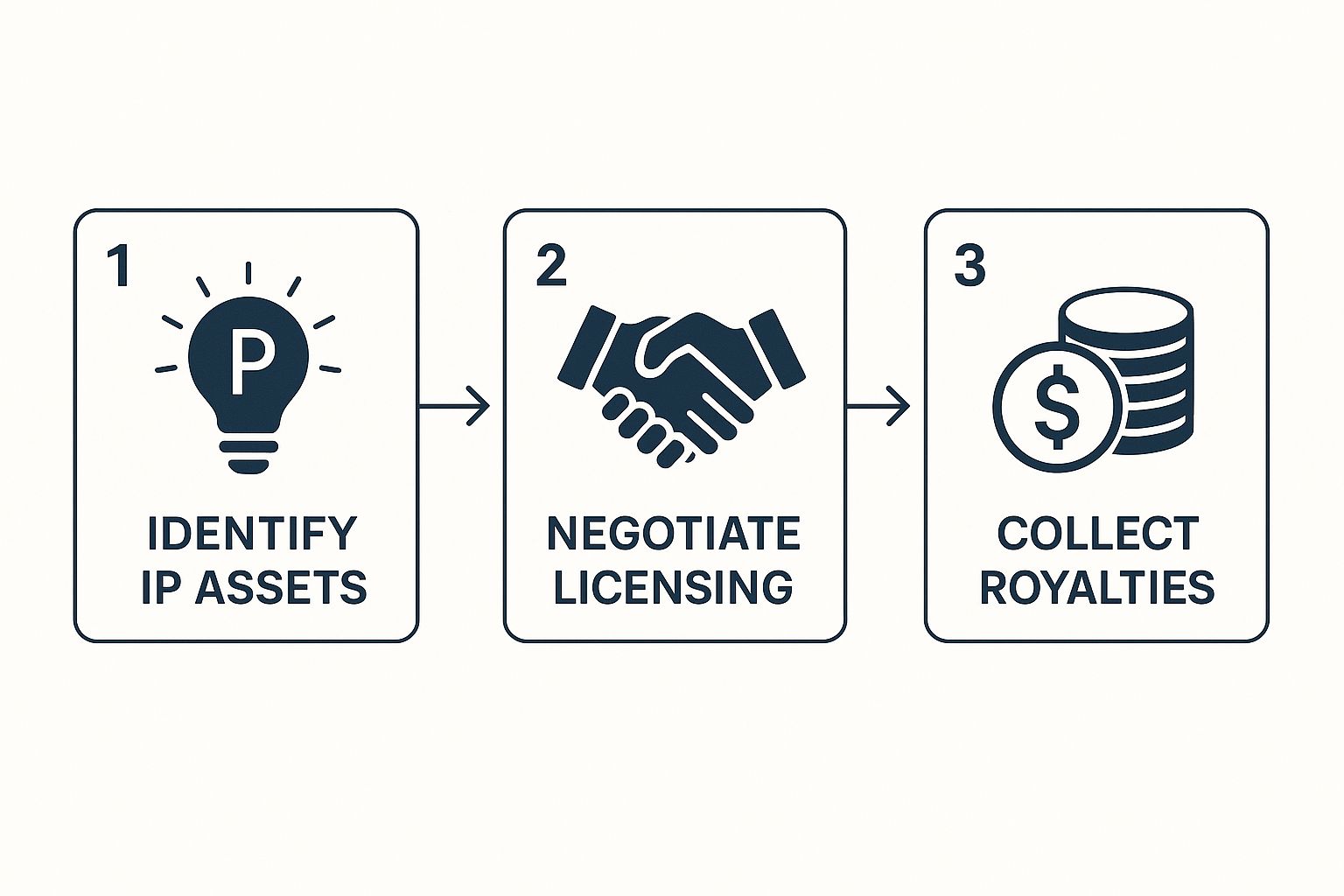

This infographic breaks down the basic flow from identifying what you have to actually collecting revenue.

