Think of a commercial lease agreement as the official rulebook for your business's physical home. It’s a legally binding contract that spells out all the specific conditions, rules, and financial duties that you (the tenant) and the landlord agree to follow. Signing one is a huge step, and it’s about a lot more than just getting the keys to a new space.

Why Your Commercial Lease Is Your Business Rulebook

It’s a common mistake to see a commercial lease as just a scary legal document. In reality, it’s a strategic asset. When you understand what’s in it, this "rulebook" can protect your operations and set you up for success. It lays the foundation for everything that happens within those four walls.

To get started, you need to know who's who in this process. Each person has a specific role and set of motivations that will influence the negotiations and the entire life of the lease.

The Main Characters in Your Lease Story

- The Landlord (or Lessor): This is the property owner giving you the right to use their space. Their main goal is pretty simple: find a reliable, long-term tenant who pays on time and keeps the property in good shape.

- The Tenant (or Lessee): That’s you—the business owner. You’re looking for a space that meets your budget and operational needs, with lease terms that give you the flexibility to grow.

- The Guarantor: Landlords often ask for a guarantor, especially for new or smaller businesses. This person or company agrees to personally cover the rent if your business can't pay. It's a massive commitment with serious financial risk, so it’s not a role to be taken lightly.

Once you know the players, you need to understand the type of "game" you'll be playing. Commercial leases aren't all the same; they come in different flavors that determine who pays for what.

A well-negotiated lease is a competitive advantage. It’s not just about getting the lowest rent; it's about securing terms that align with your business model and future goals, giving you the operational freedom to thrive.