As you can see, it's a systematic process. You move from identifying your assets to negotiating a deal and then collecting royalties鈥攁 model you can repeat as your IP portfolio grows.

Assess the Market Potential of Your Assets

Not all IP is created equal, at least not in the eyes of the market. Once you know what you have and what you want, you need to figure out which assets have real commercial appeal.

For each piece of IP, ask some tough questions. If it's a patent, is the technology it covers something people are desperate for right now? If it鈥檚 a trademark, how much brand recognition does it actually have?

This isn't a formal valuation just yet. Think of it as practical market research. Take a look at your competitors. Are they licensing similar technologies? Have comparable brands been sold or franchised recently? Getting a feel for the commercial landscape helps you prioritize which assets to focus on first and sets realistic expectations for what they might be worth.

Choosing Your IP Monetization Strategy

Deciding how to monetize your intellectual property can feel overwhelming. To make it easier, here鈥檚 a quick breakdown of the most common models. Think about your specific assets, your business goals, and your desired level of involvement to find the right fit.

| Strategy | Best For | Potential Revenue |

|---|---|---|

| Licensing | Generating ongoing, recurring income while retaining ownership of the IP. Great for patents, software, and strong brands. | Medium to High: Steady royalty payments (e.g., 5-15% of sales), upfront fees, milestone payments. |

| Direct Sale (Assignment) | Securing a large, one-time cash payment and completely transferring ownership and risk to the buyer. | High (Lump-Sum): A single, significant payment. No future royalties or involvement. |

| Joint Venture | Businesses looking to enter new markets or combine complementary technologies without a full merger. | Variable: Shared profits based on the venture's success. Can be very high but carries more risk. |

| Franchising | Established brands with a proven business model looking for rapid expansion. Involves trademarks and trade secrets. | Steady & Scalable: Franchise fees, ongoing royalties, and marketing fund contributions. |

| IP-Backed Financing | Using IP as collateral to secure loans when traditional assets aren't available. Good for asset-rich, cash-poor startups. | N/A (Financing): Not direct revenue, but provides access to capital for growth. |

| Defensive Aggregation | Pooling patents with other companies to create a defensive shield against litigation from competitors. | Cost Savings: Primarily a defensive play to avoid costly lawsuits, not a direct revenue generator. |

This table is just a starting point. The best strategy for you might even be a hybrid approach. For example, you could license your patent in one industry while pursuing a joint venture in another. The key is to match your approach to your specific goals and the market realities of your IP.

How to Confidently Value Your IP Assets

Trying to put a price tag on an idea can feel like grasping at air. It鈥檚 abstract, and frankly, a little intimidating. But here鈥檚 the truth: understanding what your intellectual property is really worth is the single most important step before you try to sell or license it.

If you don't have a solid valuation, you鈥檙e basically negotiating blind. You either end up leaving money on the table by underselling your best asset, or you scare off potential partners with a number that seems pulled out of thin air.

A confident valuation is your leverage. It turns your IP from a fuzzy concept into a hard asset with a price you can actually justify. This isn't just theory; the global trade in IP has absolutely exploded, growing over 17 times between 1990 and 2022 to an estimated $446 billion. This shows just how vital it is to get your pricing right.

The Three Core Valuation Methods

When it comes to putting a number on your IP, we generally turn to three established methods. Each one offers a different perspective, and honestly, the most accurate valuation usually comes from a blend of all three.

The Market Approach is the most direct. Think of it like pricing a house by checking the sales of similar homes in the neighborhood. You look at what comparable IP assets have recently sold or licensed for. If a competitor licensed a similar software patent for a 5% royalty, that gives you a fantastic starting point for your own talks.

Of course, this method only works if you can find good "comps," which can be tough for truly unique or trailblazing IP.

Looking at Costs and Future Income

When good market data is hard to come by, the Cost Approach gives you another angle. This method values your IP based on what it would cost to build it again from the ground up. You'd add up all your R&D expenses, legal fees for registration, and any other cash you spent to create it.

It's a useful baseline, but it has one major flaw鈥攊t completely ignores future potential. You might have spent $50,000 developing a piece of tech, but if that tech is poised to disrupt an entire industry, its real value is much, much higher than what you spent.

This is exactly where the Income Approach comes in. It's often the most telling method because it鈥檚 all about the future money your IP is expected to bring in. This could be future royalties, higher profits from a product using the IP, or even cost savings from a patented process. It鈥檚 a forward-looking approach that directly ties your IP to its ability to make money.

Key Takeaway: No single method is perfect. A robust valuation often combines all three. The cost approach sets your floor, the market approach grounds you in reality, and the income approach captures the exciting future potential.

Key Factors That Influence IP Value

Beyond these three methods, a potential buyer or licensee is going to dig into several other factors during their due diligence. You need to be ready for it.

- Legal Strength and Defensibility: How solid is your protection? A granted patent is worth a whole lot more than a pending application. A registered trademark carries more weight than an unregistered one. Clear, defensible legal status is a must-have. To get a better handle on the different types of protection, check out our breakdown of trademark vs copyright.

- Remaining Lifespan: IP doesn鈥檛 last forever. A patent with 18 years left on its term is far more valuable than one that鈥檚 about to expire in two years.

- Competitive Edge: Does your IP give you a real, sustainable advantage? The bigger the moat it creates around your business, the higher its value.

- Market Demand and Scope: Is your IP useful in a huge, growing market, or is it for a tiny niche? An asset that can be used across multiple industries or countries will always command a higher price.

At the end of the day, valuing your IP is both a science and an art. While these methods give you a solid framework, don't be afraid to call in a professional appraiser, especially for a high-stakes deal. Their objective report can stand up to tough questions and give you the confidence you need to get the best terms possible.

Choosing Your Best Monetization Path

Okay, you鈥檝e done the hard work of figuring out what your IP is worth. Now comes the real question: what are you going to do with it? This is a fork in the road, and the path you pick will shape your involvement, risk, and potential paycheck for years.

There鈥檚 no one-size-fits-all answer here. The right move depends entirely on your specific IP, your business goals, and honestly, your appetite for risk and control. Let's walk through the three main routes you can take: licensing, selling, or teaming up in a strategic alliance.

The Licensing Route: Sustained Income and Retained Ownership

Licensing is easily one of the most popular ways to monetize IP, and for good reason. You鈥檙e essentially renting out your IP. You grant another company the right to use it for a certain amount of time, and in return, they pay you royalties. The best part? You keep full ownership.

Think about it. Say you鈥檙e a developer who came up with a brilliant image compression algorithm. Instead of going through the headache of building a whole new photo app from scratch, you could license that algorithm to a bunch of existing software companies. This is a non-exclusive license. You get to create multiple streams of income from that single piece of IP.

On the flip side, you could grant an exclusive license to a single, major player who wants to lock down your tech to get a leg up on their competition. A deal like that will usually bring in a higher royalty rate or a beefy upfront payment, but it means you can鈥檛 offer it to anyone else.

Pro Tip: Don't just settle for a simple percentage. I've seen deals structured with a mix of an upfront fee, milestone payments (like when the product launches), and a minimum annual royalty. This protects your income, even if the other company's sales get off to a slow start.

Selling Your IP for a Clean Break

Sometimes, the goal isn't a slow-and-steady income stream. You just want a significant, one-time payout. This is where selling your IP鈥攁lso known as an assignment鈥攃omes in. You transfer all your ownership rights to a buyer, get your cash, and walk away.

It's a clean break. The buyer takes on all the future potential, and all the responsibility. This is a common path for founders looking to exit, companies shifting their focus, or inventors who just aren't interested in the business side of things. I've seen small design firms create a killer brand name and logo but lack the cash to launch a product line. Selling that trademark to a big consumer goods company gives them the capital to fund their next big idea.

The key here is finding the right buyer. It's not just about who has the deepest pockets. You need someone who truly gets the strategic value of what you鈥檝e built. That means doing your homework, putting together a compelling sales pitch, and making sure any potential buyer is reputable and can actually close the deal.