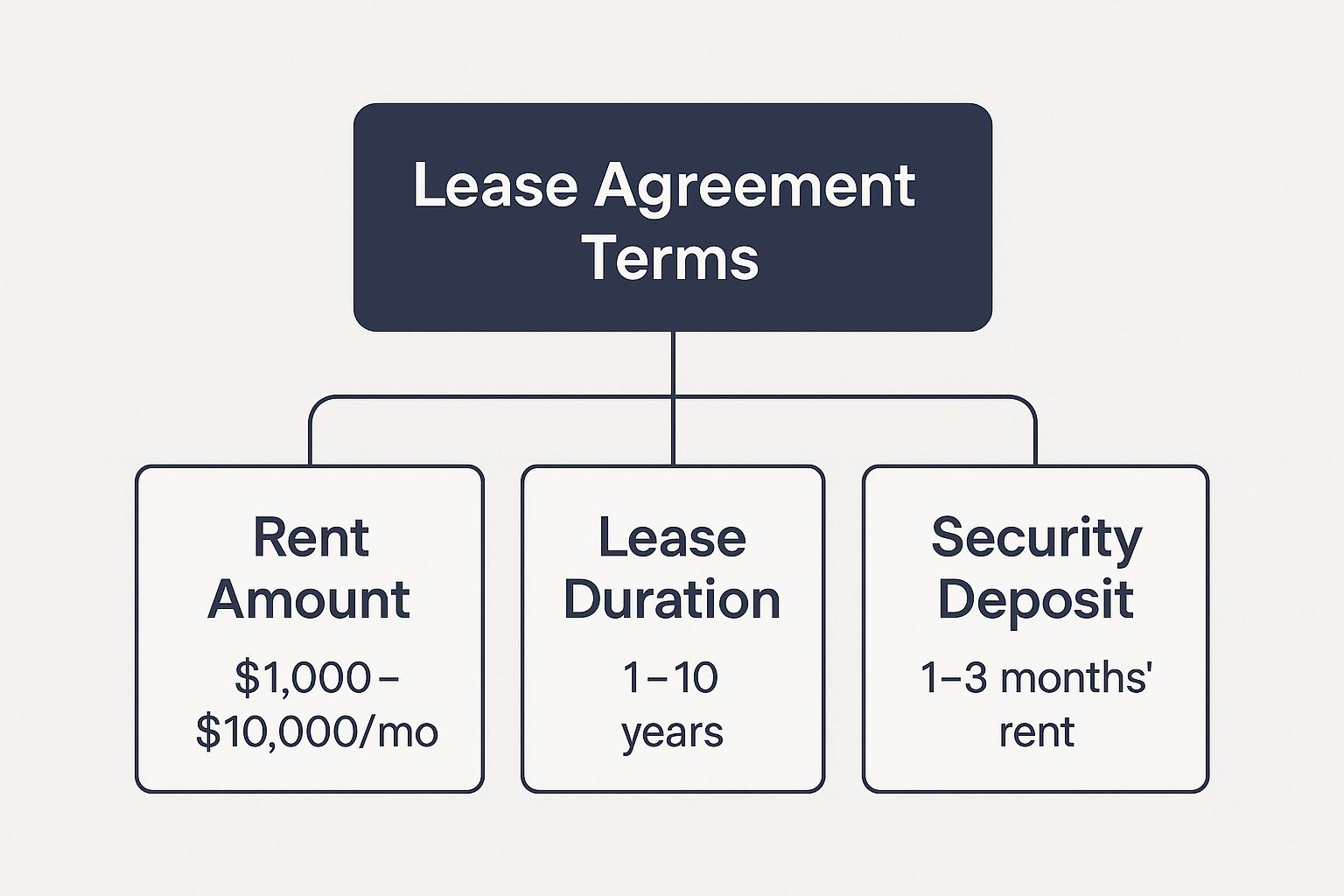

To give you a better picture, the infographic below breaks down some of the most fundamental terms you'll find in almost any commercial lease.

As the visual shows, your core financial and time-based commitments—things like rent, the lease duration, and the security deposit—form the backbone of the agreement. Knowing the typical ranges for these terms gives you a crucial starting point for your own negotiations. If you get these core concepts down from day one, you'll be in a much better position to analyze offers, sidestep common traps, and move forward with confidence.

The structure of the lease itself is another major piece of the puzzle. It dictates who is responsible for the property's major operating expenses.

To simplify this, here’s a quick rundown of the most common commercial lease types you'll encounter.

Quick Guide to Common Commercial Lease Types

| Lease Type | Tenant Pays | Landlord Pays |

|---|---|---|

| Gross Lease | Fixed monthly rent only. | All operating expenses (taxes, insurance, maintenance). |

| Net Lease (Single, Double, Triple) | Base rent plus one, two, or all three major expenses. | Any expenses not covered by the tenant. |

| Modified Gross Lease | Base rent plus a portion of operating expenses (e.g., a share of tax increases). | Base year expenses and any other items specified in the lease. |

Understanding these basic structures is key. A Gross Lease is straightforward, but the rent is often higher to cover the landlord's costs. A Triple Net (NNN) Lease, on the other hand, might have lower base rent, but you'll be on the hook for variable costs like property taxes and major repairs. Knowing the difference helps you compare apples to apples when looking at different properties.

Unpacking the Financials of Your Lease Agreement

When you get your hands on a commercial lease, it’s natural for your eyes to dart straight to the rent. But the real cost of that space is almost always more than the number printed in big, bold letters. The financial section of your commercial lease agreement terms is a complex puzzle, and every single piece has an impact on your bottom line.

Think of it like buying a plane ticket. The base fare looks great, but then you start adding on fees for baggage, seat selection, and maybe a snack. All of a sudden, that "deal" isn't quite what you thought it was. A commercial lease operates in a very similar way, with the Base Rent being just the starting point of your financial commitment.

Beyond the Base Rent

Base rent is that straightforward, predictable amount you agree to pay every month just for the right to occupy the space. It’s the headline number, but it rarely tells the whole story. Many leases, particularly in retail settings, will also have a clause for Percentage Rent.

This means you pay your base rent plus a percentage of your gross sales once you hit a certain target. For example, your lease might stipulate that you owe the landlord 5% of all gross sales over $500,000 for the year. In a way, this structure turns your landlord into a business partner; they're now directly invested in your success. The flip side is that your rent can fluctuate, making your financial forecasting a bit more of a moving target.

Then you have what's known as Additional Rent. This is really a catch-all term for all the other property-related expenses that the landlord passes through to you, the tenant. It’s in these details where the true cost of the lease is often hiding.

Understanding Net Leases

The most common way landlords deal with this additional rent is through a "Net Lease." This is where those terms you may have heard—Single (N), Double (NN), and Triple Net (NNN)—come into play. They simply define which specific operating expenses are on your tab.