Strategic Alliances and Joint Ventures

But what if you have a great piece of IP and just need a partner's resources to make it fly? A strategic alliance or joint venture (JV) is a fantastic middle ground. You bring the IP, and your partner might bring the manufacturing muscle, the distribution network, or the marketing budget.

Instead of just collecting a royalty check, you become a partner in a new venture, sharing in both the risks and the rewards. This approach can often unlock way more value than a simple licensing deal.

A perfect example is a biotech startup with a patented drug delivery system. They could team up with a huge pharmaceutical company. The startup provides the technology (their IP), and the pharma giant handles the expensive clinical trials, regulatory approvals, and global sales. They split the profits based on their agreement, amplifying the IP's value far beyond what the startup could have managed on its own.

To help you see it all at a glance, here鈥檚 a quick breakdown:

| Monetization Path | Your Level of Control | Revenue Structure | Best For… |

|---|---|---|---|

| Licensing | High (You retain ownership) | Ongoing royalties, fees | Generating long-term, passive income while keeping your core asset. |

| Direct Sale | None (Ownership is transferred) | One-time lump sum | A fast cash-out, exiting a market, or simplifying your business focus. |

| Joint Venture | Shared (You are a partner) | Shared profits from the venture | Amplifying IP value by combining it with a partner's resources for a new project. |

Ultimately, picking your path means taking a hard look at what you really want. Do you want to be a landlord, collecting rent on your IP? Are you looking to cash out and start something new? Or do you see yourself as a co-founder, building something bigger with a partner? Each route has its pros and cons, but the best one is the one that lines up with your vision for your IP's future.

Mastering IP Licensing and Sales Negotiations

This is where the rubber meets the road. All your hard work auditing, valuing, and strategizing comes down to this moment: the negotiation. It can feel like a high-stakes poker game, but it doesn't have to. With the right prep, it's just a structured business conversation where everyone walks away with something valuable.

The real goal isn't just to snag a good price. It's to build a durable, profitable, and secure agreement that turns your IP from a concept on paper into a reliable asset. Let's break down how to walk into that room with confidence.

The Power of a Well-Crafted Term Sheet

Before you even think about looking at a dense, 50-page legal contract, the conversation almost always starts with a term sheet. Think of it as the blueprint for the final deal. It's a non-binding document, written in plain English, that outlines the key points everyone needs to agree on.

A solid term sheet does more than just throw numbers around. It sets the tone for the entire negotiation and makes sure both sides are on the same page about the big-picture items before getting bogged down in legalese.

At a minimum, your term sheet should cover:

- The Parties: Who is actually making this deal?

- The IP: What specific patent, trademark, or copyright are we talking about? Be precise.

- The Scope of Rights: Is this an exclusive or non-exclusive license? What are the geographical or industry limits?

- The Financials: Lay out the proposed royalty rate, any upfront fees, and payment schedules.

- The Term: How long is this agreement going to last?

Getting this document right from the start prevents huge misunderstandings later on. It frames the entire negotiation around a shared starting point, which makes the whole process feel more collaborative and less like a battle.

Navigating Key Negotiation Points

Once the term sheet is out there, the real discussion begins. While every deal has its own quirks, there are a few critical points that almost always become the center of the conversation. How well you negotiate these will really define the long-term success of your IP monetization.

For instance, a software developer licensing a unique algorithm might focus heavily on the scope of use, making sure it can't be used in a competing product. A fashion brand selling a trademark, on the other hand, might be more concerned with the upfront payment and how the brand will be presented after the sale. You can sharpen your game by reviewing key contract negotiation strategies that apply directly to these kinds of high-value discussions.

Expert Insight: The single biggest mistake I see is creators getting fixated on the royalty percentage alone. A 7% royalty on a poorly defined sales base with no performance guarantees is far worse than a 5% royalty on gross revenue with minimum annual payments. You have to look at the entire financial picture, not just the headline number.

This broader perspective is more important than ever as the IP market heats up. The global patent licensing market, for example, is projected to hit $4.4 billion by 2032, growing at a compound annual rate of about 7.77%. This shows a clear trend: companies are getting much smarter about turning their patent portfolios into cash, which means well-structured deals are essential.

The Importance of Mutual Due Diligence

Negotiation isn't a one-way street. Just as the other party is scrutinizing your IP's strength and validity, you need to be doing your own homework on them. This is due diligence, and it鈥檚 absolutely critical for protecting your interests.

You need answers to some tough questions about your potential partner:

- Are they financially stable enough to make royalty payments on time, every time?

- Do they have the manufacturing capacity and distribution network to actually get a product to market?

- What鈥檚 their track record? Have they been tangled up in IP litigation before?

A fantastic deal on paper is worthless if your partner can't execute. I once worked with a startup that granted an exclusive license to a mid-sized company that looked perfect on the surface. But they never checked if the company had the specific technical chops to integrate the patented technology. The product launch was a disaster, and the startup was trapped in an exclusive deal with a partner who couldn't deliver, killing their revenue stream for years.

This simple checklist can keep you focused during your own due diligence process:

- Financial Health: Get a look at their financial statements or credit reports.

- Market Reputation: Ask around in the industry. What do people say about them?

- Technical Capability: Do they have the team and infrastructure to make your IP a success?

- Sales and Marketing Power: How will they sell the final product? Is their plan realistic?

By arming yourself with a strong term sheet, focusing on the complete deal structure, and doing your homework on your potential partner, you can navigate negotiations from a position of strength. This turns a process that feels intimidating into a strategic move that successfully monetizes your intellectual property.

Taking Your IP Monetization Global

Your intellectual property's value shouldn't be boxed in by your country's borders. For so many businesses I see, the real, game-changing growth opportunities are waiting in international markets. Taking your IP strategy global can transform a local asset into a genuine powerhouse, opening you up to a world of new customers, partners, and revenue.

But let's be real鈥攙enturing abroad isn't as simple as translating your website. It takes a smart, deliberate approach. You're dealing with entirely different legal systems, business cultures, and financial rules. The payoff can be huge, but you absolutely have to do your homework first.

Making International Protection Easier

The first move in any global plan is securing your rights overseas. This sounds like a massively expensive and complicated headache, right? Filing separately in dozens of countries? Thankfully, international treaties have made this a whole lot more manageable.

For patents, the Patent Cooperation Treaty (PCT) is a total game-changer. It lets you file a single international patent application to start the protection process in over 150 countries at once. This doesn't magically grant you a "world patent," but it does something incredibly valuable: it buys you time. You get up to 30 months in most places to figure out which specific countries are actually worth pursuing for national patents.

The numbers show just how popular this strategy is. The volume of international patent applications filed under the PCT system recently hit around 273,900, bouncing back after a few slow years. This surge shows a clear trend鈥攎ore and more innovators are thinking globally from day one. You can dig into the specifics of these to see how they reflect worldwide innovation.

Picking Your Markets and Adapting Your Game Plan

So, with a path to protection laid out, how do you decide where to plant your flag? Don't just throw a dart at a map. You need to be strategic to get the best return on your investment.

Start by digging into markets where:

- There's a real demand for what you offer. Look for competitors, check online search trends, and read up on industry reports.

- The laws actually protect IP. Some countries have much stronger enforcement than others. You don't want to enter a market where your rights are just words on paper.

- The business culture fits what you're trying to do. A market that values long-term relationships might be perfect for a licensing deal. A place with a fast-paced M&A scene could be better for an outright sale.

Once you鈥檝e zeroed in on a market, you have to adapt. A licensing agreement that鈥檚 ironclad in the United States might need a complete overhaul to hold up in Japan or Germany. This is especially true for technology; our guide on protecting intellectual property for software has a ton of insights you can apply to an international context.

Key Takeaway: Going global isn鈥檛 about just copying and pasting your domestic strategy. It鈥檚 about adapting it. Your success will hinge on respecting local laws, understanding cultural quirks, and tailoring your approach to each unique market.