- Single Net Lease (N): You’re on the hook for your base rent plus your portion of the property taxes. The landlord handles insurance and all maintenance.

- Double Net Lease (NN): You pay for base rent, property taxes, and the property insurance premiums. The landlord is generally just responsible for major structural maintenance.

- Triple Net Lease (NNN): This is the go-to for most standalone commercial buildings. You pay for everything—the base rent, property taxes, insurance, and all maintenance costs, from a simple leaky faucet to replacing an entire HVAC system.

Under a Triple Net (NNN) lease, the tenant essentially becomes the property's financial manager for all its operating costs. This can mean a lower base rent, but it also comes with the highest level of financial responsibility and risk from unpredictable expenses.

Because these financial obligations can get so complicated, getting professional guidance is key. For more perspective on when you should call in an expert, it’s worth reviewing some foundational business legal advice to ensure you're making smart moves from day one.

The Inevitable Rise of Rent Escalations

Another critical financial term to watch for is the rent escalation clause. It's incredibly rare for your rent to remain flat over a five or ten-year lease term. Landlords use these clauses to shield their investment from the impacts of inflation and rising property costs over time.

Your rent will typically increase in one of a few common ways:

- Fixed Annual Increase: This is the most direct method. Your rent goes up by a predetermined percentage (like 3%) or a set dollar amount each year. It’s predictable, which is great for long-term budgeting.

- Consumer Price Index (CPI) Adjustment: Here, your rent is linked to the CPI, which is a key measure of inflation. If inflation climbs, your rent climbs with it. This can be a gamble, as a sudden inflationary spike could lead to a major, unexpected rent increase.

- Operating Expense Pass-Through: In this model, your rent increases to cover your share of any rise in the building's total operating expenses when compared to a "base year." If the building’s taxes or insurance premiums jump, you'll be footing part of the bill.

Getting a firm grasp on these financial commercial lease agreement terms isn't optional—it's essential. By carefully dissecting the base rent, additional rent structures, and escalation clauses, you can build an accurate financial forecast for your business and protect yourself from serious surprises down the road.

Getting the rent and other financial terms right in a commercial lease is a huge deal, but that’s only half the battle. The other, often overlooked, half is all about your operational freedom—what you can and can’t actually do in the space you’re paying for. These clauses are the invisible walls of your business, and they set the real-world boundaries for how you operate, grow, and compete.

Think of it this way: the financial terms are the price of admission to the game, but the operational clauses are the rulebook. If you don't pay close attention to the rules, you could find yourself unable to make the moves your business needs to win.

The All-Important Use Clause

At the very center of your rights is the Use Clause. This is the part of the lease that spells out exactly what kind of business activities you’re allowed to run on the property. It’s only natural for a landlord to want to keep this as narrow as possible. For a coffee shop, they might write a clause that only permits "the sale of coffee, tea, and pastries."

On the surface, that sounds fine. But what happens next year when you realize you could boost profits by selling gourmet sandwiches, branded mugs, or hosting paid workshops? A restrictive use clause means you’d technically be in breach of your lease for trying to innovate. Your goal here is to negotiate for the broadest language you can get.

Negotiation Tip: Push for something like "for use as a café and for any other legal retail purpose." This simple change gives you a crucial safety net, letting your business evolve without having to go back to the landlord for permission every single time you have a new idea. A broad use clause is one of the most valuable non-financial assets in your entire lease.

A well-negotiated use clause gives you room to breathe and ensures your physical space can adapt right alongside your business strategy.

Building a Competitive Moat with an Exclusivity Clause

While the Use Clause defines what you can do, an Exclusivity Clause dictates what your neighbors can't do. This is a game-changer, especially if you're in a shopping center or retail strip. It stops the landlord from leasing another space in the same development to a direct competitor.

Let's say you run a specialized yoga studio. A solid exclusivity clause would prevent the landlord from bringing in another yoga studio right next door. This is huge—it protects your customer base and market share, essentially giving you a mini-monopoly within that specific property. Landlords might push back because it shrinks their pool of potential tenants, but it's a critical point to fight for.

To make this a fair ask, you need to be ready to define your "primary use" with precision. A landlord is far more likely to agree to exclusivity for "the primary purpose of providing yoga instruction and selling premium yoga apparel" than a vague request to be the only "fitness business." The more specific you are about your core offering, the stronger your argument for exclusivity becomes.

The Fine Print: Rules and Regulations

Beyond those major clauses, every lease has a section for Rules and Regulations. This is the nitty-gritty that governs day-to-day life. While a lot of it is common sense stuff, some rules can seriously cramp your style.

Here are a few things to watch for:

- Signage: The lease will get specific about the size, materials, and placement of your storefront signs. A landlord might have strict aesthetic guidelines that just don't jive with your brand. Always get your sign design approved in writing before you sign the lease.

- Hours of Operation: Many properties, particularly shared centers, will dictate when you have to be open. This can become a major headache if you want to open earlier, stay open later, or run special holiday hours to serve your customers better.

- Common Areas: The lease lays out the rules for shared spaces like parking lots, hallways, and loading docks. These terms can impact everything from how easily your customers can get to you to how you receive inventory shipments.

These operational commercial lease agreement terms are every bit as important as the rent check you write each month. When you secure favorable operational terms, your lease becomes an asset that helps your business thrive, not a contract that holds it back.

Who Pays for Repairs, Improvements, and Maintenance?

When you're dreaming up your new business space, it's easy to get caught up in the fun stuff—the layout, the location, how great your logo will look on the wall. But what happens when the air conditioning dies in a July heatwave, or a pipe bursts right in the middle of your busiest season? Trust me, figuring out who pays for what is one of the most critical parts of any commercial lease agreement.

These responsibilities can make or break your budget. If you're coming from a residential lease, you need to leave those assumptions at the door. Landlords in commercial deals don't automatically cover most repairs. Everything is on the table for negotiation, and a bad deal here can turn a predictable expense into a financial nightmare.

Your lease must spell out, in no uncertain terms, who handles everything from the roof and structural walls down to changing a lightbulb. In many common lease types, like net leases, you'd be surprised how much of this falls on the tenant.

Distinguishing Repairs from Maintenance

It’s incredibly important to know the difference between "repairs" and "maintenance" because your lease will almost certainly treat them differently. Think of it this way: maintenance is proactive work to keep things from breaking, while repairs are the reactive fixes for when they already have.

- Maintenance: This is your routine, scheduled stuff. Think cleaning HVAC filters, servicing equipment, pest control, or keeping the landscaping fresh. These are predictable, ongoing costs.

- Repairs: This is for when something is officially broken. It could be a minor annoyance like a leaky faucet or a massive headache like a damaged roof or a dead furnace.

The lease should clearly assign responsibility for both categories. While tenants usually handle routine maintenance inside their own four walls, who pays for major structural repairs is a massive negotiation point. Never, ever assume the landlord will cover a big-ticket item. Get it in writing.

The question of "who fixes what" should never be left to interpretation. A vague clause is an invitation for a serious dispute, leaving you stuck in a damaged space while you and your landlord argue over the bill. Clarity here protects your ability to actually run your business.

Funding Your Vision with a Tenant Improvement Allowance

Let's be honest, most commercial spaces aren't ready to go. They're often just empty shells waiting for you to build them out into a functioning store, office, or studio. That build-out can be shockingly expensive, involving everything from construction to new flooring and lighting. This is where a Tenant Improvement (TI) Allowance becomes your best friend.

A TI allowance is a specific amount of money the landlord contributes to your build-out costs. It's a huge negotiating tool that can save you a ton of cash upfront. The allowance is usually quoted per square foot, maybe $40 per square foot. So, for a 2,000-square-foot space, that's an $80,000 contribution from the landlord to help you build your dream setup.

Of course, the details matter. Will the landlord pay your contractors directly, or will you be reimbursed after the work is done? What exactly can the money be used for? Nailing down these specifics can give you the financial runway to create the perfect space without draining your capital.

Making Changes with an Alterations Clause

So, you're all moved in. What happens when your business needs to evolve? Maybe you want to knock down a wall to create an open-plan office or install some specialized equipment. This is where the Alterations clause comes into play.