Handling Cross-Border Money and Enforcement

Monetizing your IP across borders brings a new layer of financial complexity you need to get ahead of. Royalty payments coming from a licensee in another country will almost certainly face withholding taxes. Taking the time to understand the tax treaties between your country and your licensee's can save you a fortune and make sure you're actually getting the full value of your deal.

Enforcement also gets trickier. If a partner overseas violates your agreement or some third party infringes on your IP, you have to fight back using that country's legal system. This is where having solid, local legal counsel is non-negotiable. They'll be the ones to help you navigate foreign courts and government agencies without getting lost.

At the end of the day, taking your IP global is a major strategic move that can seriously multiply your success. If you leverage international treaties, choose your markets wisely, and stay on top of the financial and enforcement details, you can unlock the true potential of your intellectual property on the world stage.

Common Questions About Monetizing IP

As you get closer to turning your intellectual property into cash, the practical questions start popping up. It's one thing to talk theory, but it's another thing entirely to navigate the real-world details of licensing or selling your work.

I get these questions all the time from creators and entrepreneurs. Getting clear answers helps you move forward with confidence and avoid mistakes that could cost you down the road.

How Much Does It Cost to Start Monetizing My Intellectual Property?

There鈥檚 no single price tag here鈥攖he cost can swing wildly depending on your IP and your strategy. But you can count on a few key areas where you'll need to invest.

First, you have to actually secure the IP. Patents are easily the most expensive, often running into thousands of dollars for the whole filing and approval process. Trademarks and copyrights are a lot less expensive to register. Beyond that, your main costs will likely be legal fees.

Here鈥檚 a rough idea of what to expect:

- IP Registration Fees: These are the government filing fees for patents, trademarks, or copyrights.

- Legal Consultations: An attorney's time is crucial for drafting or reviewing contracts, whether it鈥檚 a licensing deal or an outright sale.

- Professional Valuation: Hiring an expert for a formal IP valuation report can be a serious investment, but it gives you powerful leverage when you sit down at the negotiating table.

Some routes have very low upfront costs. For example, a non-exclusive license for a copyrighted photo or song might just need a simple, straightforward agreement. The key is to budget for your specific path and see legal advice not as a cost, but as an essential investment to protect your asset's future.

What Is the Most Common Mistake People Make?

The single most frequent鈥攁nd most damaging鈥攎istake I see is trying to monetize intellectual property before it鈥檚 properly secured. So many innovators get excited and rush into talks with potential partners before they鈥檝e even filed a patent, registered a trademark, or properly documented their trade secrets.

This leaves them completely exposed. Without legal protection, your negotiating position is incredibly weak, and you鈥檙e basically inviting someone to steal your idea. A potential licensee has zero incentive to pay for something that isn't legally yours to give.

Always make sure your IP is legally protected and you understand its full scope before you even think about talking to potential buyers or licensees. Rushing this is like trying to sell a house you don't have the deed to.

Another huge error is not doing your homework on a potential partner. A fantastic deal on paper can quickly become a legal and financial nightmare if you鈥檙e tied to an unreliable partner who can't or won't deliver on their side of the bargain.

Do I Need a Lawyer to Monetize My Intellectual Property?

While you can technically find contract templates online for simple deals, I highly advise working with an experienced IP attorney. Monetization agreements are complex, legally binding documents. They have long-term consequences, both financially and legally, that you need to be prepared for.

Think of it this way: a lawyer isn't just an expense; they're an investment in getting the best possible return. A good attorney can help you:

- Navigate tricky clauses about royalties, liability, and how the deal can be terminated.

- Structure the agreement to maximize your earnings and minimize your tax hit.

- Protect you from hidden liabilities that could come back to bite you years later.

An expert can spot unfavorable terms that a generic template will definitely miss. The cost of good legal advice is tiny compared to the money you could lose from a badly written contract.

Ready to turn your intellectual property into a valuable asset? The legal landscape can be tricky, but you don't have to navigate it alone. Cordero Law specializes in helping entrepreneurs and creatives protect and monetize their ideas. Book a consultation with us today and let's build a strategy that works for you.