This clause lays out the ground rules for making any changes to the property. It will typically cover:

- What requires approval: Minor cosmetic touches like a new coat of paint might be fine, but any structural changes will almost always require the landlord's written consent.

- The approval process: It details how to submit your plans and get the official green light.

- Ownership of improvements: This is a big one. The clause should state who owns the alterations when your lease is up. In most cases, anything permanently attached to the building becomes the landlord's property. You can't take it with you.

Understanding this clause is crucial for making sure your space can grow with your business. Getting these physical property terms right is just as important as the rent check, ensuring your space remains a valuable and functional asset for years.

How Market Trends Impact Your Lease Negotiation

Signing a commercial lease doesn't happen in a vacuum. It’s a direct reflection of the current economic climate, and understanding this bigger picture is your secret weapon at the negotiation table. The balance of power between you and a potential landlord is constantly shifting based on what's happening in the local market. Knowing which way the wind is blowing can save you thousands.

Think of it like this: if you're negotiating in a "tenant's market," you're in the driver's seat. This happens when local vacancy rates are high, meaning there are more empty storefronts and offices than there are businesses to fill them. Landlords get nervous in this environment. They’d much rather offer you some sweet deals than let a valuable property sit empty, bleeding money month after month.

This is your prime opportunity to push for more favorable commercial lease agreement terms.

Capitalizing on a Tenant's Market

When landlords are all competing for your business, you have leverage. This is the time to negotiate for perks that can seriously cut your upfront and long-term costs.

- Generous Tenant Improvement (TI) Allowances: In a down market, it's common to see landlords willing to foot a larger portion of the bill for your build-out just to get a good tenant signed.

- Periods of Free Rent: Asking for a month or more of "rent abatement" at the beginning of your lease is a standard and often successful move. This gives you time to get set up without the immediate pressure of rent payments.

- Lower Base Rent and Fewer Escalations: With less competition from other tenants, you can often lock in a lower starting rent and negotiate for smaller—or even no—annual increases.

Of course, a "landlord's market" flips the script entirely. When vacancy rates are low and commercial space is a hot commodity, landlords hold all the cards. They might have several businesses lining up for the same spot, which means they can be much tougher on terms and way less willing to hand out concessions.

Understanding the market is like knowing the weather before you head out. In a tenant's market, you can plan for a smooth sail with favorable winds. In a landlord's market, you need to prepare for tougher conditions and pick your battles wisely.

Recent shifts in the wider economy, especially around financing, are also shaking up lease negotiations. The cost and availability of capital have a direct impact on what both you and the landlord can afford to offer or accept.

According to a global outlook survey, optimism about the commercial real estate market has shot up, with over 68% of respondents expecting better conditions—a huge jump from just 27% the previous year. A major reason for this is the expectation of better financing terms; 68% believe borrowing will get cheaper, and 69% think capital will be easier to come by. This can create a more flexible negotiating environment, though some sectors, like office spaces, still have hurdles to overcome. You can dig into these shifting financial trends in the .

Turning Market Knowledge into Action

So, how do you actually use this information? Before you even start looking at properties, you need to do your homework. Research local vacancy rates for the specific type of property you need (retail, office, industrial, etc.). Talk to a few commercial real estate brokers to get their take on the current climate.

Armed with this knowledge, you can tailor your entire approach. Knowing you’re walking into a tenant-friendly market gives you the confidence to make bolder requests. On the flip side, recognizing you’re in a landlord’s market helps you focus your energy on the lease terms that matter most to you. This strategic awareness is a cornerstone of mastering the art of the deal. For a deeper dive into how to handle these conversations, check out our guide on effective contract negotiation strategies.

When you ground your negotiation in market realities, you stop simply asking for things and start building a compelling, data-backed case for why your proposed terms are fair and reasonable.

Planning Your Exit Strategy From Day One

The smartest business owners I know think about the end of a commercial lease before they even sign on the dotted line. It sounds a little backward, I know, but planning your exit strategy from day one is one of the most powerful moves you can make. These specific commercial lease agreement terms are what give your business the flexibility it needs to adapt, grow, or even pivot down the road.

When you negotiate these future options upfront, you ensure you aren't trapped if your circumstances change. Think of it like building emergency exits into your lease agreement; you hope you never have to use them, but you’ll be incredibly grateful they’re there if you do. This kind of foresight can save your business from being stuck in a space that no longer fits.

Securing Your Future With Renewal and Expansion Options

Picture this: your lease is ending, but your business is absolutely thriving in its current location. What happens next? Without an Option to Renew, your landlord has zero obligation to let you stay. They could lease the space to the highest bidder, leaving you with the headache of a disruptive and expensive move.

An Option to Renew clause gives you the right to extend your lease for a set period. In the same vein, an Option to Expand gives you the first right of refusal on any adjacent space if it becomes available.

These options are a huge deal for long-term planning:

- They provide stability: You have the security of knowing you can stay in a location that’s working for you.

- They offer flexibility: You have the choice to grow your footprint without the pain of relocating.

- They lock in terms: The process for figuring out future rent is set in advance, which protects you from shocking, out-of-the-blue price hikes.

Transferring Your Lease With Assignment and Subletting

Business is anything but predictable. You might outgrow your space faster than you ever imagined, or you might find yourself needing to downsize. When that happens, an Assignment or Subletting clause is your absolute lifeline.

These two terms get mixed up all the time, but the distinction is critical. An assignment transfers your entire lease to a new tenant. Subletting, on the other hand, allows you to lease just a portion of your space to another business while you remain the primary tenant and ultimately responsible.

Without these rights baked into your lease, you're on the hook for rent for the entire term, even if you’ve completely moved out. Landlords will almost always want to approve any new tenant, but you should push for language stating their consent “shall not be unreasonably withheld.”

Planning for an Early Exit

Sometimes, you just need to get out of the lease entirely. A Termination Rights clause, often called a "break clause," lets you end the lease early, usually after a specific amount of time has passed and with a penalty payment. This is a tough clause to get a landlord to agree to, but it can be a lifesaver if your business model takes a sharp turn.

Finally, the Surrender clause spells out the exact condition the property must be in when you hand back the keys. It will specify what you need to do to remove your alterations and return the space to its original state. Understanding these obligations ahead of time prevents expensive, drawn-out disputes during your move-out.

These exit clauses can get complicated, and disagreements can escalate quickly. It's often wise to consider the pros and cons of having an arbitration clause in a contract for handling these kinds of disputes to avoid ending up in court.

A Few Questions We Hear All the Time

Diving into the world of commercial real estate can feel like learning a new language. But don't worry, you're not alone. Most business owners run into the same sticking points when they first see those dense commercial lease agreement terms. Let's clear up some of the most common ones.

What’s the Most Important Lease Clause?

This is a tough one, because every clause carries some weight. But if I had to pick one, it’s the Use Clause. This is the part of the lease that spells out exactly what you can and can’t do in your space.

Think of it this way: a tightly written Use Clause can box you in, making it impossible to pivot your business or add new services later on. You always want to negotiate for the broadest possible use rights. Your lease should be a launchpad for your company's growth, not a cage.

Can I Actually Negotiate a Standard Lease?

Yes. 100%. Don't ever let the words "standard lease" fool you. In commercial real estate, almost everything is on the table. How much power you have really depends on the local market, the landlord's situation, and how much they want a business like yours as a tenant.

A "standard" lease is just a starting point. Landlords expect you to negotiate. Pushing back on things like rent, the length of the lease, and tenant improvement money can save you a ton and get you much better terms.

Should I Sign a Personal Guarantee?

Ah, the personal guarantee. This is a big one. A personal guarantee makes you, the owner, personally on the hook for the rent if your business can't pay. Landlords love them, especially for new businesses without a long track record. It's a common ask, but it means your personal assets—your house, your savings—are at risk.

If a landlord won't budge on requiring one, your next move is to limit your exposure. You can try to negotiate a few things:

- Put a cap on the total amount you're responsible for.

- Limit how long the guarantee lasts (for instance, have it burn off after the first three years of the lease).

These changes can give the landlord the security they need without putting your entire personal financial future on the line.

Figuring out the complexities of commercial leases is tough, but you don't have to do it alone. At Cordero Law, we work side-by-side with entrepreneurs and creatives to get them the favorable terms they deserve. If you need a partner to help you understand and negotiate your lease, contact Cordero Law today.